Question: Multiple Select Question Select all that apply The Black Limo Company ( BLC ) purchased a limo on January 1 of Year 1 . The

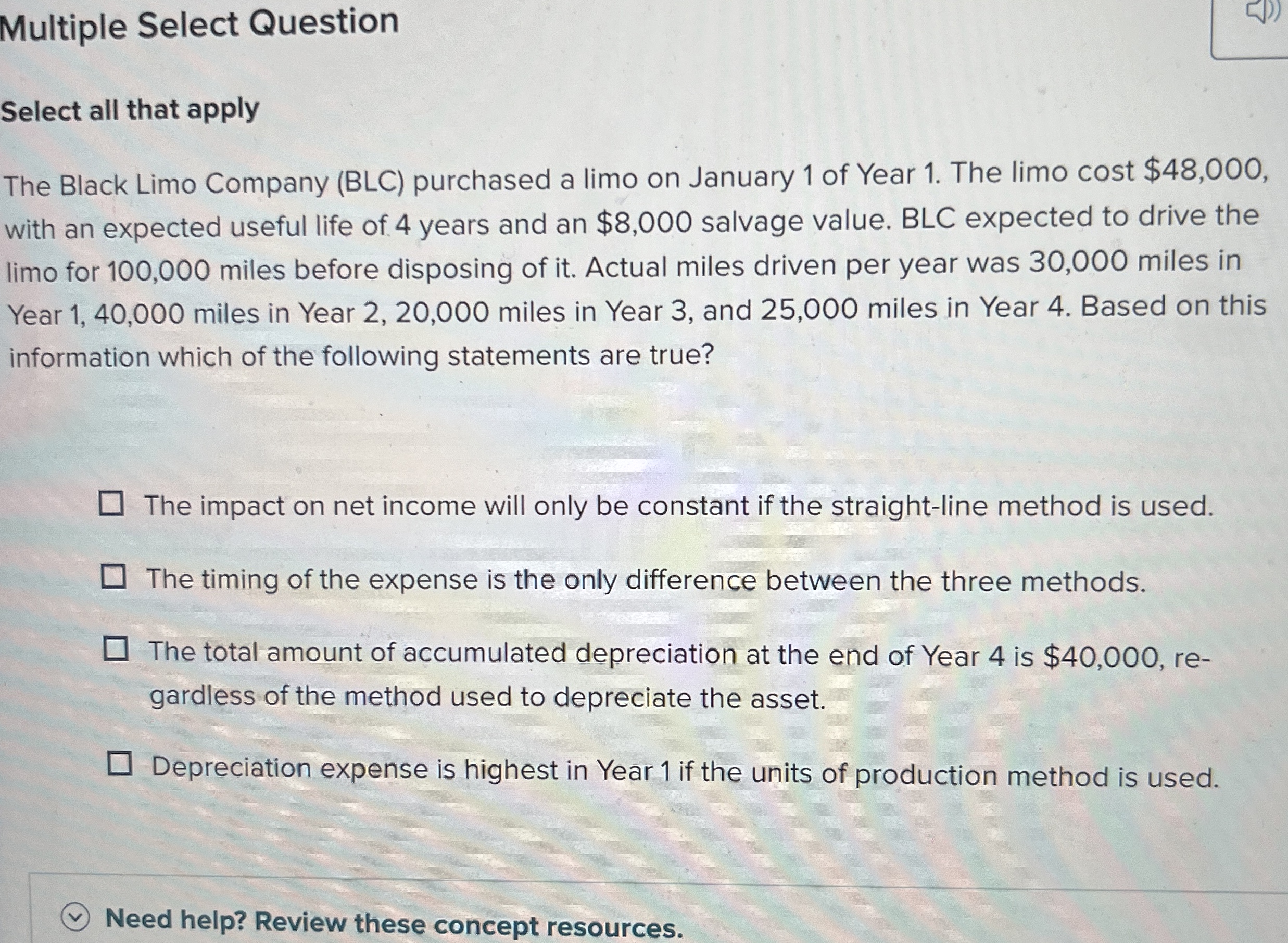

Multiple Select Question

Select all that apply

The Black Limo Company BLC purchased a limo on January of Year The limo cost $ with an expected useful life of years and an $ salvage value. BLC expected to drive the limo for miles before disposing of it Actual miles driven per year was miles in Year miles in Year miles in Year and miles in Year Based on this information which of the following statements are true?

The impact on net income will only be constant if the straightline method is used.

The timing of the expense is the only difference between the three methods.

The total amount of accumulated depreciation at the end of Year is $ regardless of the method used to depreciate the asset.

Depreciation expense is highest in Year if the units of production method is used.

Need help? Review these concept resources.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock