Question: MULTIPLE CHOICE QUESTIONS 1-1111111 | : 7-Multiple Choice Questions (45 points) | | Instruction: For part one, circle the correct answer. For parts two to

MULTIPLE CHOICE QUESTIONS

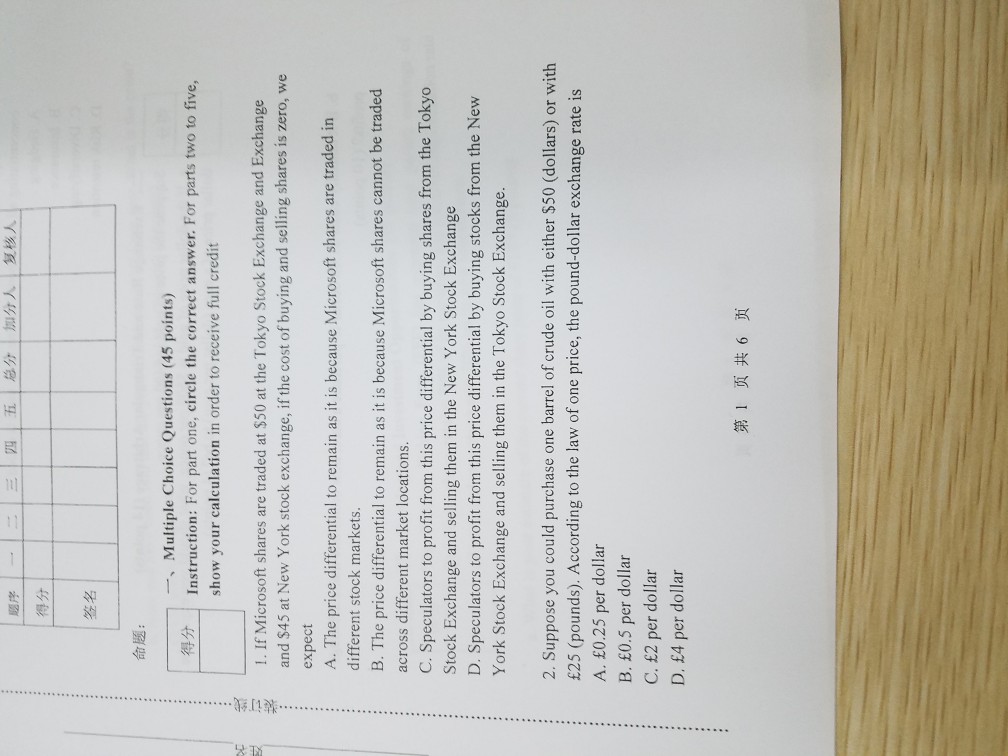

1-1111111 | : 7-Multiple Choice Questions (45 points) | | Instruction: For part one, circle the correct answer. For parts two to five, show your calculation in order to receive full credit 4F 1 . If Microsoft shares are traded at $50 at the Tokyo Stock Exchange and Exchange and $45 at New York stock exchange, if the cost of buying and selling shares is zero, we expect A. The price differential to remain as it is because Microsoft shares are traded in different stock markets. B. The price differential to remain as it is because Microsoft shares cannot be traded across different market locations C. Speculators to profit from this price differential by buying shares from the Tokyo Stock Exchange and selling them in the New York Stock Exchange D. Speculators to profit from this price differential by buying stocks from the New York Stock Exchange and selling them in the Tokyo Stock Exchange. 2. Suppose you could purchase one barrel of crude oil with either $50 (dollars) or with 25 (pounds). According to the law of one price, the pound-dollar exchange rate is A. E0.25 per dollar B. 0.5 per dollar C. 2 per dollar D. 4 per dollar 16 ARI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts