Question: Murtagh Co. is operating at its target capital structure with market values of $110 million in equity and $175 million in debt outstanding. Murtagh

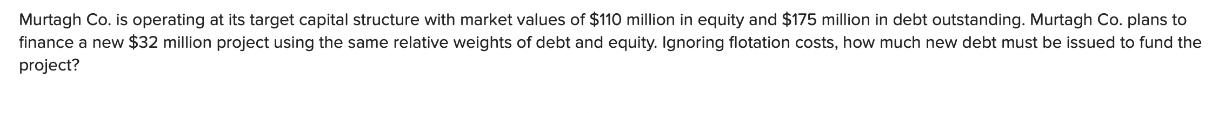

Murtagh Co. is operating at its target capital structure with market values of $110 million in equity and $175 million in debt outstanding. Murtagh Co. plans to finance a new $32 million project using the same relative weights of debt and equity. Ignoring flotation costs, how much new debt must be issued to fund the project?

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

To determine how much new debt must be issued to fund the project we need to maintain the same relat... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

663360f37a05c_935836.pdf

180 KBs PDF File

663360f37a05c_935836.docx

120 KBs Word File