Question: Multiple part question...Please answer and Explain, Thankyou! 38 III. 39 Abigail Jones has a $750,000 fully diversified portfolio. She subsequently inherits JF Inc. common stock

Multiple part question...Please answer and Explain, Thankyou!

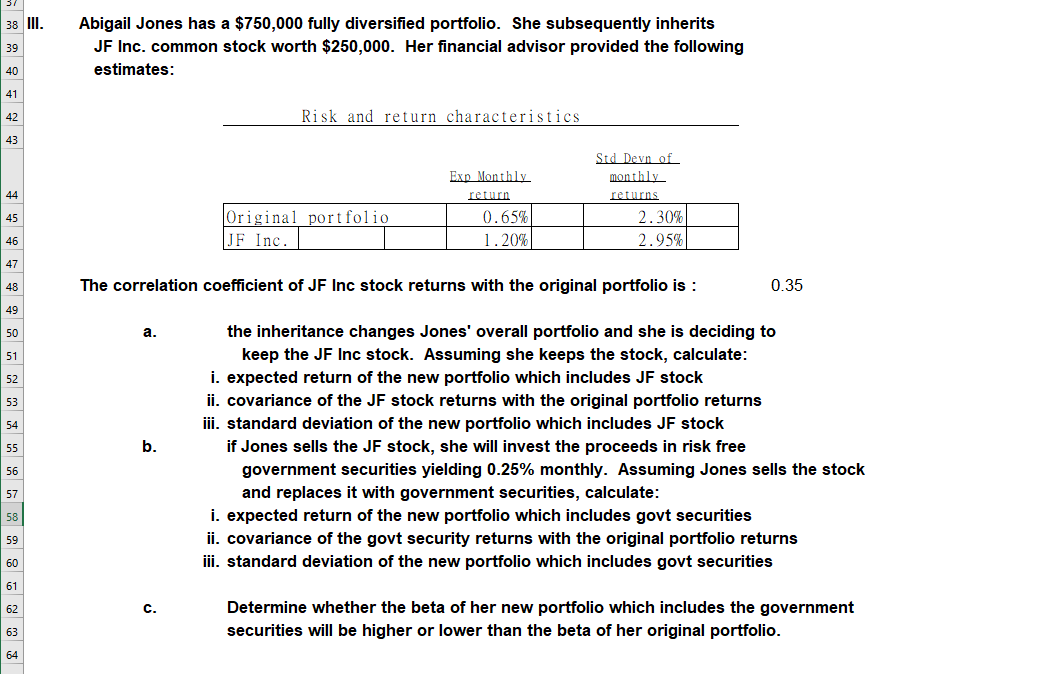

38 III. 39 Abigail Jones has a $750,000 fully diversified portfolio. She subsequently inherits JF Inc. common stock worth $250,000. Her financial advisor provided the following estimates: 40 41 42 Risk and return characteristics 43 44 Std Devn of monthly returns 2.30% 2.95% Exp Monthly return 0.65% 1. 20% 45 Original portfolio JF Inc 46 47 48 The correlation coefficient of JF Inc stock returns with the original portfolio is : 0.35 49 50 a. 51 52 53 54 55 b. the inheritance changes Jones' overall portfolio and she is deciding to keep the JF Inc stock. Assuming she keeps the stock, calculate: i. expected return of the new portfolio which includes JF stock ii. covariance of the JF stock returns with the original portfolio returns iii. standard deviation of the new portfolio which includes JF stock if Jones sells the JF stock, she will invest the proceeds in risk free government securities yielding 0.25% monthly. Assuming Jones sells the stock and replaces it with government securities, calculate: i. expected return of the new portfolio which includes govt securities ii. covariance of the govt security returns with the original portfolio returns iii. standard deviation of the new portfolio which includes govt securities 56 57 58 59 60 61 62 C. Determine whether the beta of her new portfolio which includes the government securities will be higher or lower than the beta of her original portfolio. 63 64 38 III. 39 Abigail Jones has a $750,000 fully diversified portfolio. She subsequently inherits JF Inc. common stock worth $250,000. Her financial advisor provided the following estimates: 40 41 42 Risk and return characteristics 43 44 Std Devn of monthly returns 2.30% 2.95% Exp Monthly return 0.65% 1. 20% 45 Original portfolio JF Inc 46 47 48 The correlation coefficient of JF Inc stock returns with the original portfolio is : 0.35 49 50 a. 51 52 53 54 55 b. the inheritance changes Jones' overall portfolio and she is deciding to keep the JF Inc stock. Assuming she keeps the stock, calculate: i. expected return of the new portfolio which includes JF stock ii. covariance of the JF stock returns with the original portfolio returns iii. standard deviation of the new portfolio which includes JF stock if Jones sells the JF stock, she will invest the proceeds in risk free government securities yielding 0.25% monthly. Assuming Jones sells the stock and replaces it with government securities, calculate: i. expected return of the new portfolio which includes govt securities ii. covariance of the govt security returns with the original portfolio returns iii. standard deviation of the new portfolio which includes govt securities 56 57 58 59 60 61 62 C. Determine whether the beta of her new portfolio which includes the government securities will be higher or lower than the beta of her original portfolio. 63 64

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts