Question: Multiple Choice - Select the best answer. 1 Arnold Company purchases a new delivery truck for $40,000. The sales taxes are $2,500. The logo of

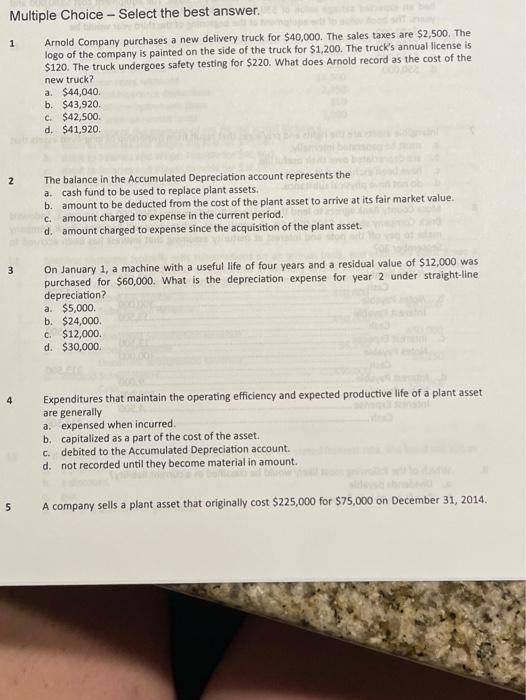

Multiple Choice - Select the best answer. 1 Arnold Company purchases a new delivery truck for $40,000. The sales taxes are $2,500. The logo of the company is painted on the side of the truck for $1,200. The truck's annual license is $120. The truck undergoes safety testing for $220. What does Arnold record as the cost of the new truck? a. $44,040 b. $43,920. c $42,500 d. $41,920. 2 The balance in the Accumulated Depreciation account represents the a. cash fund to be used to replace plant assets. b. amount to be deducted from the cost of the plant asset to arrive at its fair market value. c. amount charged to expense in the current period, d. amount charged to expense since the acquisition of the plant asset. 3 On January 1, a machine with a useful life of four years and a residual value of $12,000 was purchased for $60,000. What is the depreciation expense for year 2 under straight-line depreciation? a. $5,000. b. $24,000. c. $12,000. d. $30,000 4 Expenditures that maintain the operating efficiency and expected productive life of a plant asset are generally a, expensed when incurred. b. capitalized as a part of the cost of the asset. c. debited to the Accumulated Depreciation account. d. not recorded until they become material in amount. 5 A company sells a plant asset that originally cost $225,000 for $75,000 on December 31, 2014

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts