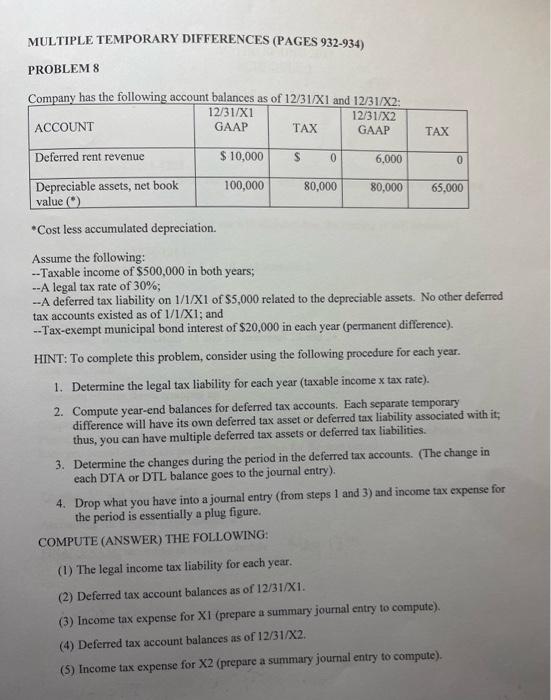

Question: MULTIPLE TEMPORARY DIFFERENCES (PAGES 932-934) PROBLEM 8 Comnanv has the following account balances as of 12/31/X1 and s 13 iva. * Cost less accumulated depreciation.

MULTIPLE TEMPORARY DIFFERENCES (PAGES 932-934) PROBLEM 8 Comnanv has the following account balances as of 12/31/X1 and s 13 iva. * Cost less accumulated depreciation. Assume the following: - Taxable income of $500,000 in both years; --A legal tax rate of 30% -A deferred tax liability on 1/1/X1 of $5,000 related to the depreciable assets. No other deferred tax accounts existed as of 1/1/X1; and - Tax-exempt municipal bond interest of $20,000 in each year (permanent difference). HINT: To complete this problem, consider using the following procedure for each year. 1. Determine the legal tax liability for each year (taxable income x tax rate). 2. Compute year-end balances for deferred tax accounts. Each separate temporary difference will have its own deferred tax asset or deferred tax liability associated with it; thus, you can have multiple deferred tax assets or deferred tax liabilities. 3. Determine the changes during the period in the deferred tax accounts. (The change in each DTA or DTL balance goes to the journal entry). 4. Drop what you have into a journal entry (from steps 1 and 3 ) and income tax expense for the period is essentially a plug figure. COMPUTE (ANSWER) THE FOLLOWING: (1) The legal income tax liability for each year. (2) Deferred tax account balances as of 12/31/X1. (3) Income tax expense for X1 (prepare a summary journal entry to compute). (4) Deferred tax account balances as of 12/31/X2. (5) Income tax expense for X2 (prepare a summary journal entry to compute)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts