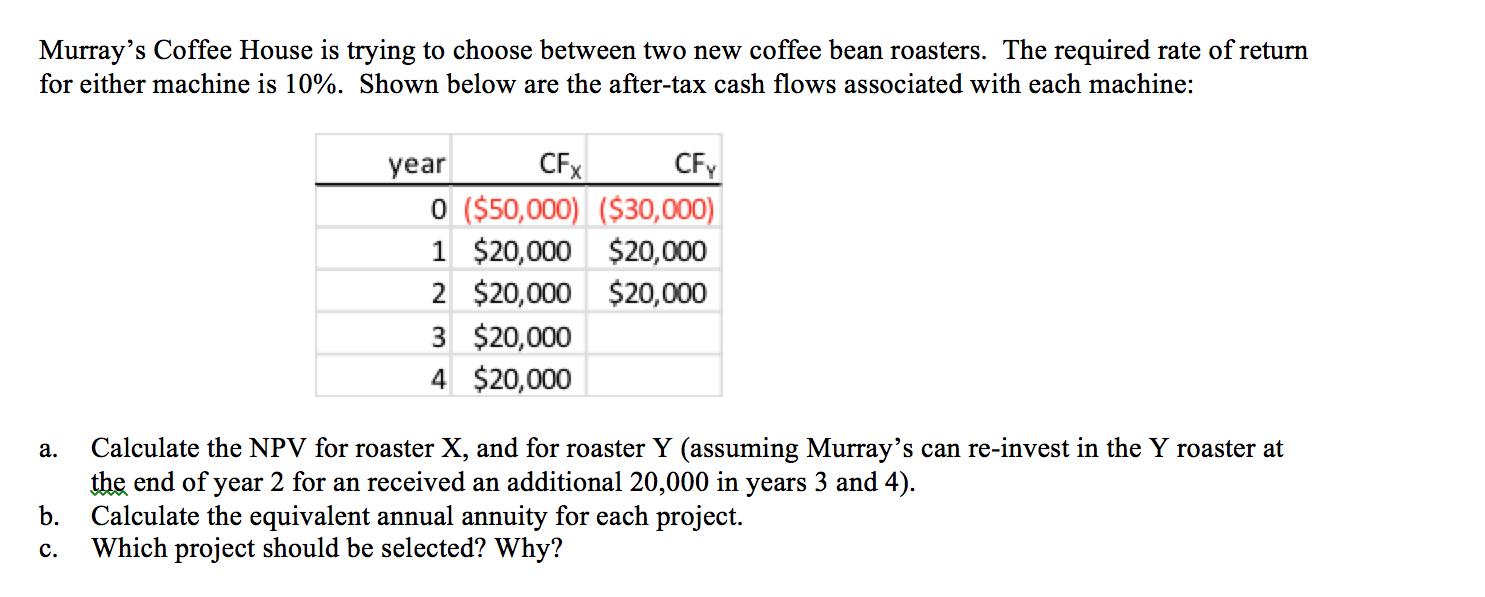

Question: Murray's Coffee House is trying to choose between two new coffee bean roasters. The required rate of return for either machine is 10%. Shown

Murray's Coffee House is trying to choose between two new coffee bean roasters. The required rate of return for either machine is 10%. Shown below are the after-tax cash flows associated with each machine: a. b. C. CFx CFy 0 ($50,000) ($30,000) 1 $20,000 $20,000 2 $20,000 $20,000 3 $20,000 4 $20,000 year Calculate the NPV for roaster X, and for roaster Y (assuming Murray's can re-invest in the Y roaster at the end of year 2 for an received an additional 20,000 in years 3 and 4). Calculate the equivalent annual annuity for each project. Which project should be selected? Why?

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

1 calculation of NPV Year Cash Flows PVF 10 PV 0 50000 1 500... View full answer

Get step-by-step solutions from verified subject matter experts