Question: Multi-Product CVP Analysis Cathy's Towels sells three items (which it purchases from a supplier): bath towels, hand towels, and washcloths in a 4:3:2 mix (thus,

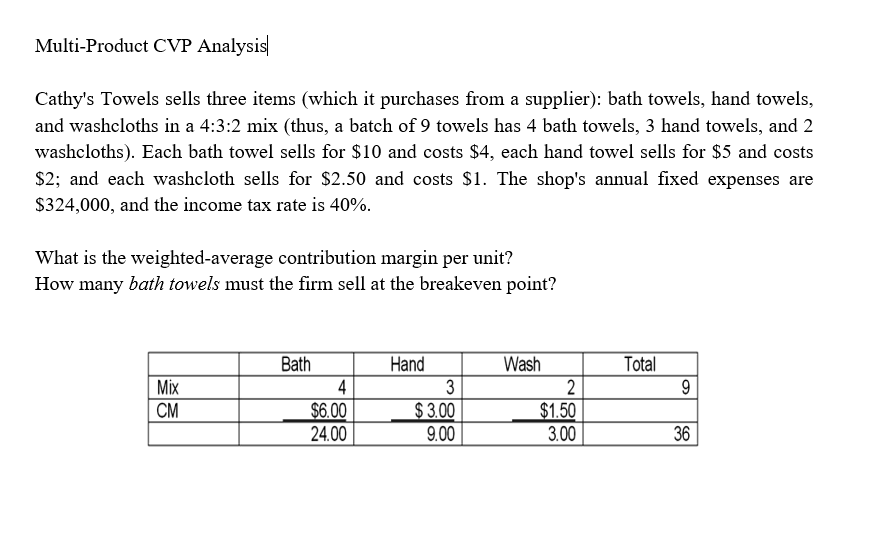

Multi-Product CVP Analysis Cathy's Towels sells three items (which it purchases from a supplier): bath towels, hand towels, and washcloths in a 4:3:2 mix (thus, a batch of 9 towels has 4 bath towels, 3 hand towels, and 2 washcloths). Each bath towel sells for $10 and costs $4, each hand towel sells for $5 and costs S2; and each washcloth sells for $2.50 and costs S1. The shop's annual fixed expenses are $324,000, and the income tax rate is 40% What is the weighted-average contribution margin per unit? How many bath towels must the firm sell at the breakeven point? Bath Hand Wash Total Mix CM 6.00 24.00 1.50 3.00 9.00 36

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts