Question: Must carry the $ 9 , 5 0 0 deduction forward to the next year. ofrifinaned deduction. Must inform the partnership of her ineligibility and

Must carry the $ deduction forward to the next year.

ofrifinaned deduction.

Must inform the partnership of her ineligibility and request that the partnership amend its the

Mark for follow up

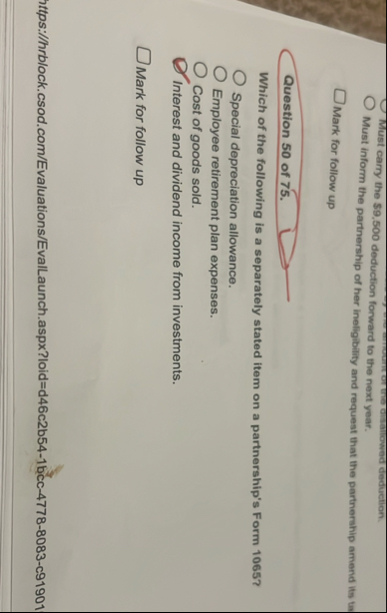

Question of

Which of the following is a separately stated item on a partnership's Form

Special depreciation allowance.

Employee retirement plan expenses.

Cost of goods sold.

Interest and dividend income from investments.

Mark for follow up

ttps:hrblockcsod.comEvaluationsEvalLaunchaspx?loiddcbbccc

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock