Question: Murl Plastics Inc. purchased a new machine one year ago at a cost of $60,000. Although the machine operates well, the president of Murl Plastics

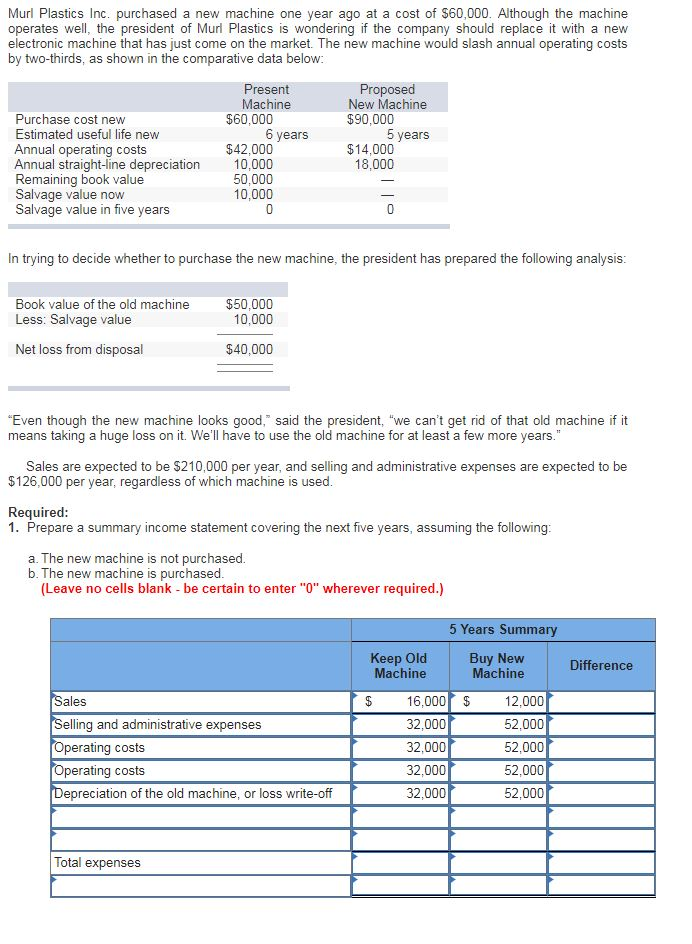

| Murl Plastics Inc. purchased a new machine one year ago at a cost of $60,000. Although the machine operates well, the president of Murl Plastics is wondering if the company should replace it with a new electronic machine that has just come on the market. The new machine would slash annual operating costs by two-thirds, as shown in the comparative data below: |

Murl Plastics Inc. purchased a new machine one year ago at a cost of $60,000. Although the machine operates we the president of Murl Plastics is wondering if the company should replace it with a new electronic machine that has just come on the market. The new machine would slash annual operating costs by two-thirds, as shown in the comparative data below: Present Machine Proposed New Machine $90,000 Purchase cost new Estimated useful life new Annual operating costs Annual straight-line depreciation Remaining book value Salvage value now Salvage value in five years $60,000 6 years 5 years $42,000 10,000 50,000 10,000 $14,000 18,000 In trying to decide whether to purchase the new machine, the president has prepared the following analysis Book value of the old machine Less: Salvage value $50,000 10,000 Net loss from disposal $40,000 Even though the new machine looks good," said the president, "we can't get rid of that old machine if it means taking a huge loss on it. We'll have to use the old machine for at least a few more years." Sales are expected to be $210,000 per year, and selling and administrative expenses are expected to be $126,000 per year, regardless of which machine is used Required: 1. Prepare a summary income statement covering the next five years, assuming the following a. The new machine is not purchased. b. The new machine is purchased (Leave no cells blank be certain to enter "O" wherever required.) 5 Years Summary Keep Old Machine Buy New Machine Difference 6,000$ 32,000 32,000 32,000 32.000 12,000 52,000 52,000 52,000 52,000 ales elling and administrative expenses Operating costs Operating costs epreciation of the old machine, or loss write-off Total expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts