Question: multiple choice questions 1. Using a bank account provides the following control advantages: A. Reduces the amount of cash on-hand B. Provides an independent record

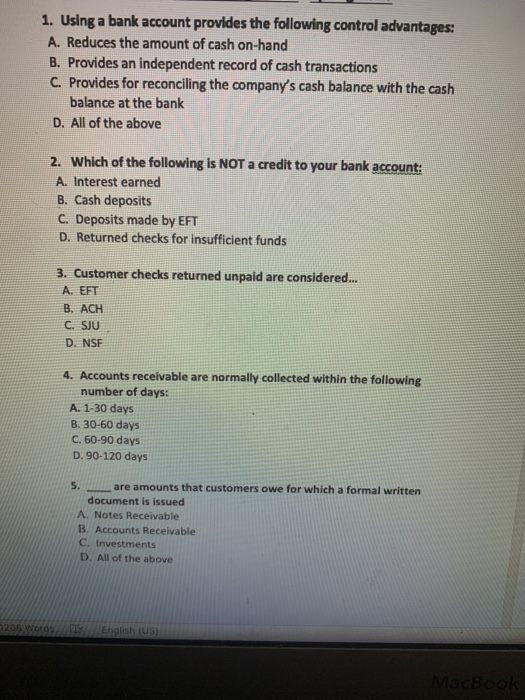

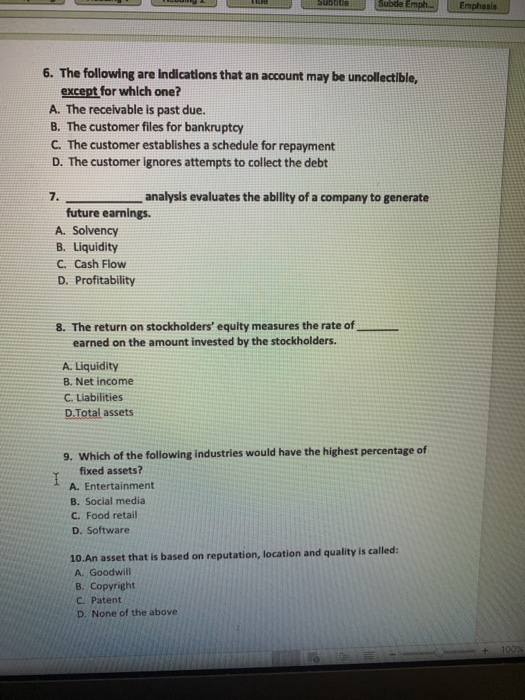

1. Using a bank account provides the following control advantages: A. Reduces the amount of cash on-hand B. Provides an independent record of cash transactions C. Provides for reconciling the company's cash balance with the cash balance at the bank D. All of the above 2. Which of the following is NOT a credit to your bank account: A. Interest earned B. Cash deposits C. Deposits made by EFT D. Returned checks for insufficient funds 3. Customer checks returned unpaid are considered... A, EET B. ACH C. SJU D. NSF 4. Accounts receivable are normally collected within the following number of days: A. 1-30 days B. 30-60 days C. 60-90 days D. 90-120 days are amounts that customers owe for which a formal written document is issued A Notes Receivable B. Accounts Receivable C. Investments D. All of the above 206 Words English (US) Subtle Emph.. Emphasis 6. The following are indications that an account may be uncollectible, except for which one? A. The receivable is past due. B. The customer files for bankruptcy C. The customer establishes a schedule for repayment D. The customer ignores attempts to collect the debt analysis evaluates the ability of a company to generate future earnings. A. Solvency B. Liquidity C. Cash Flow D. Profitability 8. The return on stockholders' equity measures the rate of earned on the amount invested by the stockholders. A. Liquidity B. Net income C. Liabilities D.Total assets 9. Which of the following industries would have the highest percentage of fixed assets? A. Entertainment B. Social media C. Food retail D. Software 10.An asset that is based on reputation, location and quality is called: A. Goodwill B. Copyright C. Patent D. None of the above 1. Using a bank account provides the following control advantages: A. Reduces the amount of cash on-hand B. Provides an independent record of cash transactions C. Provides for reconciling the company's cash balance with the cash balance at the bank D. All of the above 2. Which of the following is NOT a credit to your bank account: A. Interest earned B. Cash deposits C. Deposits made by EFT D. Returned checks for insufficient funds 3. Customer checks returned unpaid are considered... A, EET B. ACH C. SJU D. NSF 4. Accounts receivable are normally collected within the following number of days: A. 1-30 days B. 30-60 days C. 60-90 days D. 90-120 days are amounts that customers owe for which a formal written document is issued A Notes Receivable B. Accounts Receivable C. Investments D. All of the above 206 Words English (US) Subtle Emph.. Emphasis 6. The following are indications that an account may be uncollectible, except for which one? A. The receivable is past due. B. The customer files for bankruptcy C. The customer establishes a schedule for repayment D. The customer ignores attempts to collect the debt analysis evaluates the ability of a company to generate future earnings. A. Solvency B. Liquidity C. Cash Flow D. Profitability 8. The return on stockholders' equity measures the rate of earned on the amount invested by the stockholders. A. Liquidity B. Net income C. Liabilities D.Total assets 9. Which of the following industries would have the highest percentage of fixed assets? A. Entertainment B. Social media C. Food retail D. Software 10.An asset that is based on reputation, location and quality is called: A. Goodwill B. Copyright C. Patent D. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts