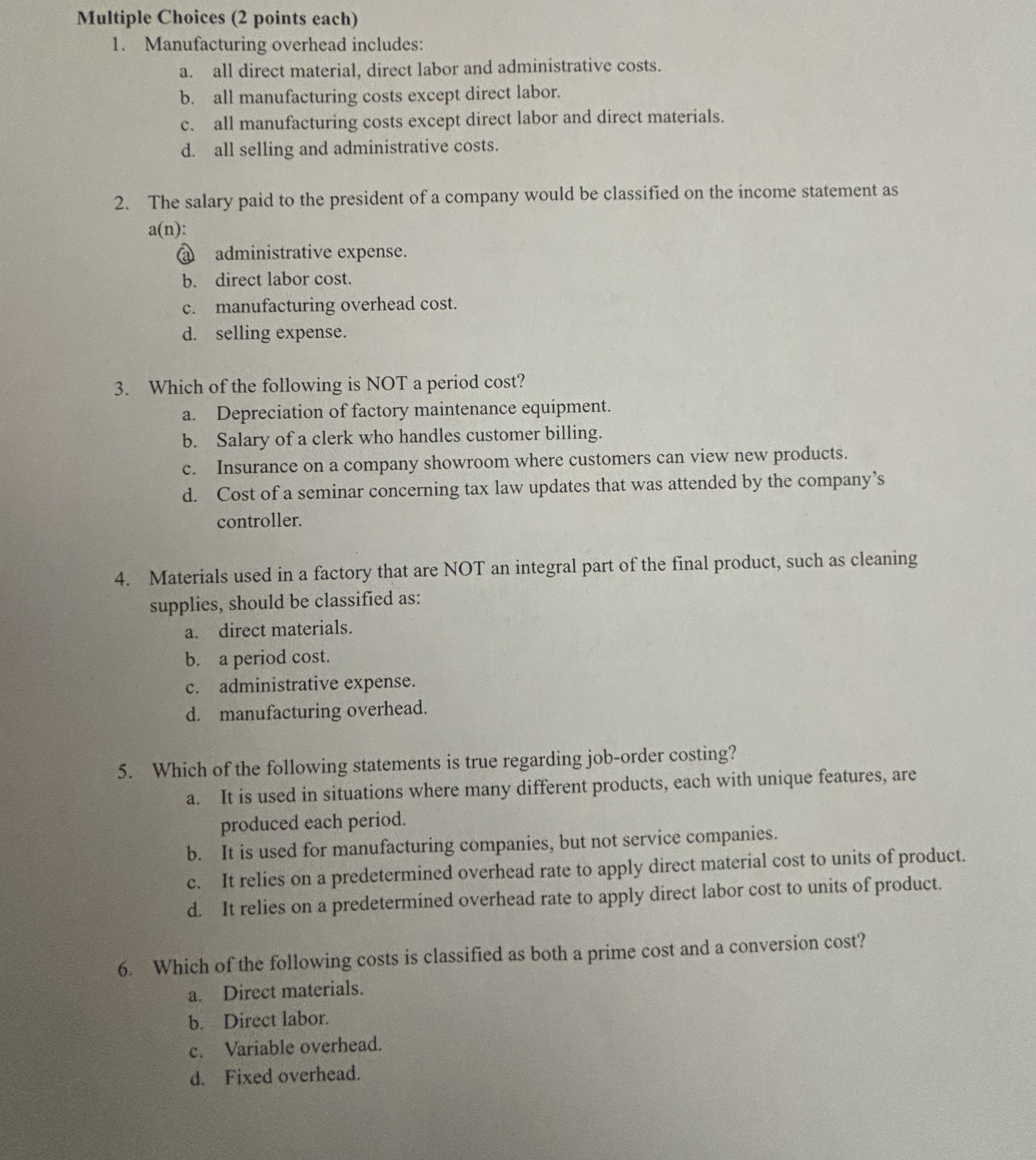

Question: Multiple Choices ( 2 points each ) Manufacturing overhead includes: a . all direct material, direct labor and administrative costs. b . all manufacturing costs

Multiple Choices points each

Manufacturing overhead includes:

a all direct material, direct labor and administrative costs.

b all manufacturing costs except direct labor.

c all manufacturing costs except direct labor and direct materials.

d all selling and administrative costs.

The salary paid to the president of a company would be classified on the income statement as

:

a administrative expense.

b direct labor cost.

c manufacturing overhead cost.

d selling expense.

Which of the following is NOT a period cost?

a Depreciation of factory maintenance equipment.

b Salary of a clerk who handles customer billing.

c Insurance on a company showroom where customers can view new products.

d Cost of a seminar concerning tax law updates that was attended by the company's

controller.

Materials used in a factory that are NOT an integral part of the final product, such as cleaning

supplies, should be classified as:

a direct materials.

b a period cost.

c administrative expense.

d manufacturing overhead.

Which of the following statements is true regarding joborder costing?

a It is used in situations where many different products, each with unique features, are

produced each period.

b It is used for manufacturing companies, but not service companies.

c It relies on a predetermined overhead rate to apply direct material cost to units of product.

d It relies on a predetermined overhead rate to apply direct labor cost to units of product.

Which of the following costs is classified as both a prime cost and a conversion cost?

a Direct materials.

b Direct labor.

c Variable overhead.

d Fixed overhead.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock