Question: Must be done in Excel. Problem 1: Compare the 3 mutual funds below. For each fund, calculate the value at the end of Years 1,

Must be done in Excel.

Must be done in Excel.

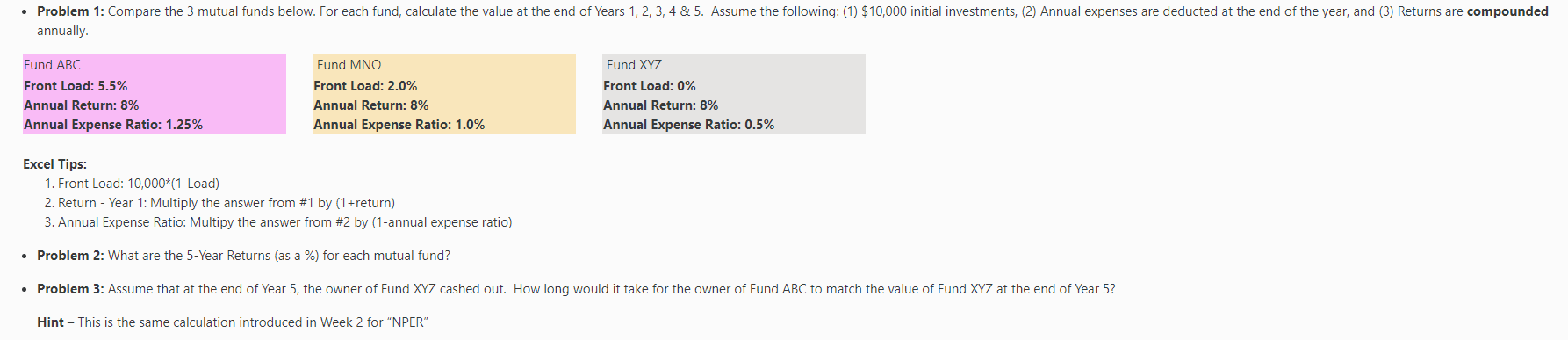

Problem 1: Compare the 3 mutual funds below. For each fund, calculate the value at the end of Years 1, 2, 3, 4 & 5. Assume the following: (1) $10,000 initial investments, (2) Annual expenses are deducted at the end of the year, and (3) Returns are compounded annually Fund ABC Front Load: 5.5% Annual Return: 8% Annual Expense Ratio: 1.25% Fund MNO Front Load: 2.0% Annual Return: 8% Annual Expense Ratio: 1.0% Fund XYZ Front Load: 0% Annual Return: 8% Annual Expense Ratio: 0.5% Excel Tips: 1. Front Load: 10,000*(1-Load) 2. Return - Year 1: Multiply the answer from #1 by (1 +return) 3. Annual Expense Ratio: Multipy the answer from #2 by (1-annual expense ratio) Problem 2: What are the 5-Year Returns (as a %) for each mutual fund? Problem 3: Assume that at the end of Year 5, the owner of Fund XYZ cashed out. How long would it take for the owner of Fund ABC to match the value of Fund XYZ at the end of Year 5? Hint - This is the same calculation introduced in Week 2 for "NPER" Problem 1: Compare the 3 mutual funds below. For each fund, calculate the value at the end of Years 1, 2, 3, 4 & 5. Assume the following: (1) $10,000 initial investments, (2) Annual expenses are deducted at the end of the year, and (3) Returns are compounded annually Fund ABC Front Load: 5.5% Annual Return: 8% Annual Expense Ratio: 1.25% Fund MNO Front Load: 2.0% Annual Return: 8% Annual Expense Ratio: 1.0% Fund XYZ Front Load: 0% Annual Return: 8% Annual Expense Ratio: 0.5% Excel Tips: 1. Front Load: 10,000*(1-Load) 2. Return - Year 1: Multiply the answer from #1 by (1 +return) 3. Annual Expense Ratio: Multipy the answer from #2 by (1-annual expense ratio) Problem 2: What are the 5-Year Returns (as a %) for each mutual fund? Problem 3: Assume that at the end of Year 5, the owner of Fund XYZ cashed out. How long would it take for the owner of Fund ABC to match the value of Fund XYZ at the end of Year 5? Hint - This is the same calculation introduced in Week 2 for "NPER

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts