Question: MULTIPLE-CHOICE TEST QUESTIONS. TOTAL 100 MARKS. Answer the following multiple choice questions. The following situation concerns questions 13. AAA corporation is considering replacing a projector

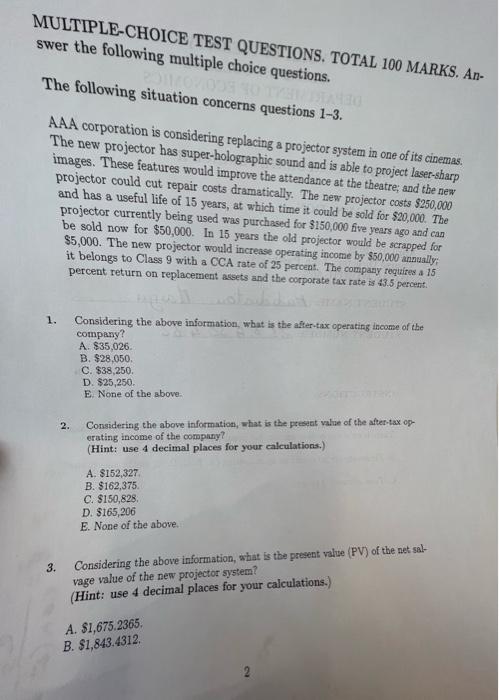

MULTIPLE-CHOICE TEST QUESTIONS. TOTAL 100 MARKS. Answer the following multiple choice questions. The following situation concerns questions 13. AAA corporation is considering replacing a projector system in one of its cinemas. The new projector has super-holographic sound and is able to project laser-sharp images. These features would improve the attendance at the theatre; and the new projector could cut repair costs dramatically. The new projector costs $250,000 and has a useful life of 15 years, at which time it could be sold for $20,000. The projector currently being used was purchased for $150,000 five years ago and can be sold now for $50,000. In 15 years the old projector would be scrapped for $5,000. The new projector would increase operating income by $50,000 annually: it belongs to Class 9 with a CCA rate of 25 percent. The company requifes a 15 percent return on replacement assets and the corporate tax rate is 43.5 percert. 1. Considering the above information, what is the affer-tax operating ircome of the company? A. $35,026. B. $28,050. C. $38,250, D. $25,250. E. None of the above- 2. Considering the above informatios, what is the preseat value of the aftertax ogerating income of the company? (Hint: use 4 decimal places for your calculations.) A. $152,327. B. $162,375. C. $150,828. D. $165,206 E. None of the above. 3. Considering the above information, what is the present valse (PV) of the net salvage value of the new projector system? (Hint: use 4 decimal places for your calculations.) A. $1,675.2365. B. $1,843.4312. C. $1,773.1289. D. $1,974.3376. E. None of the above. MULTIPLE-CHOICE TEST QUESTIONS. TOTAL 100 MARKS. Answer the following multiple choice questions. The following situation concerns questions 13. AAA corporation is considering replacing a projector system in one of its cinemas. The new projector has super-holographic sound and is able to project laser-sharp images. These features would improve the attendance at the theatre; and the new projector could cut repair costs dramatically. The new projector costs $250,000 and has a useful life of 15 years, at which time it could be sold for $20,000. The projector currently being used was purchased for $150,000 five years ago and can be sold now for $50,000. In 15 years the old projector would be scrapped for $5,000. The new projector would increase operating income by $50,000 annually: it belongs to Class 9 with a CCA rate of 25 percent. The company requifes a 15 percent return on replacement assets and the corporate tax rate is 43.5 percert. 1. Considering the above information, what is the affer-tax operating ircome of the company? A. $35,026. B. $28,050. C. $38,250, D. $25,250. E. None of the above- 2. Considering the above informatios, what is the preseat value of the aftertax ogerating income of the company? (Hint: use 4 decimal places for your calculations.) A. $152,327. B. $162,375. C. $150,828. D. $165,206 E. None of the above. 3. Considering the above information, what is the present valse (PV) of the net salvage value of the new projector system? (Hint: use 4 decimal places for your calculations.) A. $1,675.2365. B. $1,843.4312. C. $1,773.1289. D. $1,974.3376. E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts