Question: Multiple Choice Select the best answer for each question. Jamison is a single dad with two dependent children: Zoey. age 7, and Conner, age 3.

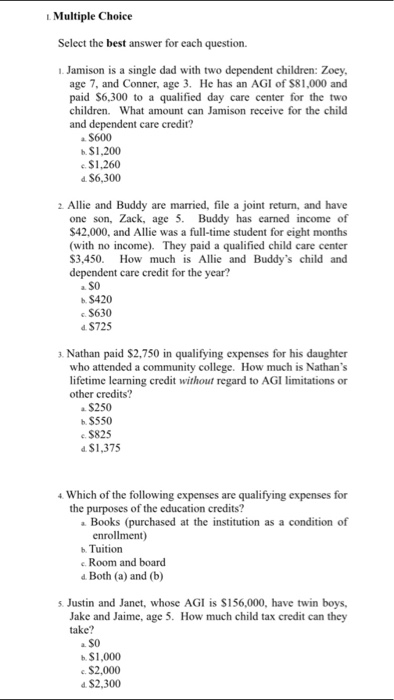

Multiple Choice Select the best answer for each question. Jamison is a single dad with two dependent children: Zoey. age 7, and Conner, age 3. He has an AGI of S81,000 and paid S6.300 to a qualified day care center for the two children. What amount can Jamison receive for the child and dependent care credit? S600 b $1.200 S1.260 d S6.300 2 Allie and Buddy are married, file a joint returm, and have one son, Zack, age 5 Buddy has earned income of $42,000, and Allie was a full-time student for eight months (with no income) They paid a qualified child care center $3.450 How much is Allie and Buddy's child and dependent care credit for the year? a.S0 b S420 S630 d S725 3. Nathan paid S2,750 in qualifying expenses for his daughter who attended a community college. How much is Nathan's lifetime learning credit without regard to AGI limitations or other credits? S250 b S550 S825 d S1.375 4 Which of the following expenses are qualifying expenses for the purposes of the education credits? a Books (purchased at the institution as a condition of enrollment) b Tuition Room and board d Both (a) and (b) 5 Justin and Janet, whose AGI is S156,000, have twin boys, Jake and Jaime, age 5. How much child tax credit can they take? a S0 b $1.000 S2,000 d S2.300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts