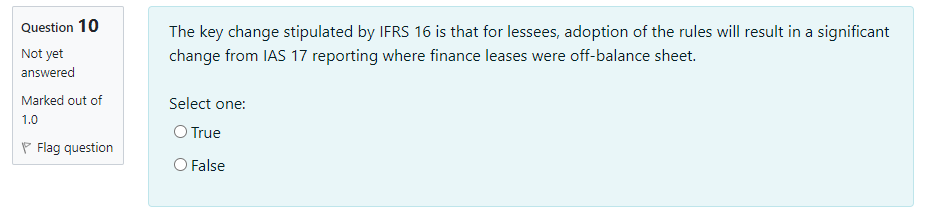

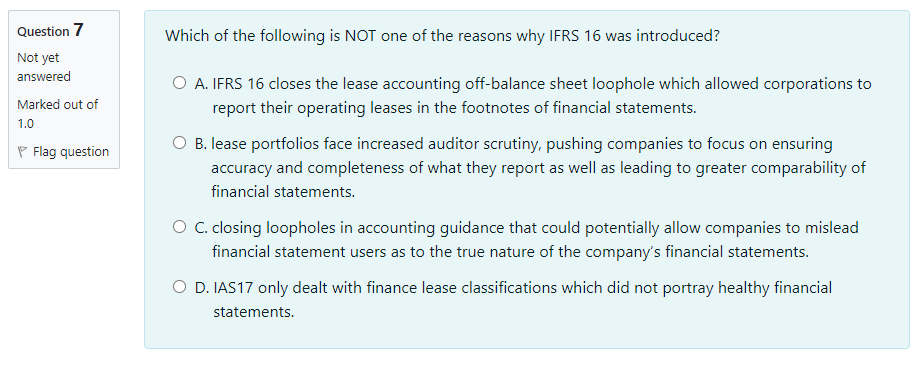

Question: Multiple choice questions attached below Question 1 0 Not yet answered Marked out of 1.0 'F Flag question The key change stipulated by IFRS 16

Multiple choice questions attached below

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock