Question: Multiple Choices 1) At 30, Artemis mortality is modeled assuming DeMoivre's Law. We know that her 10 year temporary expectation of life is equal to

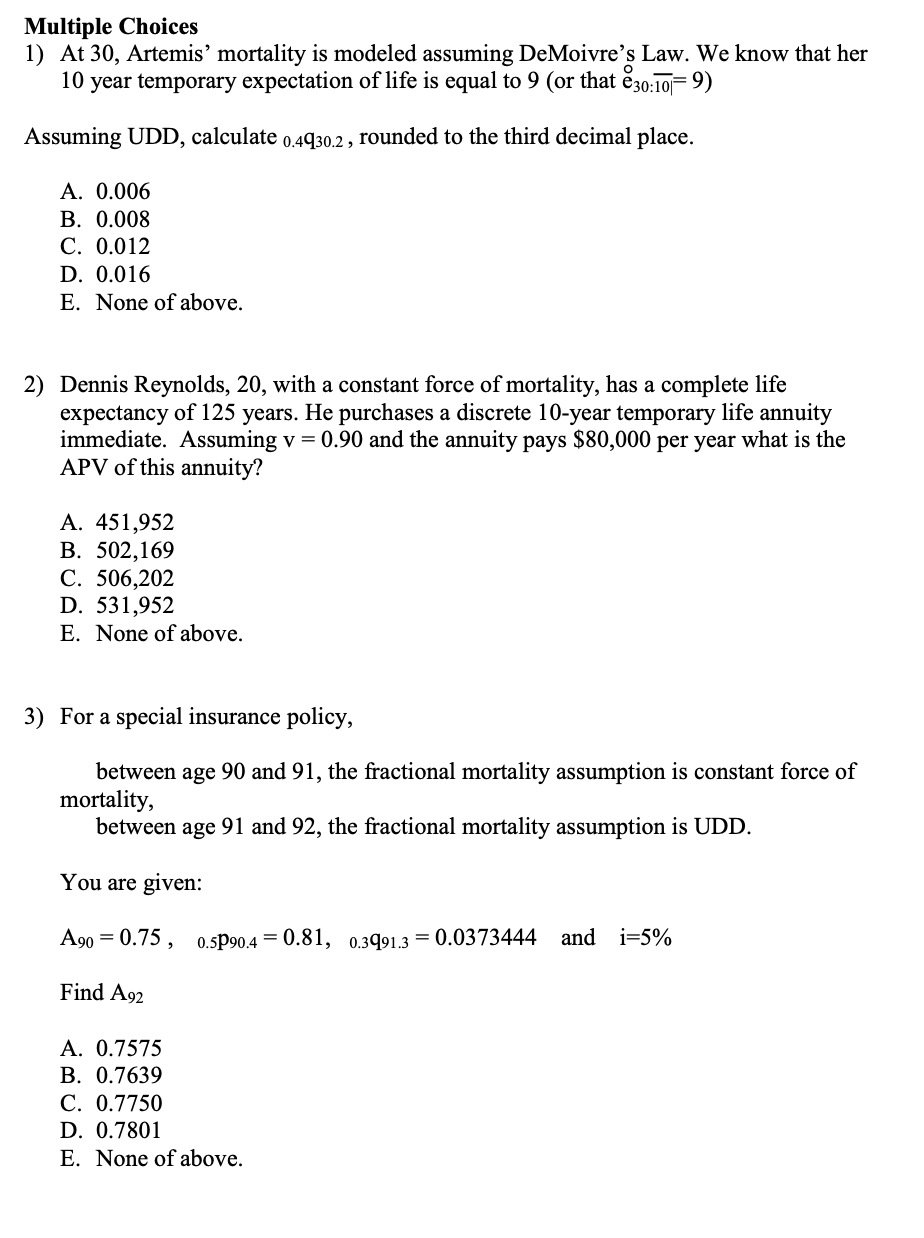

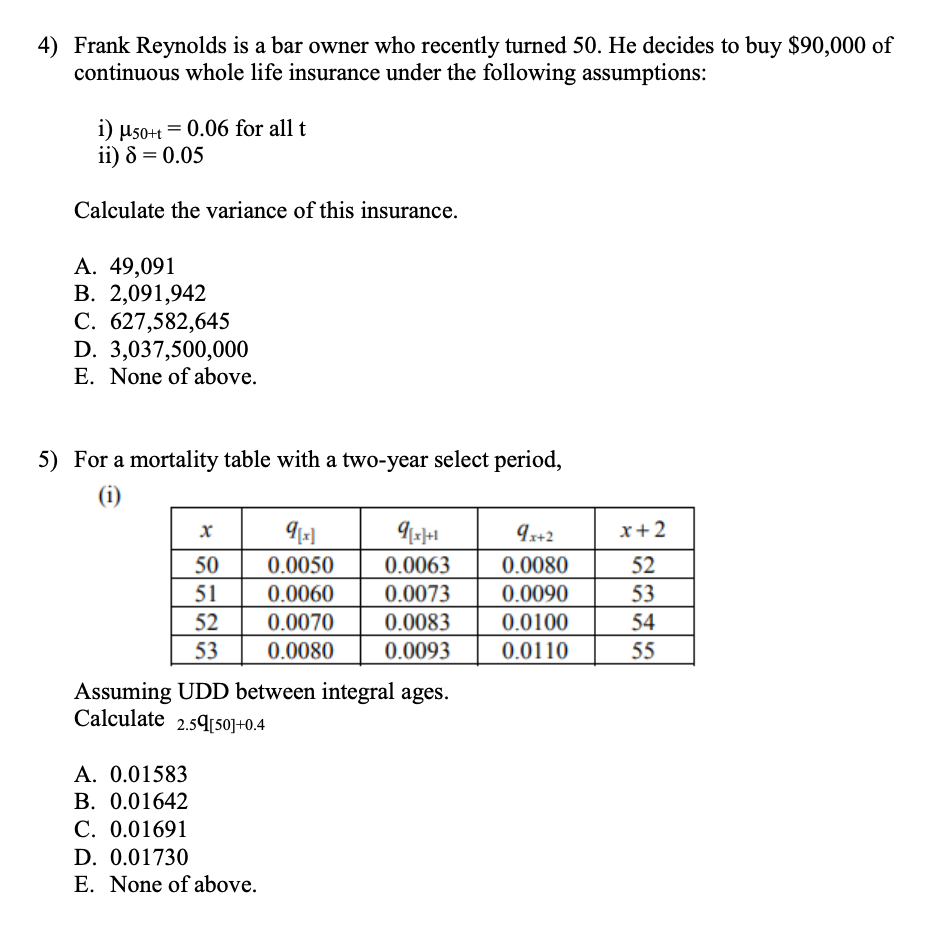

Multiple Choices 1) At 30, Artemis mortality is modeled assuming DeMoivre's Law. We know that her 10 year temporary expectation of life is equal to 9 (or that 30:10=9) Assuming UDD, calculate 0.4230.2 , rounded to the third decimal place. A. 0.006 B. 0.008 C. 0.012 D. 0.016 E. None of above. 2) Dennis Reynolds, 20, with a constant force of mortality, has a complete life expectancy of 125 years. He purchases a discrete 10-year temporary life annuity immediate. Assuming v = 0.90 and the annuity pays $80,000 per year what is the APV of this annuity? A. 451,952 B. 502,169 C. 506,202 D. 531,952 E. None of above. 3) For a special insurance policy, between age 90 and 91, the fractional mortality assumption is constant force of mortality, between age 91 and 92, the fractional mortality assumption is UDD. You are given: A90 = 0.75, 0.5P90.4 = 0.81, 0.3991.3 = 0.0373444 and i=5% Find A92 A. 0.7575 B. 0.7639 C. 0.7750 D. 0.7801 E. None of above. 4) Frank Reynolds is a bar owner who recently turned 50. He decides to buy $90,000 of continuous whole life insurance under the following assumptions: i) U5044 = 0.06 for all t ii) 8 = 0.05 Calculate the variance of this insurance. A. 49,091 B. 2,091,942 C. 627,582,645 D. 3,037,500,000 E. None of above. 5) For a mortality table with a two-year select period, x + 2 50 51 52 53 9[x] 0.0050 0.0060 0.0070 0.0080 9x+ 0.0063 0.0073 0.0083 0.0093 9x+2 0.0080 0.0090 0.0100 0.0110 52 53 54 55 Assuming UDD between integral ages. Calculate 2.59[50]+0.4 A. 0.01583 B. 0.01642 C. 0.01691 D. 0.01730 E. None of above. Multiple Choices 1) At 30, Artemis mortality is modeled assuming DeMoivre's Law. We know that her 10 year temporary expectation of life is equal to 9 (or that 30:10=9) Assuming UDD, calculate 0.4230.2 , rounded to the third decimal place. A. 0.006 B. 0.008 C. 0.012 D. 0.016 E. None of above. 2) Dennis Reynolds, 20, with a constant force of mortality, has a complete life expectancy of 125 years. He purchases a discrete 10-year temporary life annuity immediate. Assuming v = 0.90 and the annuity pays $80,000 per year what is the APV of this annuity? A. 451,952 B. 502,169 C. 506,202 D. 531,952 E. None of above. 3) For a special insurance policy, between age 90 and 91, the fractional mortality assumption is constant force of mortality, between age 91 and 92, the fractional mortality assumption is UDD. You are given: A90 = 0.75, 0.5P90.4 = 0.81, 0.3991.3 = 0.0373444 and i=5% Find A92 A. 0.7575 B. 0.7639 C. 0.7750 D. 0.7801 E. None of above. 4) Frank Reynolds is a bar owner who recently turned 50. He decides to buy $90,000 of continuous whole life insurance under the following assumptions: i) U5044 = 0.06 for all t ii) 8 = 0.05 Calculate the variance of this insurance. A. 49,091 B. 2,091,942 C. 627,582,645 D. 3,037,500,000 E. None of above. 5) For a mortality table with a two-year select period, x + 2 50 51 52 53 9[x] 0.0050 0.0060 0.0070 0.0080 9x+ 0.0063 0.0073 0.0083 0.0093 9x+2 0.0080 0.0090 0.0100 0.0110 52 53 54 55 Assuming UDD between integral ages. Calculate 2.59[50]+0.4 A. 0.01583 B. 0.01642 C. 0.01691 D. 0.01730 E. None of above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts