Question: Multiple Choices Read each statement carefully. Identify the correct answer. Choose correctly from possible answers. 1. This pertains to the original source materials evidenceing a

Multiple Choices

Read each statement carefully. Identify the correct answer. Choose correctly from possible answers.

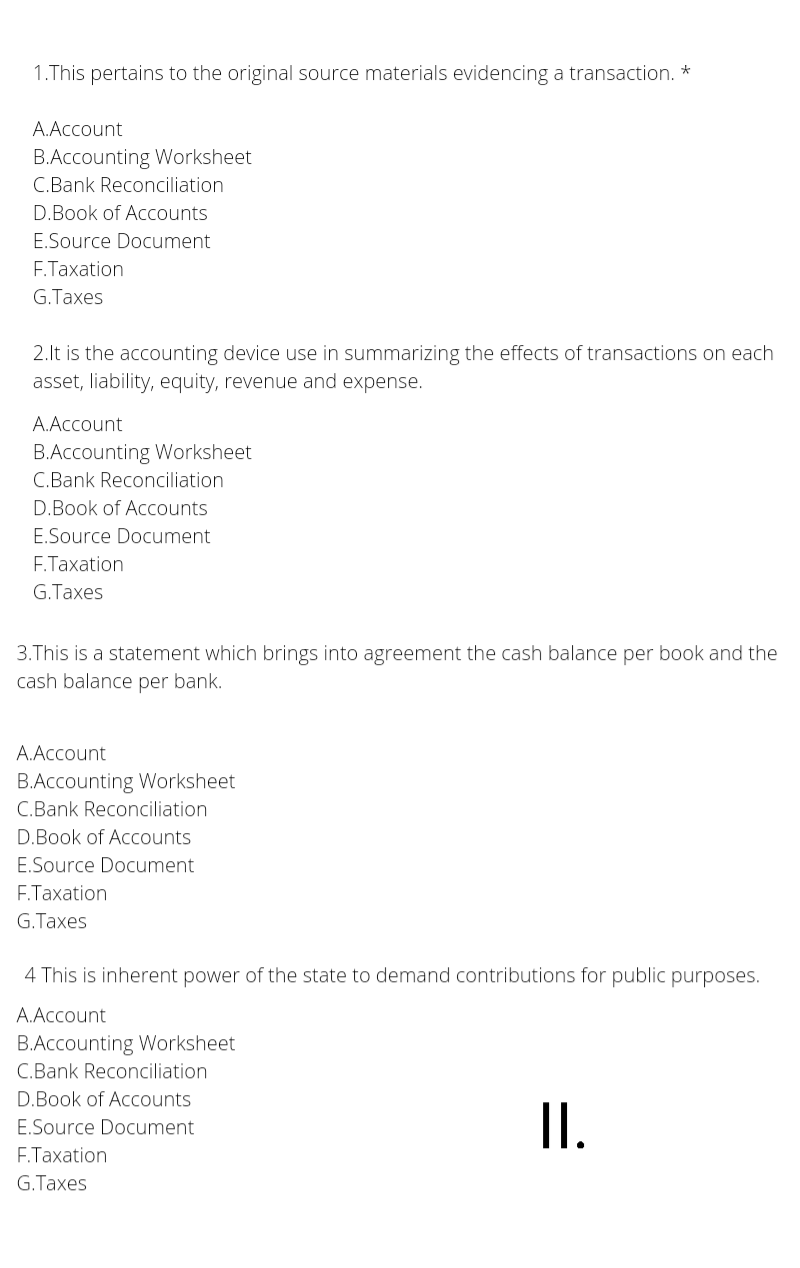

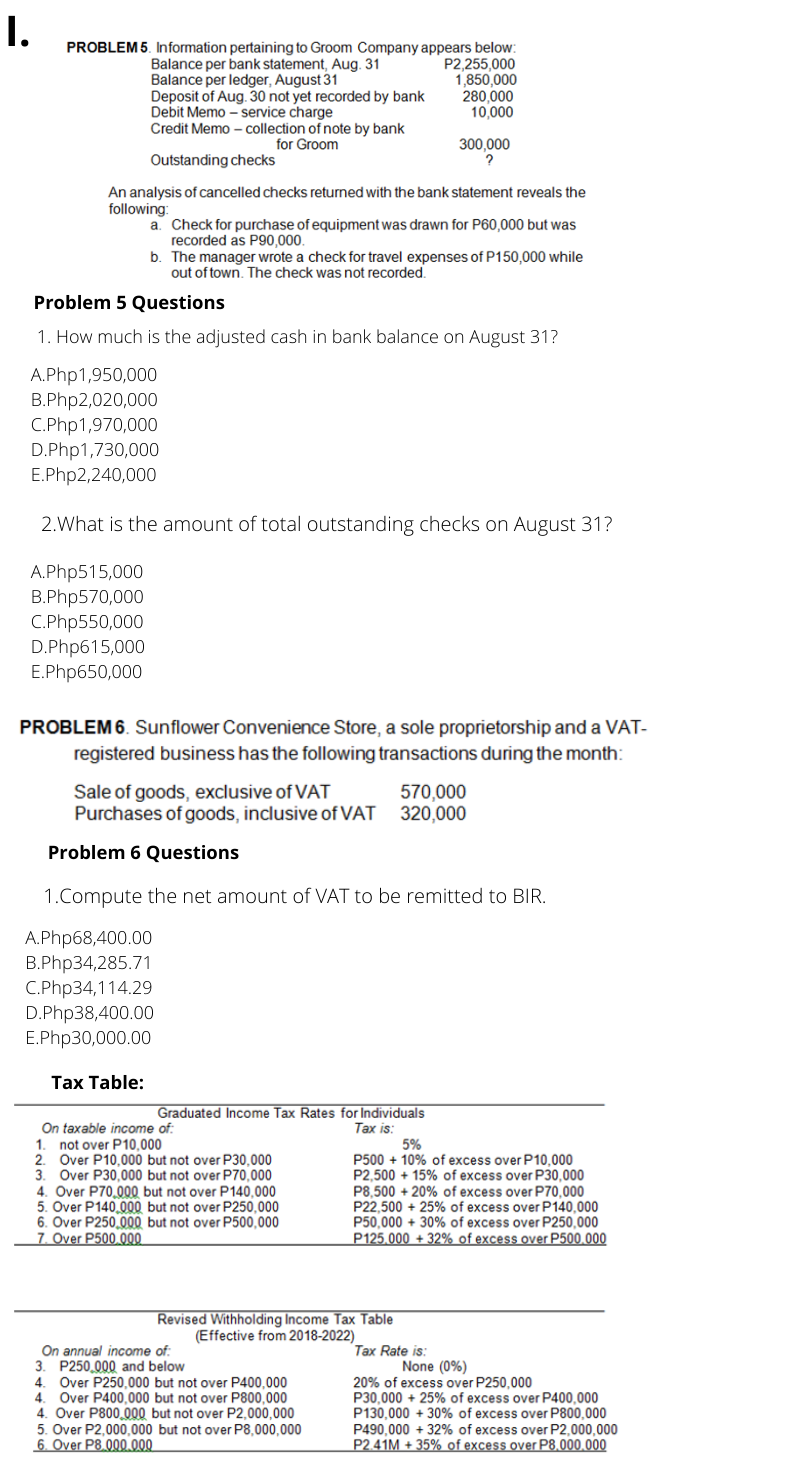

1. This pertains to the original source materials evidenceing a transaction. * A.Account B.Accounting Worksheet C.Bank Reconciliation D.Book of Accounts E.Source Document F. Taxation G. Taxes 2.It is the accounting device use in summarizing the effects of transactions on each asset, liability, equity, revenue and expense. A.Account B.Accounting Worksheet C.Bank Reconciliation D.Book of Accounts E.Source Document F. Taxation G. Taxes 3. This is a statement which brings into agreement the cash balance per book and the cash balance per bank. A.Account B.Accounting Worksheet C.Bank Reconciliation D.Book of Accounts E.Source Document F.Taxation G.Taxes 4 This is inherent power of the state to demand contributions for public purposes. A.Account B.Accounting Worksheet C.Bank Reconciliation D.Book of Accounts E.Source Document F. Taxation G. TaxesPROBLEM 5. Information pertaining to Groom Company appears below: Balance per bank statement, Aug. 31 P2,255,000 Balance per ledger, August 31 850,000 Deposit of Aug. 30 not yet recorded by bank 280,000 Debit Memo - service charge 10,000 Credit Memo - collection of note by bank for Groom 300,000 Outstanding checks 2 An analysis of cancelled checks returned with the bank statement reveals the following: a. Check for purchase of equipment was drawn for P60,000 but was recorded as P90,000. b. The manager wrote a check for travel expenses of P150,000 while out of town. The check was not recorded. Problem 5 Questions 1. How much is the adjusted cash in bank balance on August 31? A.Php1,950,000 B.Php2,020,000 C.Php1,970,000 D.Php1,730,000 E.Php2,240,000 2.What is the amount of total outstanding checks on August 31? A.Php515,000 B.Php570,000 C.Php550,000 D.Php615,000 E.Php650,000 PROBLEM 6. Sunflower Convenience Store, a sole proprietorship and a VAT- registered business has the following transactions during the month: Sale of goods, exclusive of VAT 570,000 Purchases of goods, inclusive of VAT 320,000 Problem 6 Questions 1.Compute the net amount of VAT to be remitted to BIR. A.Php68,400.00 B.Php34,285.71 C.Php34,114.29 D.Php38,400.00 E.Php30,000.00 Tax Table: Graduated Income Tax Rates for Individuals On taxable income of. Tax is: not over P10,000 5% 2. Over P10,000 but not over P30,000 P500 + 10% of excess over P10,000 3. Over P30,000 but not over P70,000 P2,500 + 15% of excess over P30,000 4. Over P70,000 but not over P140,000 P8,500 + 20% of excess over P70,000 5. Over P140,000 but not over P250,000 P22,500 + 25% of excess over P140,000 6. Over P250,000 but not over P500,000 P50,000 + 30% of excess over P250,000 7. Over P500 000 P125 000 + 32% of excess over P500 000 Revised Withholding Income Tax Table (Effective from 2018-2022) On annual income of: Tax Rate is: 3. P250,000 and below None (0%) 4. Over P250,000 but not over P400,000 20% of excess over P250,000 4. Over P400,000 but not over P800,000 P30,000 + 25% of excess over P400,000 4. Over P800,000 but not over P2,000,000 P130,000 + 30% of excess over P800,000 5. Over P2,000,000 but not over P8,000,000 P490,000 + 32% of excess over P2,000,000 6. Over P8 000 000 P2.41M + 35% of excess over P8 000.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts