Question: (must be solved without excel) 2. Based on the following information, calculate the expected return and standard deviation for Stock A and B. State of

(must be solved without excel)

(must be solved without excel)

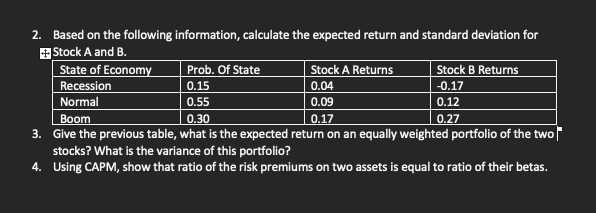

2. Based on the following information, calculate the expected return and standard deviation for Stock A and B. State of Economy Prob. Of State Stock A Returns Stock B Returns Recession 0.15 0.04 -0.17 Normal 0.55 0.09 0.12 Boom 0.30 0.17 0.27 3. Give the previous table, what is the expected return on an equally weighted portfolio of the two stocks? What is the variance of this portfolio? 4. Using CAPM, show that ratio of the risk premiums on two assets is equal to ratio of their betas

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts