Question: MUST BE WORTH 50 MARKS PLEASE Case Study 2 Following the emergence of the sub-prime crisis and problems in the residential mortgage-backed securities (RMBS) and

MUST BE WORTH 50 MARKS PLEASE

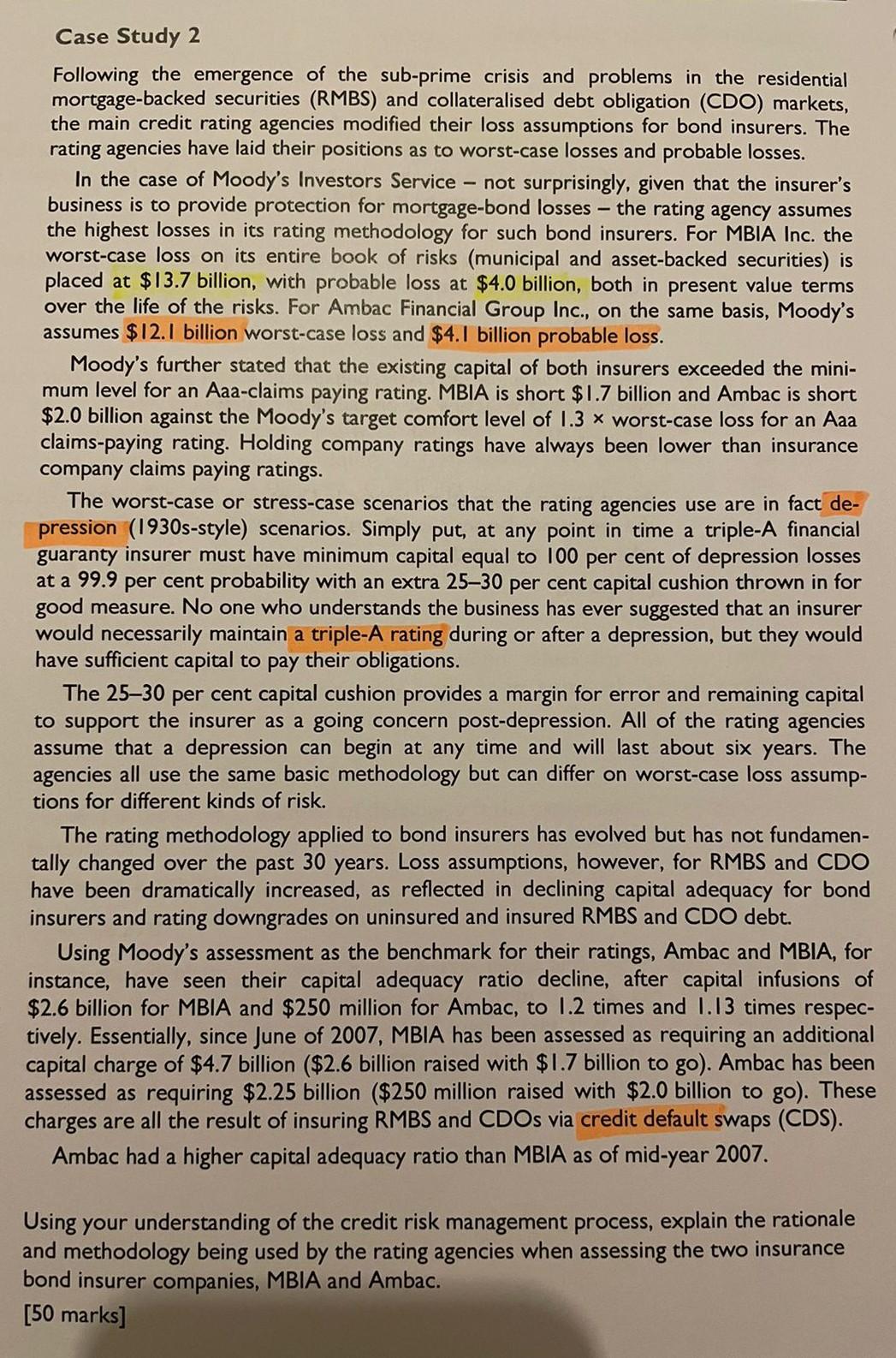

Case Study 2 Following the emergence of the sub-prime crisis and problems in the residential mortgage-backed securities (RMBS) and collateralised debt obligation (CDO) markets, the main credit rating agencies modified their loss assumptions for bond insurers. The rating agencies have laid their positions as to worst-case losses and probable losses. In the case of Moody's Investors Service - not surprisingly, given that the insurer's business is to provide protection for mortgage-bond losses - the rating agency assumes the highest losses in its rating methodology for such bond insurers. For MBIA Inc. the worst-case loss on its entire book of risks (municipal and asset-backed securities) is placed at $13.7 billion, with probable loss at $4.0 billion, both in present value terms over the life of the risks. For Ambac Financial Group Inc., on the same basis, Moody's assumes $12.1 billion worst-case loss and $4.1 billion probable loss. Moody's further stated that the existing capital of both insurers exceeded the mini- mum level for an Aaa-claims paying rating. MBIA is short $1.7 billion and Ambac is short $2.0 billion against the Moody's target comfort level of 1.3 x worst-case loss for an Aaa claims-paying rating. Holding company ratings have always been lower than insurance company claims paying ratings. The worst-case or stress-case scenarios that the rating agencies use are in fact de- pression (1930s-style) scenarios. Simply put, at any point in time a triple-A financial guaranty insurer must have minimum capital equal to 100 per cent of depression losses at a 99.9 per cent probability with an extra 2530 per cent capital cushion thrown in for good measure. No one who understands the business has ever suggested that an insurer would necessarily maintain a triple-A rating during or after a depression, but they would have sufficient capital to pay their obligations. The 2530 per cent capital cushion provides a margin for error and remaining capital to support the insurer as a going concern post-depression. All of the rating agencies assume that a depression can begin at any time and will last about six years. The agencies all use the same basic methodology but can differ on worst-case loss assump- tions for different kinds of risk. The rating methodology applied to bond insurers has evolved but has not fundamen- tally changed over the past 30 years. Loss assumptions, however, for RMBS and CDO have been dramatically increased, as reflected in declining capital adequacy for bond insurers and rating downgrades on uninsured and insured RMBS and CDO debt. Using Moody's assessment as the benchmark for their ratings, Ambac and MBIA, for instance, have seen their capital adequacy ratio decline, after capital infusions of $2.6 billion for MBIA and $250 million for Ambac, to 1.2 times and 1.13 times respec- tively. Essentially, since June of 2007, MBIA has been assessed as requiring an additional capital charge of $4.7 billion ($2.6 billion raised with $1.7 billion to go). Ambac has been assessed as requiring $2.25 billion ($250 million raised with $2.0 billion to go). These charges are all the result of insuring RMBS and CDOs via credit default swaps (CDS). Ambac had a higher capital adequacy ratio than MBIA as of mid-year 2007. Using your understanding of the credit risk management process, explain the rationale and methodology being used by the rating agencies when assessing the two insurance bond insurer companies, MBIA and Ambac. [50 marks] Case Study 2 Following the emergence of the sub-prime crisis and problems in the residential mortgage-backed securities (RMBS) and collateralised debt obligation (CDO) markets, the main credit rating agencies modified their loss assumptions for bond insurers. The rating agencies have laid their positions as to worst-case losses and probable losses. In the case of Moody's Investors Service - not surprisingly, given that the insurer's business is to provide protection for mortgage-bond losses - the rating agency assumes the highest losses in its rating methodology for such bond insurers. For MBIA Inc. the worst-case loss on its entire book of risks (municipal and asset-backed securities) is placed at $13.7 billion, with probable loss at $4.0 billion, both in present value terms over the life of the risks. For Ambac Financial Group Inc., on the same basis, Moody's assumes $12.1 billion worst-case loss and $4.1 billion probable loss. Moody's further stated that the existing capital of both insurers exceeded the mini- mum level for an Aaa-claims paying rating. MBIA is short $1.7 billion and Ambac is short $2.0 billion against the Moody's target comfort level of 1.3 x worst-case loss for an Aaa claims-paying rating. Holding company ratings have always been lower than insurance company claims paying ratings. The worst-case or stress-case scenarios that the rating agencies use are in fact de- pression (1930s-style) scenarios. Simply put, at any point in time a triple-A financial guaranty insurer must have minimum capital equal to 100 per cent of depression losses at a 99.9 per cent probability with an extra 2530 per cent capital cushion thrown in for good measure. No one who understands the business has ever suggested that an insurer would necessarily maintain a triple-A rating during or after a depression, but they would have sufficient capital to pay their obligations. The 2530 per cent capital cushion provides a margin for error and remaining capital to support the insurer as a going concern post-depression. All of the rating agencies assume that a depression can begin at any time and will last about six years. The agencies all use the same basic methodology but can differ on worst-case loss assump- tions for different kinds of risk. The rating methodology applied to bond insurers has evolved but has not fundamen- tally changed over the past 30 years. Loss assumptions, however, for RMBS and CDO have been dramatically increased, as reflected in declining capital adequacy for bond insurers and rating downgrades on uninsured and insured RMBS and CDO debt. Using Moody's assessment as the benchmark for their ratings, Ambac and MBIA, for instance, have seen their capital adequacy ratio decline, after capital infusions of $2.6 billion for MBIA and $250 million for Ambac, to 1.2 times and 1.13 times respec- tively. Essentially, since June of 2007, MBIA has been assessed as requiring an additional capital charge of $4.7 billion ($2.6 billion raised with $1.7 billion to go). Ambac has been assessed as requiring $2.25 billion ($250 million raised with $2.0 billion to go). These charges are all the result of insuring RMBS and CDOs via credit default swaps (CDS). Ambac had a higher capital adequacy ratio than MBIA as of mid-year 2007. Using your understanding of the credit risk management process, explain the rationale and methodology being used by the rating agencies when assessing the two insurance bond insurer companies, MBIA and Ambac. [50 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts