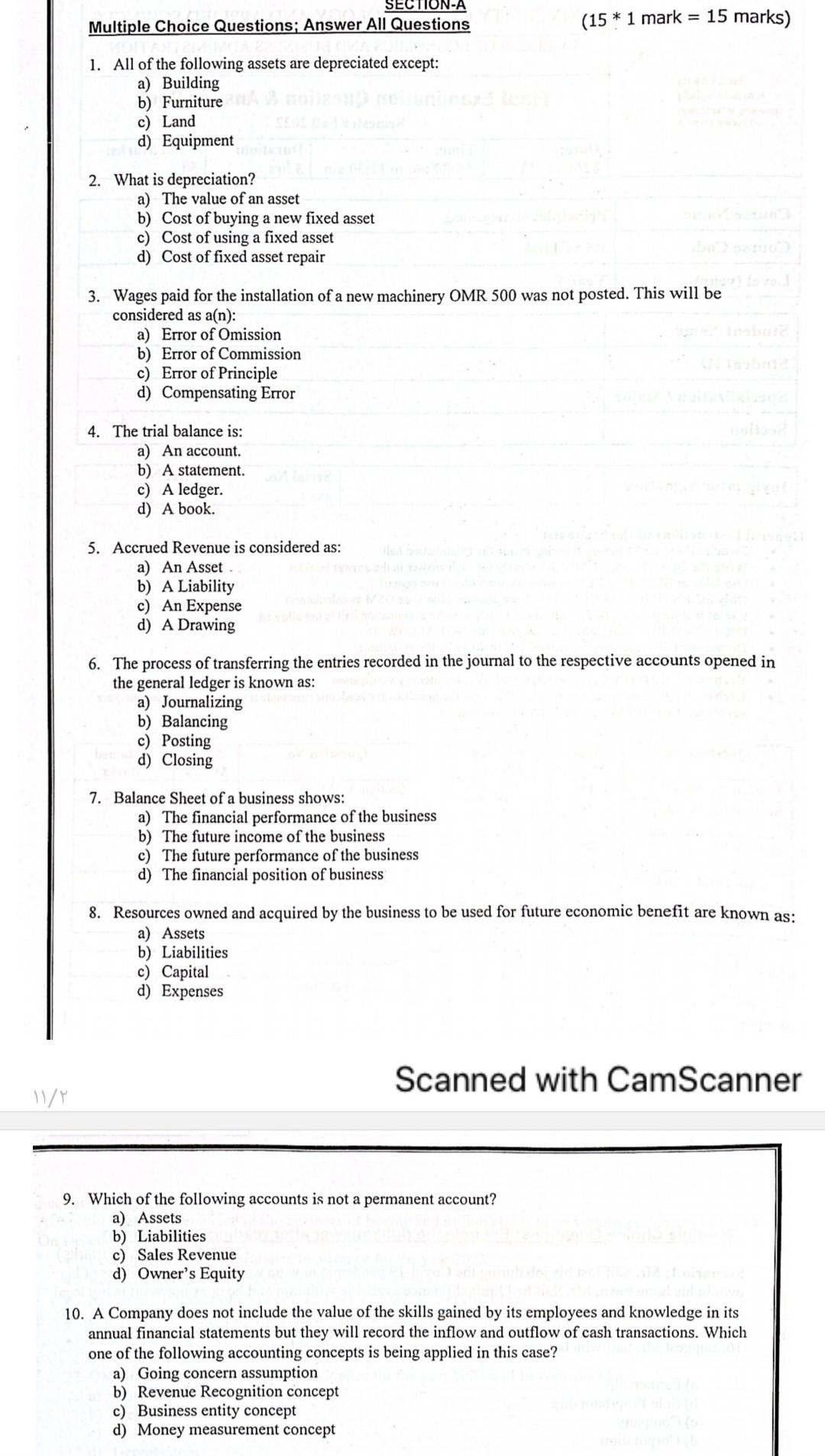

Question: Multiple Choice Questions; Answer All Questions (151 mark = 15 marks ) 1. All of the following assets are depreciated except: a) Building b) Furniture

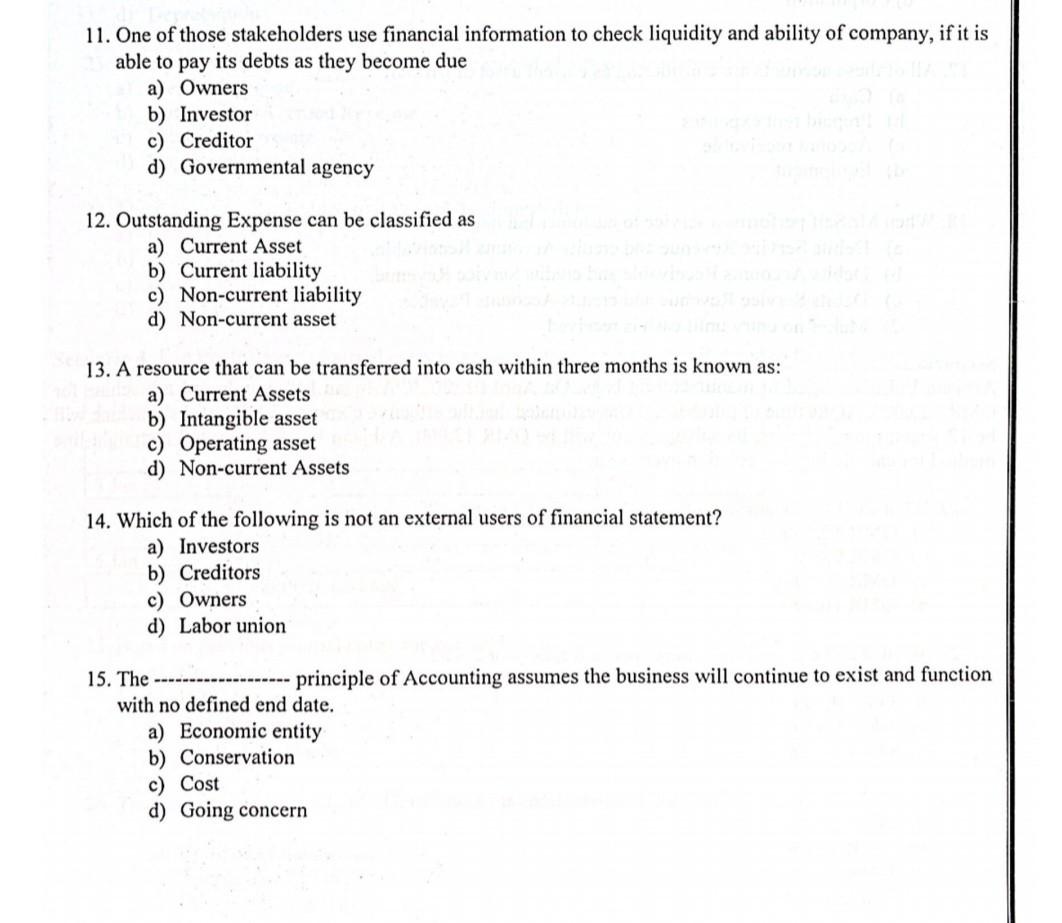

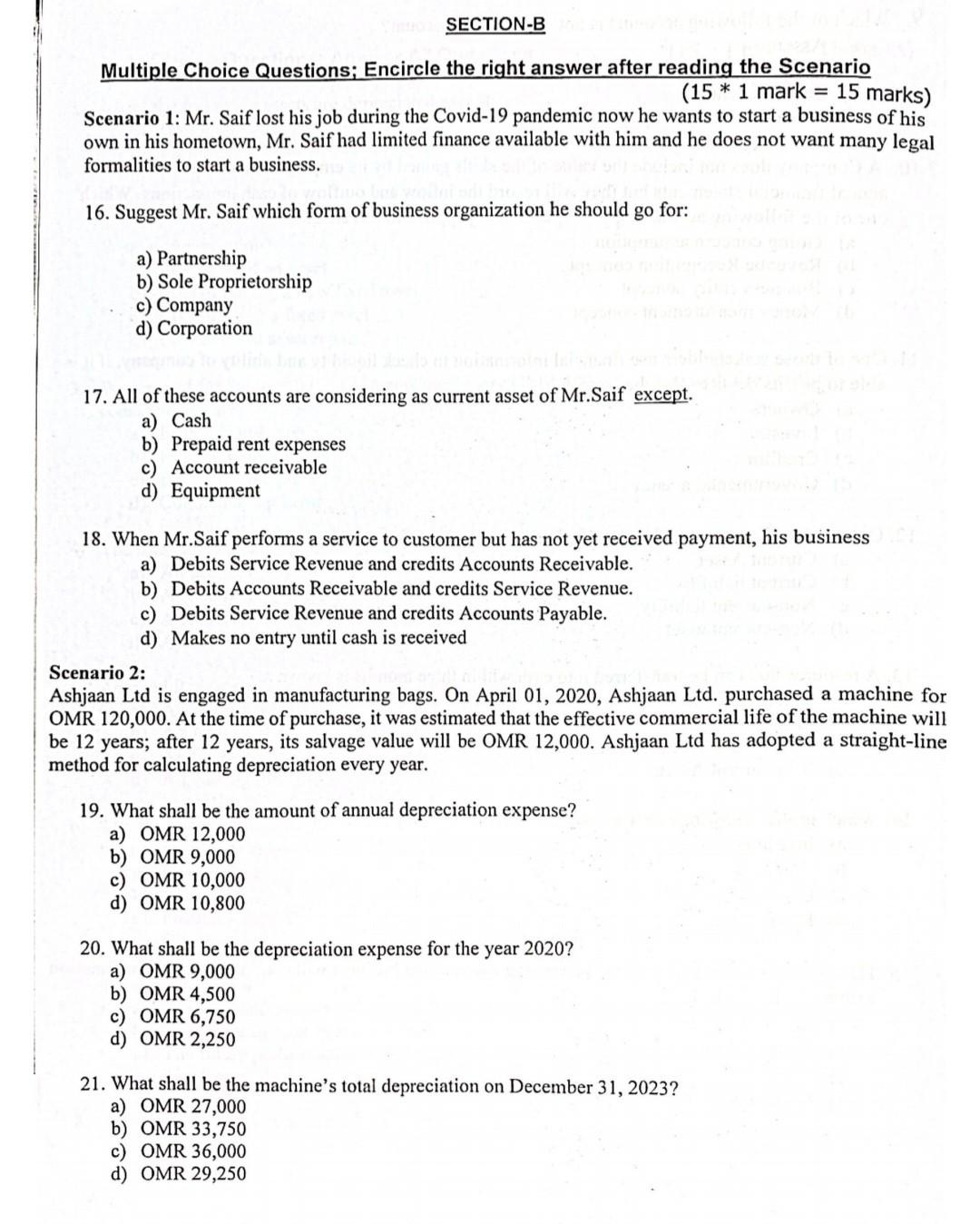

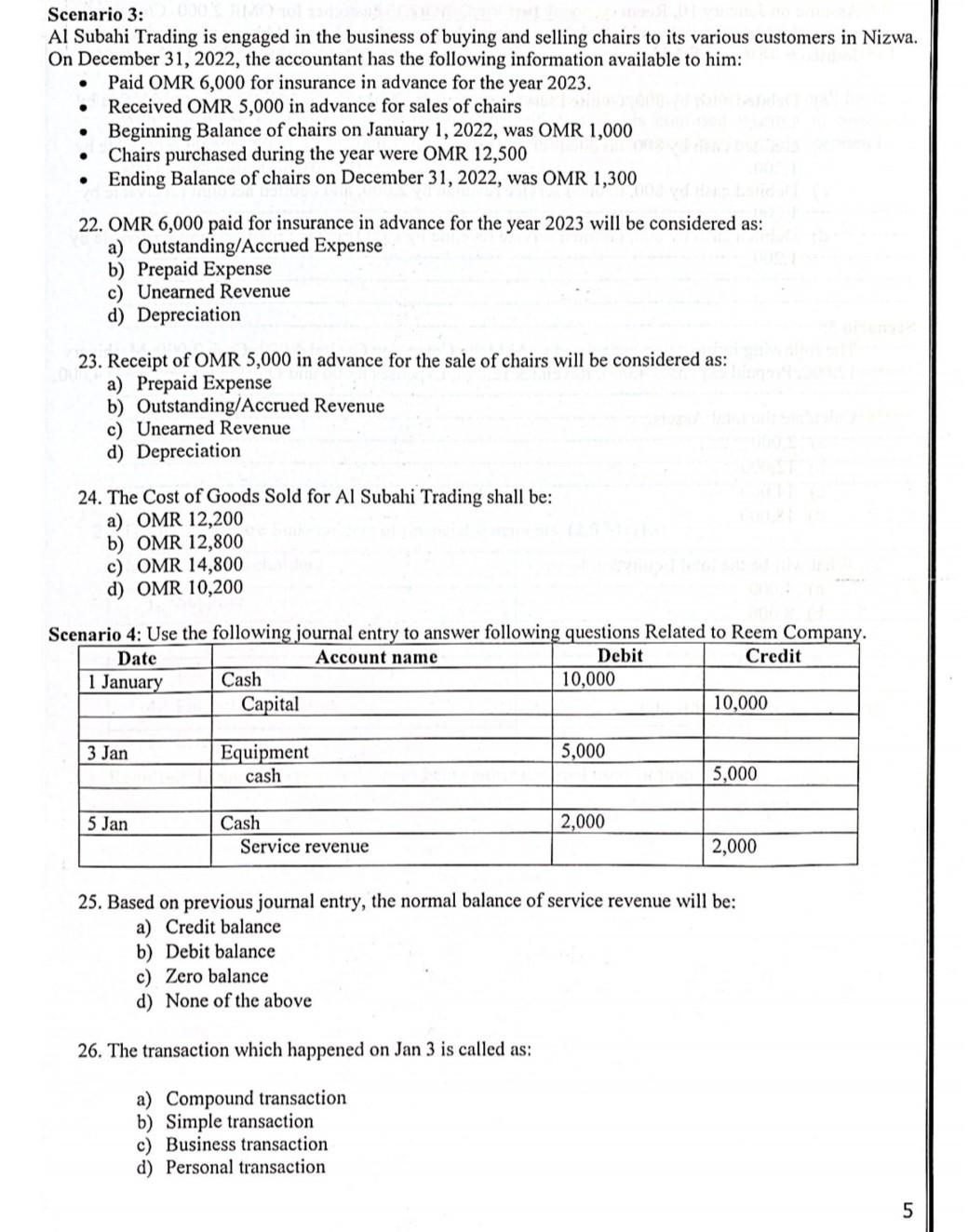

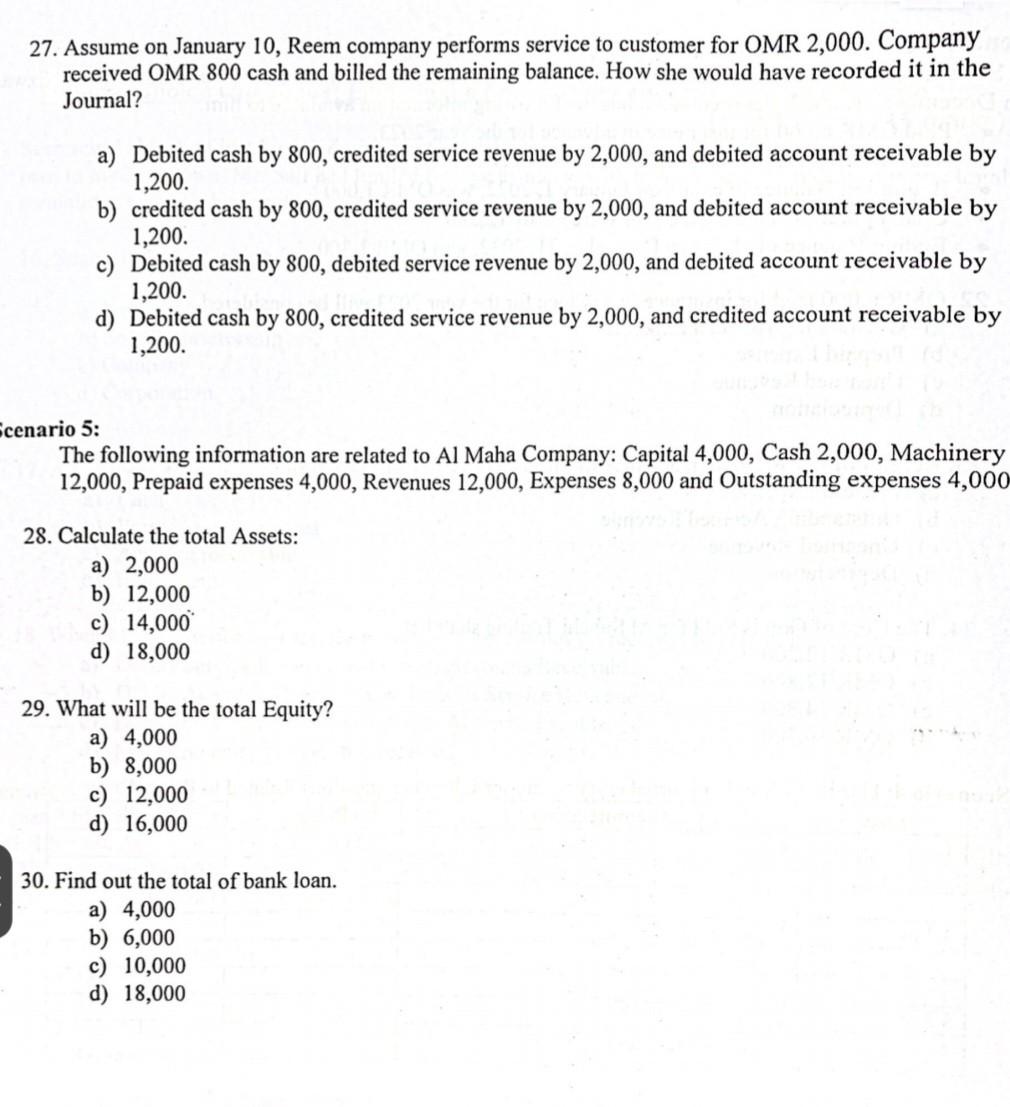

Multiple Choice Questions; Answer All Questions (151 mark = 15 marks ) 1. All of the following assets are depreciated except: a) Building b) Furniture c) Land d) Equipment 2. What is depreciation? a) The value of an asset b) Cost of buying a new fixed asset c) Cost of using a fixed asset d) Cost of fixed asset repair 3. Wages paid for the installation of a new machinery OMR 500 was not posted. This will be considered as a(n): a) Error of Omission b) Error of Commission c) Error of Principle d) Compensating Error 4. The trial balance is: a) An account. b) A statement. c) A ledger. d) A book. 5. Accrued Revenue is considered as: a) An Asset . b) A Liability c) An Expense d) A Drawing 6. The process of transferring the entries recorded in the journal to the respective accounts opened in the general ledger is known as: a) Journalizing b) Balancing c) Posting d) Closing 7. Balance Sheet of a business shows: a) The financial performance of the business b) The future income of the business c) The future performance of the business d) The financial position of business 8. Resources owned and acquired by the business to be used for future economic benefit are known as: a) Assets b) Liabilities c) Capital d) Expenses Scanned with CamScanner 9. Which of the following accounts is not a permanent account? a) Assets b) Liabilities c) Sales Revenue d) Owner's Equity 10. A Company does not include the value of the skills gained by its employees and knowledge in its annual financial statements but they will record the inflow and outflow of cash transactions. Which one of the following accounting concepts is being applied in this case? a) Going concern assumption b) Revenue Recognition concept c) Business entity concept d) Money measurement concept 11. One of those stakeholders use financial information to check liquidity and ability of company, if it is able to pay its debts as they become due a) Owners b) Investor c) Creditor d) Governmental agency 12. Outstanding Expense can be classified as a) Current Asset b) Current liability c) Non-current liability d) Non-current asset 13. A resource that can be transferred into cash within three months is known as: a) Current Assets b) Intangible asset c) Operating asset d) Non-current Assets 14. Which of the following is not an external users of financial statement? a) Investors b) Creditors c) Owners d) Labor union 15. The principle of Accounting assumes the business will continue to exist and function with no defined end date. a) Economic entity b) Conservation c) Cost d) Going concern (15 * 1 mark = 15 marks) Scenario 1: Mr. Saif lost his job during the Covid-19 pandemic now he wants to start a business of his own in his hometown, Mr. Saif had limited finance available with him and he does not want many legal formalities to start a business. 16. Suggest Mr. Saif which form of business organization he should go for: a) Partnership b) Sole Proprietorship c) Company d) Corporation 17. All of these accounts are considering as current asset of Mr.Saif except. a) Cash b) Prepaid rent expenses c) Account receivable d) Equipment 18. When Mr.Saif performs a service to customer but has not yet received payment, his business a) Debits Service Revenue and credits Accounts Receivable. b) Debits Accounts Receivable and credits Service Revenue. c) Debits Service Revenue and credits Accounts Payable. d) Makes no entry until cash is received Scenario 2: Ashjaan Ltd is engaged in manufacturing bags. On April 01, 2020, Ashjaan Ltd. purchased a machine for OMR 120,000 . At the time of purchase, it was estimated that the effective commercial life of the machine will be 12 years; after 12 years, its salvage value will be OMR 12,000. Ashjaan Ltd has adopted a straight-line method for calculating depreciation every year. 19. What shall be the amount of annual depreciation expense? a) OMR 12,000 b) OMR 9,000 c) OMR10,000 d) OMR10,800 20. What shall be the depreciation expense for the year 2020 ? a) OMR 9,000 b) OMR 4,500 c) OMR 6,750 d) OMR 2,250 21. What shall be the machine's total depreciation on December 31,2023 ? a) OMR 27,000 b) OMR 33,750 c) OMR36,000 d) OMR 29,250 Scenario 3: Al Subahi Trading is engaged in the business of buying and selling chairs to its various customers in Nizwa. On December 31,2022, the accountant has the following information available to him: - Paid OMR 6,000 for insurance in advance for the year 2023. - Received OMR 5,000 in advance for sales of chairs - Beginning Balance of chairs on January 1,2022, was OMR 1,000 - Chairs purchased during the year were OMR 12,500 - Ending Balance of chairs on December 31, 2022, was OMR 1,300 22. OMR 6,000 paid for insurance in advance for the year 2023 will be considered as: a) Outstanding/Accrued Expense b) Prepaid Expense c) Unearned Revenue d) Depreciation 23. Receipt of OMR 5,000 in advance for the sale of chairs will be considered as: a) Prepaid Expense b) Outstanding/Accrued Revenue c) Unearned Revenue d) Depreciation 24. The Cost of Goods Sold for Al Subahi Trading shall be: a) OMR 12,200 b) OMR 12,800 c) OMR 14,800 d) OMR 10,200 Scenarin 4: I Ise the following iournal entrv to answer following auestions Related to Reem Comnanv. 25. Based on previous journal entry, the normal balance of service revenue will be: a) Credit balance b) Debit balance c) Zero balance d) None of the above 26. The transaction which happened on Jan 3 is called as: a) Compound transaction b) Simple transaction c) Business transaction d) Personal transaction 27. Assume on January 10, Reem company performs service to customer for OMR 2,000. Company received OMR 800 cash and billed the remaining balance. How she would have recorded it in the Journal? a) Debited cash by 800 , credited service revenue by 2,000 , and debited account receivable by 1,200 . b) credited cash by 800 , credited service revenue by 2,000 , and debited account receivable by 1,200 . c) Debited cash by 800 , debited service revenue by 2,000 , and debited account receivable by 1,200 . d) Debited cash by 800 , credited service revenue by 2,000 , and credited account receivable by 1,200 . enario 5: The following information are related to Al Maha Company: Capital 4,000, Cash 2,000, Machinery 12,000, Prepaid expenses 4,000, Revenues 12,000, Expenses 8,000 and Outstanding expenses 4,000 28. Calculate the total Assets: a) 2,000 b) 12,000 c) 14,000 d) 18,000 29. What will be the total Equity? a) 4,000 b) 8,000 c) 12,000 d) 16,000 30. Find out the total of bank loan. a) 4,000 b) 6,000 c) 10,000 d) 18,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts