Question: Must complete questions 1,2,3 under requirements . Also construct an income statement to determine your highest price based on expected income for part 1. Then

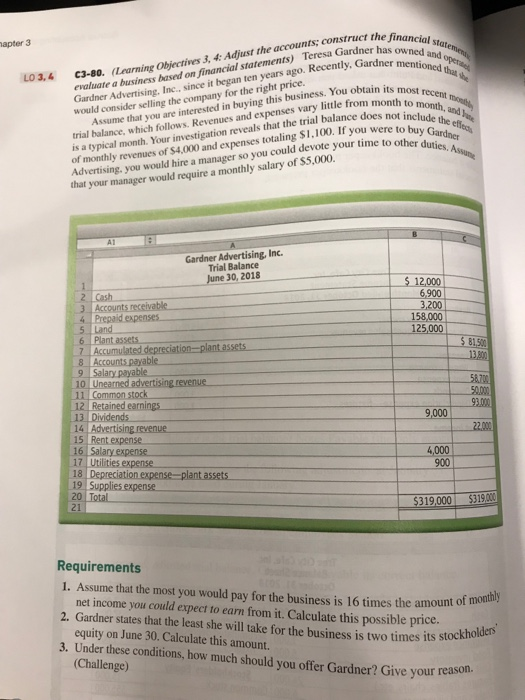

mapter 3 financial stateme owned and open mentioned that Objection financiran ten LO 3,4 evaluate Advertising, Inc., since it for the right price mess. You obtain its m Adver selling the cometed in buying thanses vary litt che priccines most recent oth to month, and dude the citos C3-80. (Learning Objectives 3. 4: Adjust the accounts, construct the fin evaluate a business based on financial statements) Teresa Gardner has Gardner Advertising, Inc.. since it began ten years ago. Recently, Gardner would consider selling the company for the right price. Assume that you are interested in buying this business. You obtain its trial balance, which follows. Revenues and expenses vary little from month is a typical month. Your investigation reveals that the trial balance does not in of monthly revenues of $4.000 and expenses totaling $1.100. If you were to bu Advertising, you would hire a manager so you could devote your time to other that your manager would require a monthly salary of $5,000. re to buy Gardner her duties. As Gardner Advertising, Inc. Trial Balance June 30, 2018 $ 12,000 6,900 3,200 158,000 125,000 $ 815 13801 2 Cash 3 Accounts receivable 4 Prepaid expenses 5 Land 6 Plant assets 17 Accumulated depreciation plant assets 8 Accounts payable 9 Salary payable 10 Unearned advertising revenue 11 Common stock 12 Retained earnings 13 Dividends 14 Advertising revenue 15 Rent expense 16 Salary expense 17 Utilities expense 18 Depreciation expense-plant assets 19 Supplies expense 20 Total 50.000 92.000 9,000 22.000 4,000 900 $319,000 $319.000 Requirements 1. Assume that the most you would pay for the business is 16 times the amount net income you could expect to earn from it. Calculate this possible price. 2. Gardner states that the least she will take for the business is two times its so equity on June 30. Calculate this amount. 3. Under these conditions, how much should you offer Gardner? Give your reason (Challenge) the amount of monthly times its stockholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts