Question: MULTIPLE CHOICE QUESTIONS 1. The absolute version of PPP: a. is based on the law of one price b. assumes that there are no market

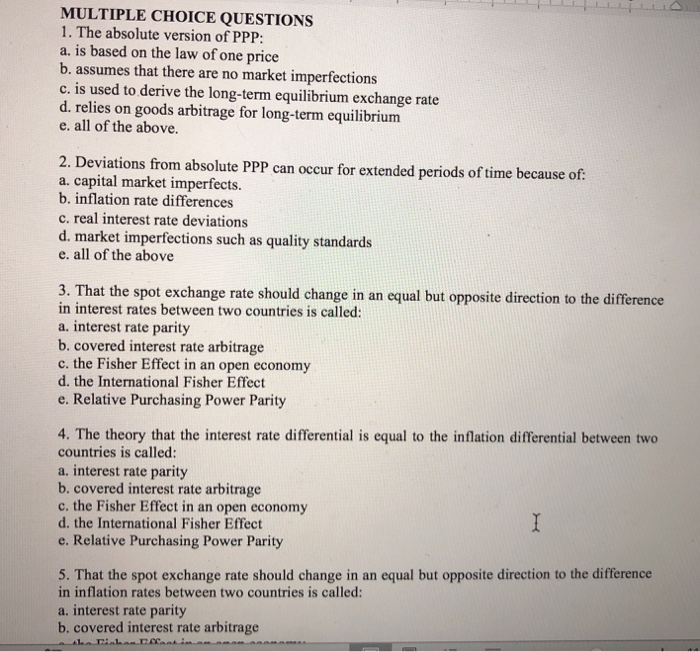

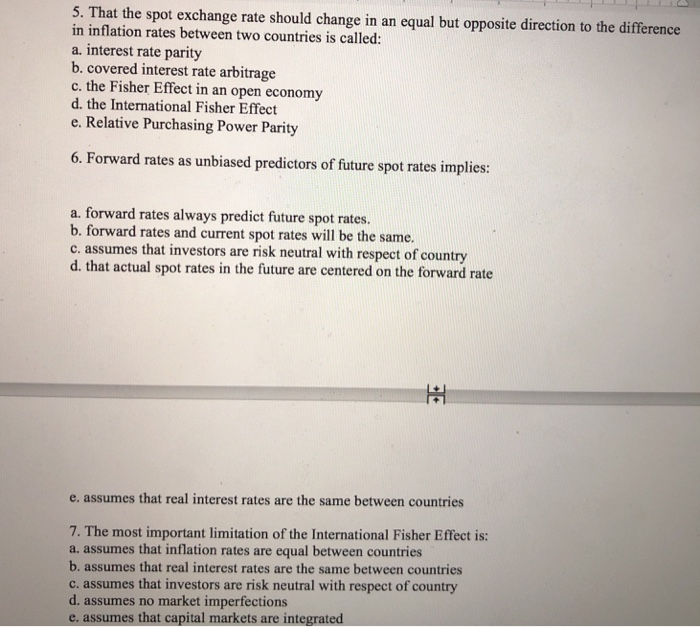

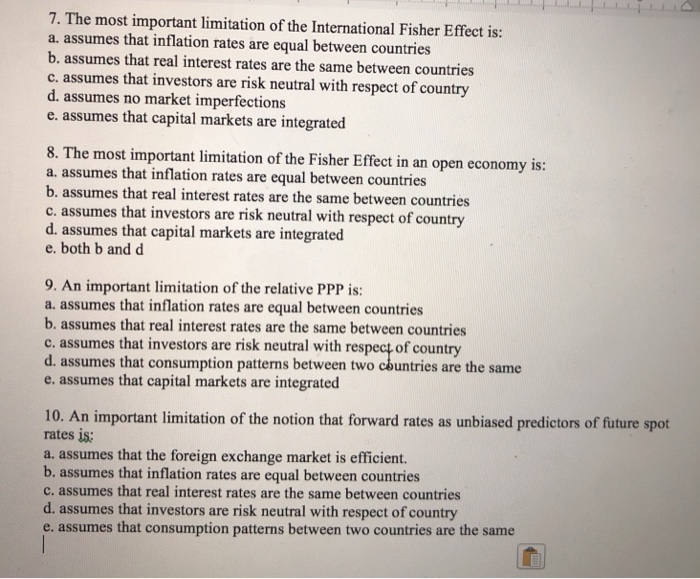

MULTIPLE CHOICE QUESTIONS 1. The absolute version of PPP: a. is based on the law of one price b. assumes that there are no market imperfections c. is used to derive the long-term equilibrium exchange rate d. relies on goods arbitrage for long-term equilibrium e. all of the above. 2. Deviations from absolute PPP can occur for extended periods of time because of: a. capital market imperfects. b. inflation rate differences c. real interest rate deviations d. market imperfections such as quality standards e. all of the above 3. That the spot exchange rate should change in an equal but opposite direction to the difference in interest rates between two countries is called: a. interest rate parity b. covered interest rate arbitrage c. the Fisher Effect in an open economy d. the International Fisher Effect e. Relative Purchasing Power Parity 4. The theory that the interest rate differential is equal to the inflation differential between two countries is called: a. interest rate parity b. covered interest rate arbitrage c. the Fisher Effect in an open economy d. the International Fisher Effect e. Relative Purchasing Power Parity 5. That the spot exchange rate should change in an equal but opposite direction to the difference in inflation rates between two countries is called: a. interest rate parity b. covered interest rate arbitrage 5. That the spot exchange rate should change in an equal but opposite direction to the difference in inflation rates between two countries is called: a. interest rate parity b. covered interest rate arbitrage c. the Fisher Effect in an open economy d. the International Fisher Effect e. Relative Purchasing Power Parity 6. Forward rates as unbiased predictors of future spot rates implies: a. forward rates always predict future spot rates. b. forward rates and current spot rates will be the same. c. assumes that investors are risk neutral with respect of country d. that actual spot rates in the future are centered on the forward rate e. assumes that real interest rates are the same between countries 7. The most important limitation of the International Fisher Effect is: a. assumes that inflation rates are equal between countries b. assumes that real interest rates are the same between countries c. assumes that investors are risk neutral with respect of country d. assumes no market imperfections e. assumes that capital markets are integrated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts