Question: Multiple Select Question Select all that apply When appreciated property is transferred to a closely held corporation, a taxable gain is triggered upon the sale

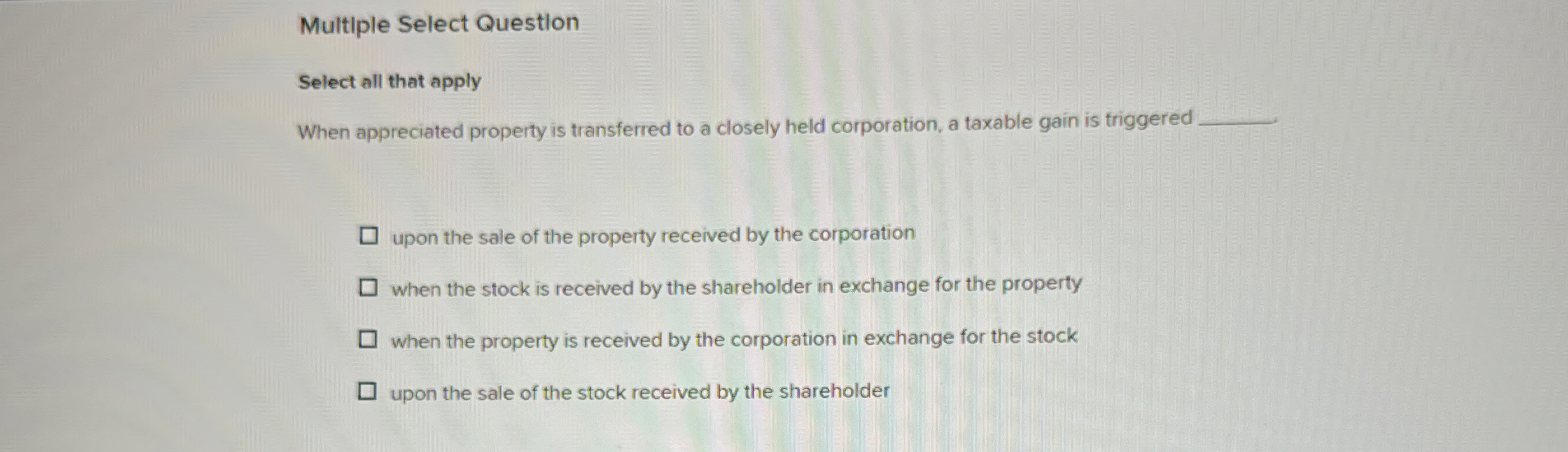

Multiple Select Question

Select all that apply

When appreciated property is transferred to a closely held corporation, a taxable gain is triggered

upon the sale of the property received by the corporation

when the stock is received by the shareholder in exchange for the property

when the property is received by the corporation in exchange for the stock

upon the sale of the stock received by the shareholder

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock