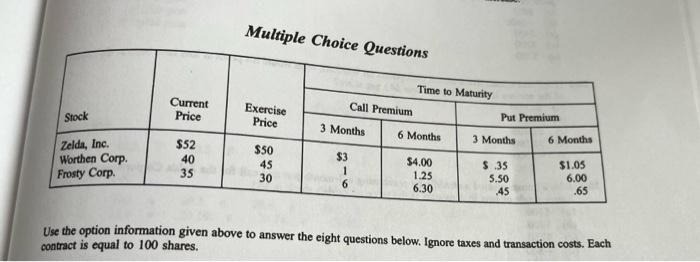

Question: Multiple Choice Questions Time to Maturity Current Price Call Premium Stock Exercise Price Put Premium 3 Months 6 Months $52 3 Months Zelda, Inc. 6

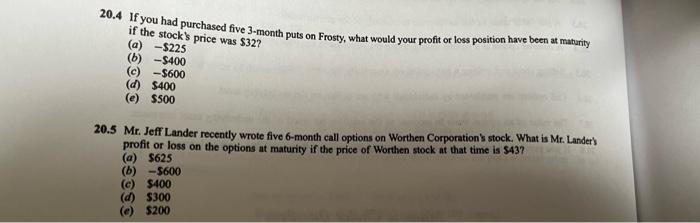

Multiple Choice Questions Time to Maturity Current Price Call Premium Stock Exercise Price Put Premium 3 Months 6 Months $52 3 Months Zelda, Inc. 6 Months Worthen Corp Frosty Corp 40 35 $50 45 30 $3 1 6 $4.00 1.25 6.30 $ 35 5.50 .45 $1.05 6.00 .65 Use the option information given above to answer the eight questions below. Ignore taxes and transaction costs. Each contract is equal to 100 shares. 20.4 If you had purchased five 3-month puts on Frosty, what would your profit or loss position have been at maturity if the stock's price was $32? (a) -$225 (b) -$400 --$600 (d) $400 (e) $500 (c) 20.5 Mr. Jeff Lander recently wrote five 6-month call options on Worthen Corporation's stock. What is Mr. Lander's profit or loss on the options at maturity if the price of Worthen stock at that time is S43? (a) $625 (b) -5600 (c) $400 (d) $300 (e) $200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts