Question: (Multiple choice.....choose the correct answer ....without explanation) (Multiple choice.....choose the correct answer ....without explanation) (Multiple choice.....choose the correct answer ....without explanation) (Multiple choice.....choose the correct

(Multiple choice.....choose the correct answer ....without explanation)

(Multiple choice.....choose the correct answer ....without explanation) (Multiple choice.....choose the correct answer ....without explanation)

(Multiple choice.....choose the correct answer ....without explanation) (Multiple choice.....choose the correct answer ....without explanation)

(Multiple choice.....choose the correct answer ....without explanation) (Multiple choice.....choose the correct answer ....without explanation)

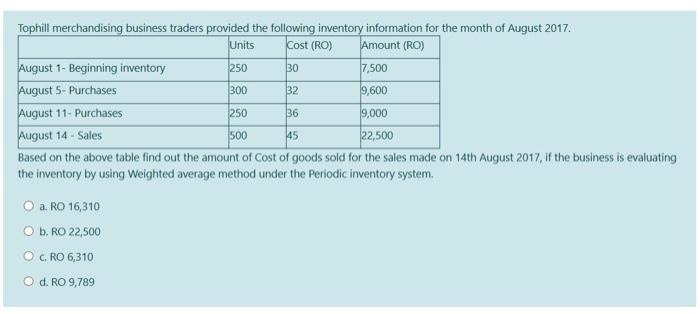

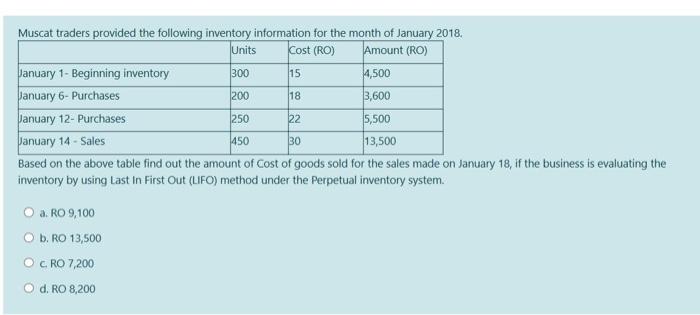

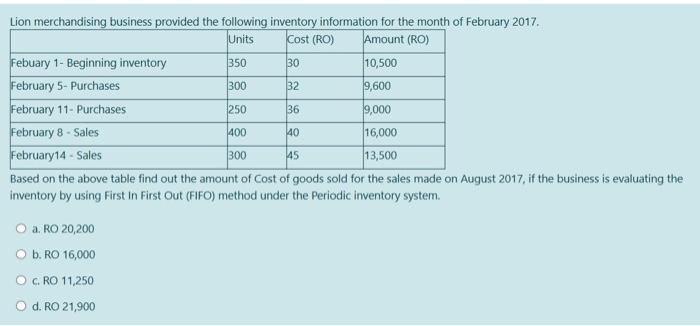

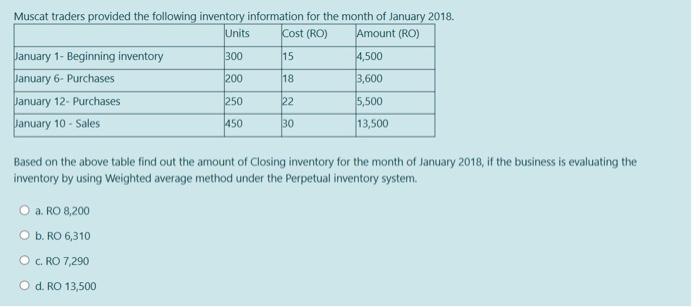

(Multiple choice.....choose the correct answer ....without explanation)Units 300 145 Tophill merchandising business traders provided the following inventory information for the month of August 2017. Cost (RO) Amount (RO) August 1- Beginning inventory 250 30 7,500 August 5. Purchases 32 9,600 August 11- Purchases 250 36 9,000 August 14 - Sales 500 22,500 Based on the above table find out the amount of Cost of goods sold for the sales made on 14th August 2017. if the business is evaluating the inventory by using Weighted average method under the Periodic inventory system, O a. RO 16,310 O b.RO 22,500 O C. RO 6,310 d. RO 9,789 300 15 200 18 Muscat traders provided the following inventory information for the month of January 2018. Units Cost (RO) Amount (RO) January 1- Beginning inventory 4,500 January 6- Purchases 3,600 January 12- Purchases 250 22 5,500 January 14 - Sales 30 13,500 Based on the above table find out the amount of Cost of goods sold for the sales made on January 18, if the business is evaluating the inventory by using Last In First Out (LIFO) method under the Perpetual inventory system 4450 a. RO 9,100 O b. RO 13,500 O c RO 7,200 O d. RO 8,200 Lion merchandising business provided the following inventory information for the month of February 2017 Units Cost (RO) Amount (RO) Febuary 1- Beginning inventory 350 30 10,500 February 5- Purchases 300 32 9,600 February 11- Purchases 250 36 9,000 February 8 - Sales 400 40 16,000 February 14 - Sales 300 45 13,500 Based on the above table find out the amount of Cost of goods sold for the sales made on August 2017, if the business is evaluating the inventory by using First In First Out (FIFO) method under the Periodic inventory system a. RO 20,200 b. RO 16,000 O C. RO 11,250 d.RO 21,900 Muscat traders provided the following inventory information for the month of January 2018. Units Cost (RO) Amount (RO) January 1- Beginning inventory 300 15 4,500 January 6-Purchases 200 3,600 January 12- Purchases 5,500 January 10 - Sales 13,500 18 250 22 1450 30 Based on the above table find out the amount of Closing inventory for the month of January 2018, if the business is evaluating the inventory by using Weighted average method under the Perpetual inventory system O a. RO 8,200 O b. RO 6,310 O c.RO 7,290 O d. RO 13,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts