Question: MULTIPLE question. CHOICE. Choose the one alternative that best completes the statement or answers the 8) 8) The actual real rate of return on an

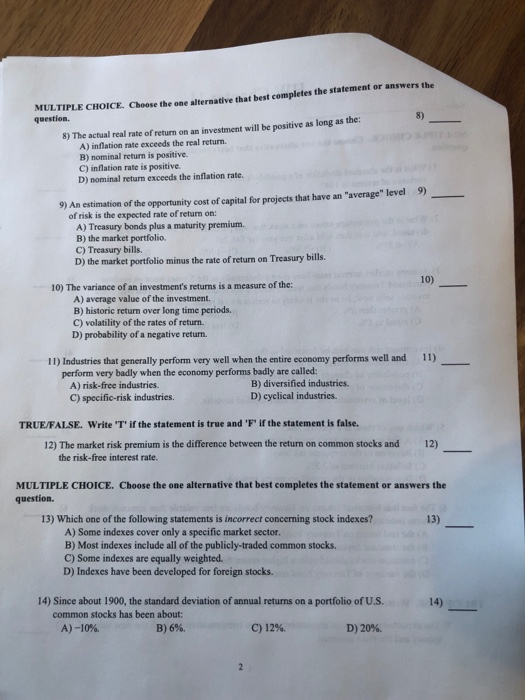

MULTIPLE question. CHOICE. Choose the one alternative that best completes the statement or answers the 8) 8) The actual real rate of return on an investment will be positive as long as the: A) inflation rate exceeds the real return. B) nominal return is positive. C) inflation rate is positive D) nominal return exceeds the inflation rate. 9) 9) An estimation of the opportunity cost of capital for projects that have an "average" level of risk is the expected rate of return on: A) Treasury bonds plus a maturity premium. B) the market portfolio. C) Treasury bills D) the market portfolio minus the rate of return on Treasury bills. 10) 10) The variance of an investment's returns is a measure of the: A) average value of the investment. B) historic return over long time periods. C) volatility of the rates of return. D) probability of a negative return. 11) 11) Industries that generally perform very well when the entire economy performs well and perform very badly when the economy performs badly are called A) risk-free industries. C) specific-risk industries B) diversified industries. D) cyclical industries. TRUE/FALSE. Write 'T' if the statement is true and 'F if the statement is false. 12) The market risk premium is the difference between the returnm on common stocks and 12) the risk-free interest rate. MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 13) Which one of the following statements is incorrect concerning stock indexes? 13) A) Some indexes cover only a specific market sector. B) Most indexes include all of the publicly-traded common stocks C) Some indexes are equally weighted. D) Indexes have been developed for foreign stocks. 14) Since about 1900, the standard deviation of annual returns on a portfolio of U.S. 14 common stocks has been about: B) 6%. A)-10%. d) 12%. D) 20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts