Question: Multiple Choice Question Which statement below correctly describes merchandise inventory? Merchandise inventory is an expense account reported on the income statement and contains the cost

Multiple Choice Question

Which statement below correctly describes merchandise inventory?

Merchandise inventory is an expense account reported on the income statement and contains the cost of products purchased for sale.

Merchandise inventory is subtracted from net sales on the income statement to determine gross profit for the period.

Merchandise inventory is increased when products are sold to customers.

Merchandise inventory is an asset reported on the balance sheet and contains the cost of products purchased for sale.

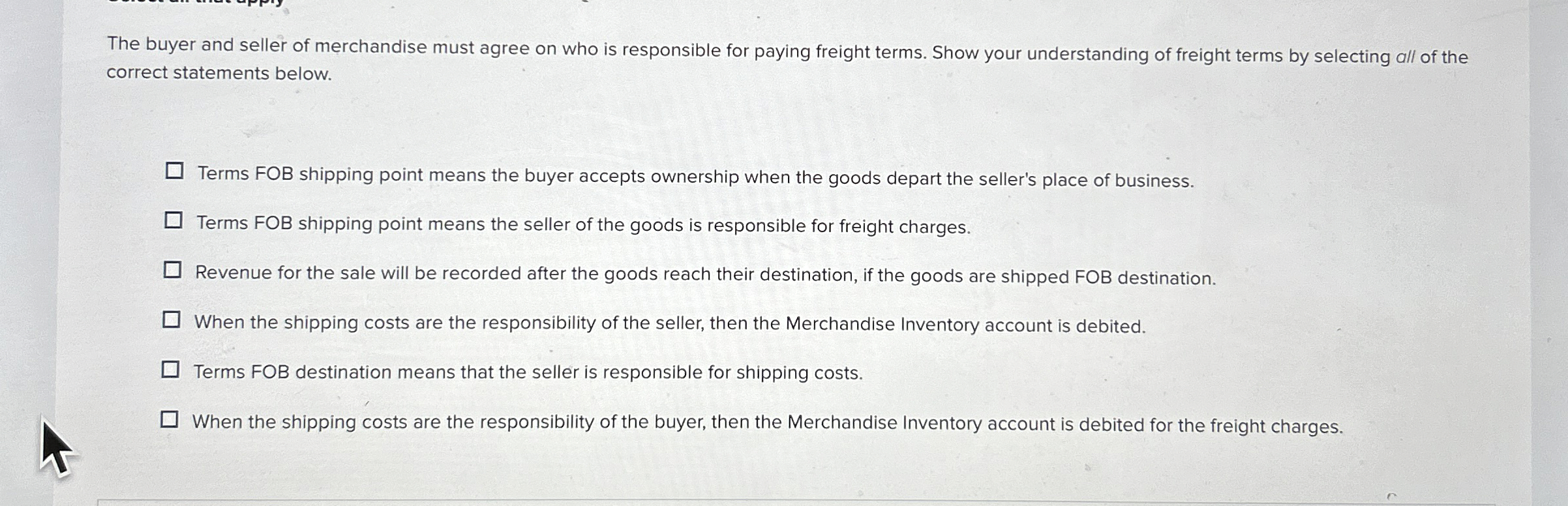

The buyer and seller of merchandise must agree on who is responsible for paying freight terms. Show your understanding of freight terms by selecting all of the

correct statements below.

Terms FOB shipping point means the buyer accepts ownership when the goods depart the seller's place of business.

Terms FOB shipping point means the seller of the goods is responsible for freight charges.

Revenue for the sale will be recorded after the goods reach their destination, if the goods are shipped FOB destination.

When the shipping costs are the responsibility of the seller, then the Merchandise Inventory account is debited.

Terms FOB destination means that the seller is responsible for shipping costs.

When the shipping costs are the responsibility of the buyer, then the Merchandise Inventory account is debited for the freight charges.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock