Question: Multiple Choice Questions (15 questions, 30 points suggested time 15 minutes) Write your answers on the multiple choice answer sheet . If you place an

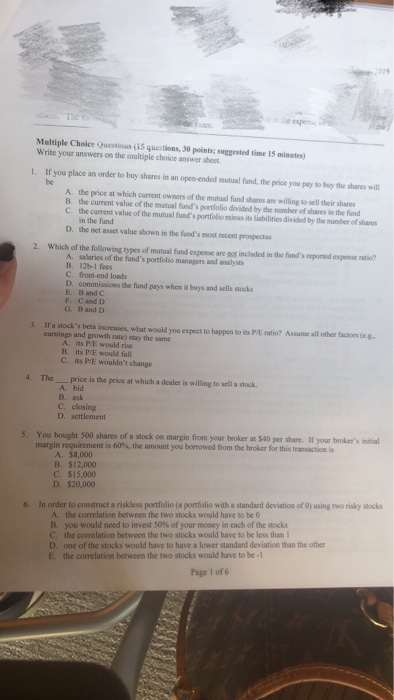

Multiple Choice Questions (15 questions, 30 points suggested time 15 minutes) Write your answers on the multiple choice answer sheet . If you place an order to buy shares in an open-ended mutual fund, the price you pay to buy the shares will be A. the price at which current owners of the mutual fund shares are willing to sell their shares B. the current value of the mutual fund's portfolio divided by the number of shares in the fund C the current value of the mutual fund's portfolio mienus its liabilities divided by the number of shares in the fund D. the net asset value shown in the fund's most recent prospectus 2. Which of the following types of mutual fund expense are not incladed in the fund's reporied expense ratio? A. salaries of the fund's portfolio managers and analysts B. 12b-1 fees C. front-end loads D. commissions the fund pays when it buys and sells stocks E. B and c F. C and D G. B and D If a stock's beta increases, what woald you expect to happen to its P/E ratio? Assume all other factons (e g earnings and growth rate stay the same A. its P/E would rise B. its PE would fall C. its P/E wouldn't change 4. The price is the price at which a dealer is willing to sell a stock A. bid B. ask C. closing D. settlement 5. You bought 500 shares of a stock on margin from your broker at $40 per share. If your broker's initial margin requirement is 60%, the amount you borrowed from the broker for this transacten is A. $8,000 B. $12,000 C. $15,000 D. $20,000 6. In order to construct a riskless portfolio (a portfolio with a standard deviation of 0) using two risky stocks A. the correlation between the two stocks would have to be 0 B. you would need to invest 50% of your money in each of the stocks C the correlation between the two stocks would have to be less than 1 D. one of the stocks would have to have a lower standard deviation than the other E. the correlation between the two stocks would have to be -1 Page 1 of 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts