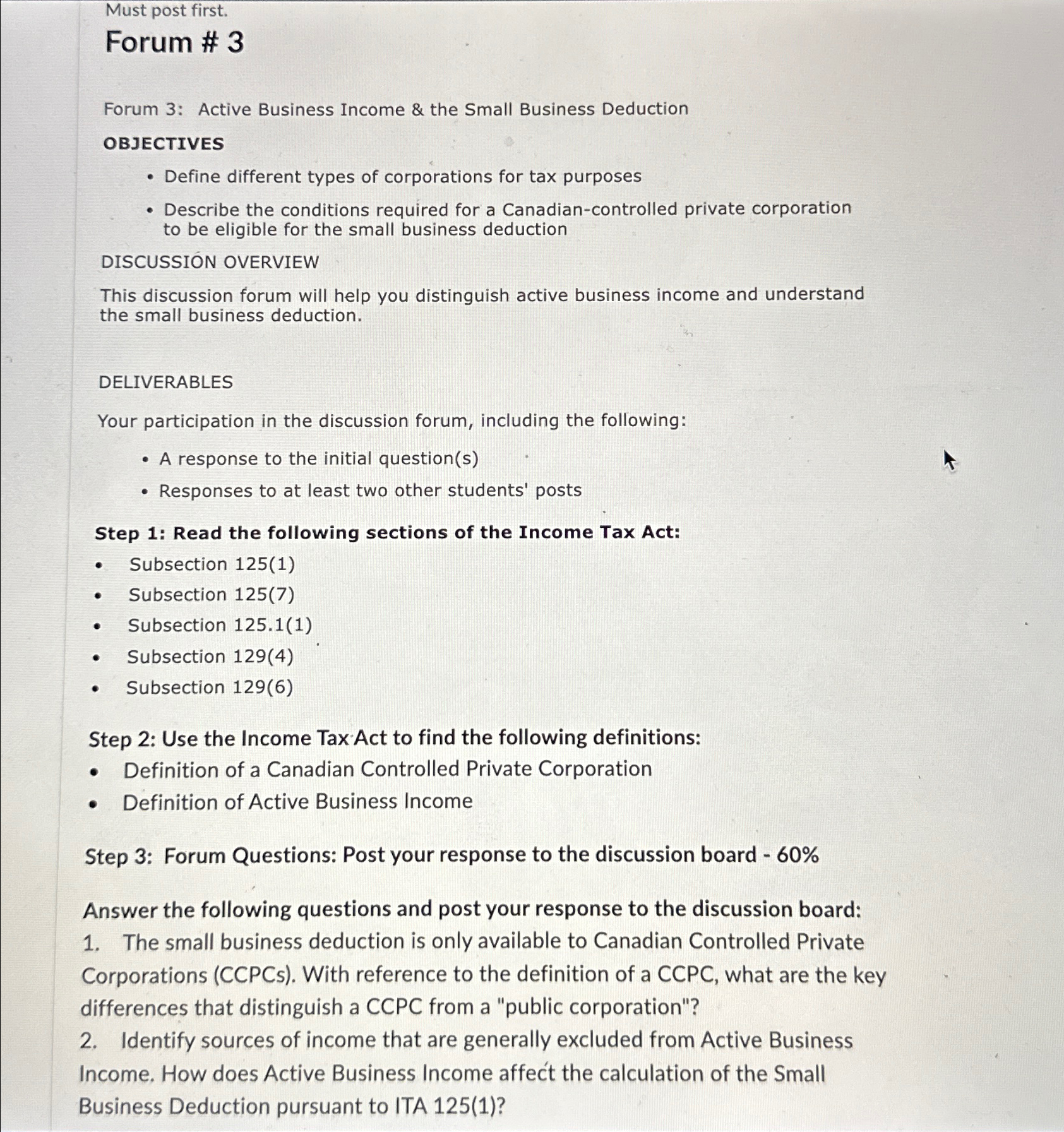

Question: Must post first. Forum # 3 Forum 3 : Active Business Income & the Small Business Deduction OBJECTIVES Define different types of corporations for tax

Must post first.

Forum #

Forum : Active Business Income & the Small Business Deduction

OBJECTIVES

Define different types of corporations for tax purposes

Describe the conditions required for a Canadiancontrolled private corporation to be eligible for the small business deduction

DISCUSSIN OVERVIEW

This discussion forum will help you distinguish active business income and understand the small business deduction.

DELIVERABLES

Your participation in the discussion forum, including the following:

A response to the initial questions

Responses to at least two other students' posts

Step : Read the following sections of the Income Tax Act:

Subsection

Subsection

Subsection

Subsection

Subsection

Step : Use the Income Tax Act to find the following definitions:

Definition of a Canadian Controlled Private Corporation

Definition of Active Business Income

Step : Forum Questions: Post your response to the discussion board

Answer the following questions and post your response to the discussion board:

The small business deduction is only available to Canadian Controlled Private Corporations CCPCs With reference to the definition of a CCPC what are the key differences that distinguish a CCPC from a "public corporation"?

Identify sources of income that are generally excluded from Active Business Income. How does Active Business Income affect the calculation of the Small Business Deduction pursuant to ITA

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock