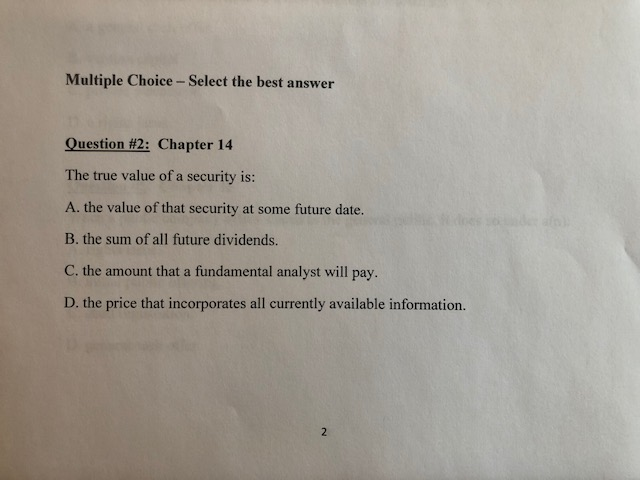

Question: Multiple Choice- Select the best answer Question #2: Chapter 14 The true value of a security is: A. the value of that security at some

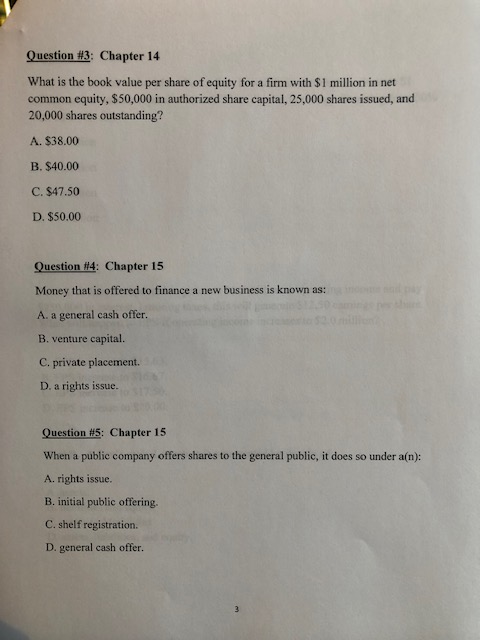

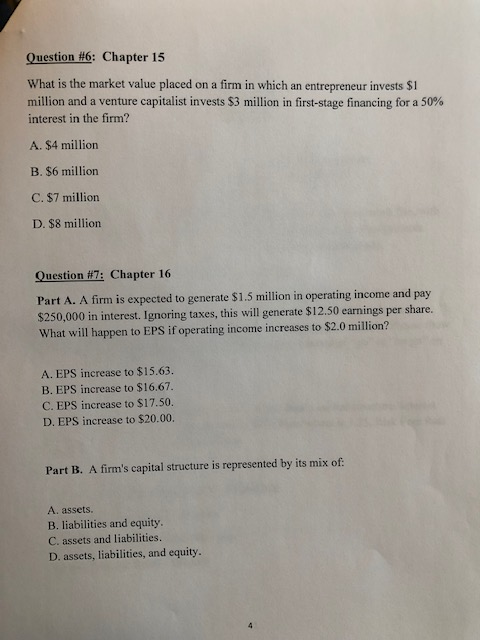

Multiple Choice- Select the best answer Question #2: Chapter 14 The true value of a security is: A. the value of that security at some future date. B. the sum of all future dividends. C. the amount that a fundamental analyst will pay. D. the price that incorporates all currently available information. Question #3: Chapter 14 What is the book value per share of equity for a firm with $1 million in net common equity, $50,000 in authorized share capital, 25,000 shares issued, and 20,000 shares outstanding? A. $38.00 B. $40.00 C. $47.50 D. $50.00 Question #4: Chapter 15 Money that is offered to finance a new business is known as: A. a general cash offer. B. venture capital. C. private placement. D. a rights issue. Question #5: Chapter 15 When a public company offers shares to the general public, it does so under a(n): A. rights issue. B. initial public offering C. shelf registration. D. general cash offer. Question #6: Chapter 15 What is the market value placed on a firm in which an entrepreneur invests $1 million and a venture capitalist invests $3 million in first-stage financing for a 50% interest in the firm? A. $4 million B. $6 million C. $7 million D. $8 million Question #7: Chapter 16 Part A. A firm is expected to generate $1.5 million in operating income and pay $250,000 in interest. Ignoring taxes, this will generate $12.50 earnings per share. What will happen to EPS if operating income increases to $2.0 million? A. EPS increase to $15.63. B. EPS increase to $16.67. C. EPS increase to $17.50. D. EPS increase to $20.00. Part B. A firm's capital structure is represented by its mix of: A. assets. B. liabilities and equity C. assets and liabilities D. assets, liabilities, and equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts