Question: (MUST POST FIRST) Initial Post - As an employee, write an internal memo to your manager addressing the following: Using the Internet, locate the most

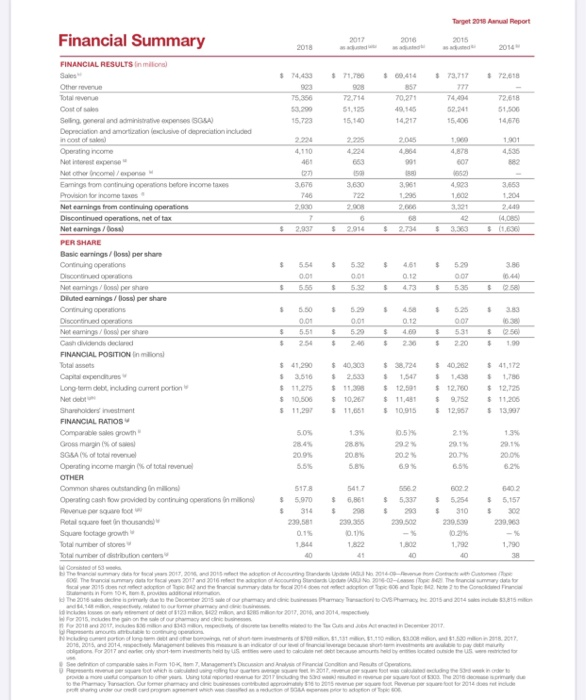

(MUST POST FIRST) Initial Post - As an employee, write an internal memo to your manager addressing the following: Using the Internet, locate the most recent annual report of a company of your choosing and write an initial post by responding to the following: Do not research the company listed in the text. For the most recent day indicated, what were the highest and lowest prices at which the company's common stock sold? Find the company's balance sheet and determine the following: the number of outstanding shares of common stock and the average price at which those shares were originally sold. What is the relationship between the current market price and the amount you have calculated in part b as the average price at which the stock originally sold? Find the company's income statement and identify the trend in basic earnings per share, including discontinued operations. Did discontinued operations have a significant impact on EPS? For the most recent year, what is the average number of shares of common stock that was used to compute basic earnings per share? Why is that number different from the number outstanding in the company's balance sheet? Target 2018 Au Report Financial Summary 2016 2015 73,717 72.618 52.41 15.05 51 50 14,676 195) 1,204 14.085) (1636) 3 363 $ 529 GOT 35 5 $ 07 531 220 $ 256) .99 5 1 FINANCIAL RESULTS In min) $ 74.433 $ 71.780 00.414 Other revenue Total Cost of 51.15 Selling general and m e xpenses SGLA) 15.723 15.100 14,217 Depreciation and amortization exclusive of depreciation included in cost of all Operating income 4,110 Net n est expense 991 Netto income aminos from continung o ns before income taxes 3676 Provision for income taxes 722 Not earnings from continuing operations 2.000 Discontinued operations, net of tax Net earnings / Boss) $ 2,937 2014 2734 PER SHARE Basic earnings / Bloss) per share Continuing operations $ 55+ $ 539 $ 451 Discontinued operations 0.01 0.01 0.12 Net amigos per share 530 4. 73 Diluted earnings / lis) per share Corting operations Discontinueda s 0.01 0.01 0.12 Net amigos per share $ 5.51 $ 5.29 $ 4.60 Ch ands declared $ 2.54 $ 200 $ 230 FINANCIAL POSITION in ons Total assets $ 41.250 $ 40.303 $ 38.724 Capital expenditures $ 3516 2.533 $ 1,547 Long-term debt, including current portion $ 12.591 Net $ 101500 0.500 10.267 $ 11,451 Shar e stment $ 11,297 $ 10.915 FINANCIAL RATIOS Com e sales growth 1.3% 0.5% Gross margina 28.4% SGS of total revenuel 202 Operating income margin of revenue 6.5% 5.8% OTHER Common sharestanding in min 5178 5417 Operating cash fow provided by continuing rations in milions) $ 5970 $ 6,861 $ 5337 Revenue per square foot $ 314 $ 208 Retal square foot Onthousands Square footage growth 015 0.1% Total number of stores 1.844 Total number of distribution centers WC53 The truncumart s 2017 and 2016 otton for S U AS 2011- 2015 second andere r 2016 section and The 2016 December 2016 sowym 120 m 2 d o 2017, 2016 and 1 2013 201 3 - orfofondo 13 .30 sonder of our of t $ $ 40.262 1.438 12.780 9752 12,567 41.172 1.780 12.25 $ $ 5 $ 13.997 5.09 2.1% 20% 20.04 6.2% 6022 5.254 310 5 $ 5402 5.157 300 230. $ 10.2% 1.792 1.790 The trunciar to the order 2015 2014 3.15 2017 N 10 2018 2017 See on companies in om 10 M g Decondary condition and on 2017 ponad de busc Tha 2016 Hvor 2014 o (MUST POST FIRST) Initial Post - As an employee, write an internal memo to your manager addressing the following: Using the Internet, locate the most recent annual report of a company of your choosing and write an initial post by responding to the following: Do not research the company listed in the text. For the most recent day indicated, what were the highest and lowest prices at which the company's common stock sold? Find the company's balance sheet and determine the following: the number of outstanding shares of common stock and the average price at which those shares were originally sold. What is the relationship between the current market price and the amount you have calculated in part b as the average price at which the stock originally sold? Find the company's income statement and identify the trend in basic earnings per share, including discontinued operations. Did discontinued operations have a significant impact on EPS? For the most recent year, what is the average number of shares of common stock that was used to compute basic earnings per share? Why is that number different from the number outstanding in the company's balance sheet? Target 2018 Au Report Financial Summary 2016 2015 73,717 72.618 52.41 15.05 51 50 14,676 195) 1,204 14.085) (1636) 3 363 $ 529 GOT 35 5 $ 07 531 220 $ 256) .99 5 1 FINANCIAL RESULTS In min) $ 74.433 $ 71.780 00.414 Other revenue Total Cost of 51.15 Selling general and m e xpenses SGLA) 15.723 15.100 14,217 Depreciation and amortization exclusive of depreciation included in cost of all Operating income 4,110 Net n est expense 991 Netto income aminos from continung o ns before income taxes 3676 Provision for income taxes 722 Not earnings from continuing operations 2.000 Discontinued operations, net of tax Net earnings / Boss) $ 2,937 2014 2734 PER SHARE Basic earnings / Bloss) per share Continuing operations $ 55+ $ 539 $ 451 Discontinued operations 0.01 0.01 0.12 Net amigos per share 530 4. 73 Diluted earnings / lis) per share Corting operations Discontinueda s 0.01 0.01 0.12 Net amigos per share $ 5.51 $ 5.29 $ 4.60 Ch ands declared $ 2.54 $ 200 $ 230 FINANCIAL POSITION in ons Total assets $ 41.250 $ 40.303 $ 38.724 Capital expenditures $ 3516 2.533 $ 1,547 Long-term debt, including current portion $ 12.591 Net $ 101500 0.500 10.267 $ 11,451 Shar e stment $ 11,297 $ 10.915 FINANCIAL RATIOS Com e sales growth 1.3% 0.5% Gross margina 28.4% SGS of total revenuel 202 Operating income margin of revenue 6.5% 5.8% OTHER Common sharestanding in min 5178 5417 Operating cash fow provided by continuing rations in milions) $ 5970 $ 6,861 $ 5337 Revenue per square foot $ 314 $ 208 Retal square foot Onthousands Square footage growth 015 0.1% Total number of stores 1.844 Total number of distribution centers WC53 The truncumart s 2017 and 2016 otton for S U AS 2011- 2015 second andere r 2016 section and The 2016 December 2016 sowym 120 m 2 d o 2017, 2016 and 1 2013 201 3 - orfofondo 13 .30 sonder of our of t $ $ 40.262 1.438 12.780 9752 12,567 41.172 1.780 12.25 $ $ 5 $ 13.997 5.09 2.1% 20% 20.04 6.2% 6022 5.254 310 5 $ 5402 5.157 300 230. $ 10.2% 1.792 1.790 The trunciar to the order 2015 2014 3.15 2017 N 10 2018 2017 See on companies in om 10 M g Decondary condition and on 2017 ponad de busc Tha 2016 Hvor 2014 o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts