Question: Multiple Choice Question How much of a self - employed taxpayer's self - employment tax may be deducted for AGI? None of self - employment

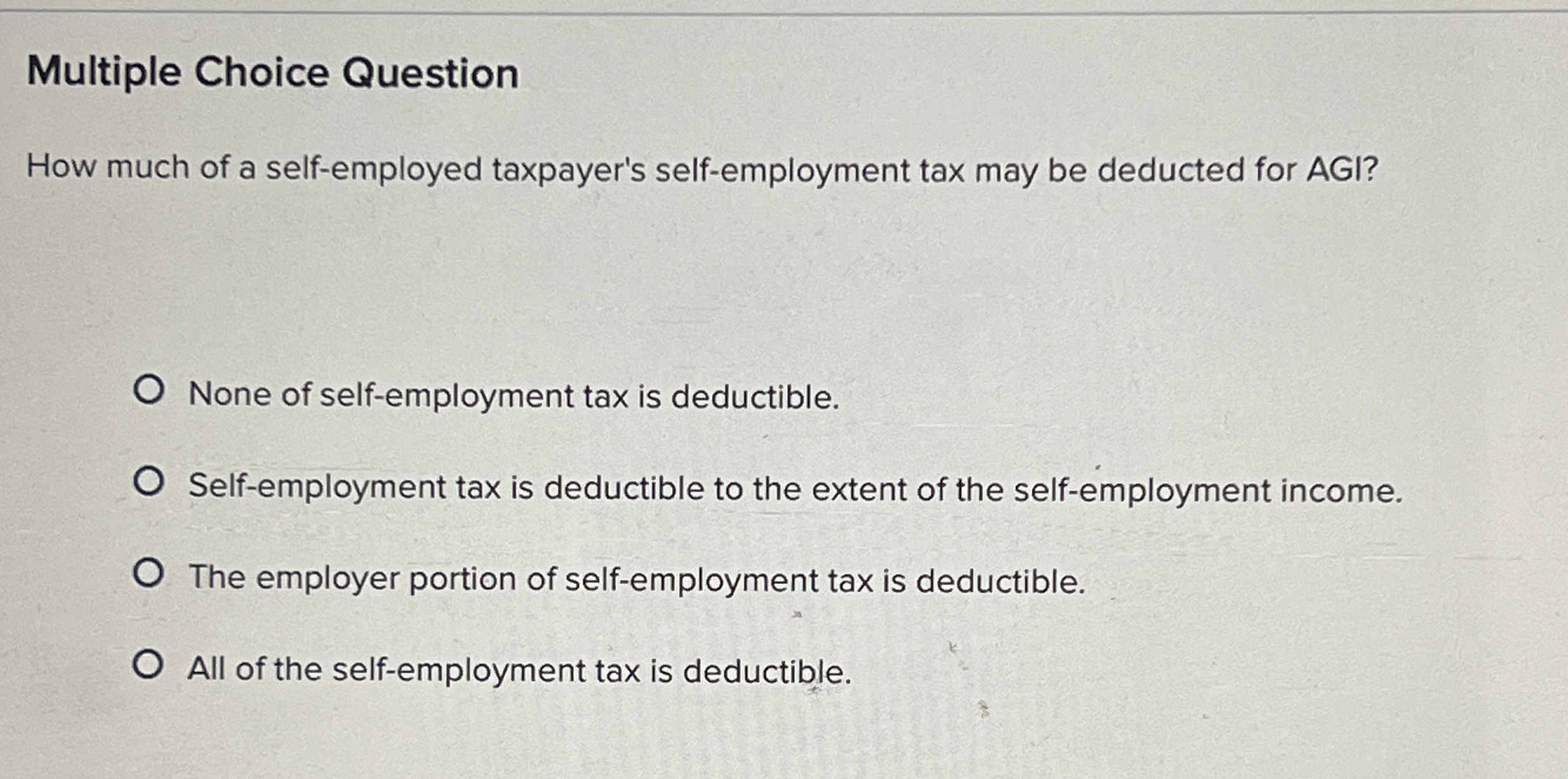

Multiple Choice Question

How much of a selfemployed taxpayer's selfemployment tax may be deducted for AGI?

None of selfemployment tax is deductible.

Selfemployment tax is deductible to the extent of the selfemployment income.

The employer portion of selfemployment tax is deductible.

All of the selfemployment tax is deductible.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock