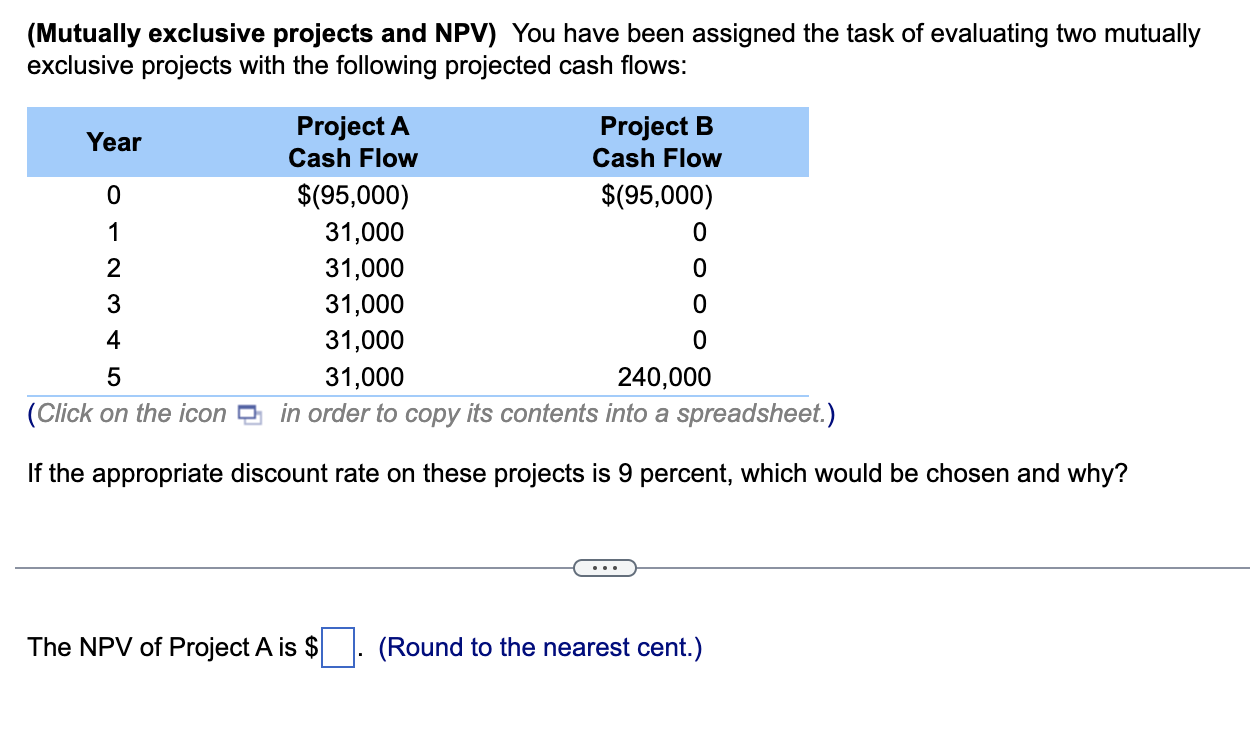

Question: (Mutually exclusive projects and NPV) You have been assigned the task of evaluating two mutually exclusive projects with the following projected cash flows: Year Project

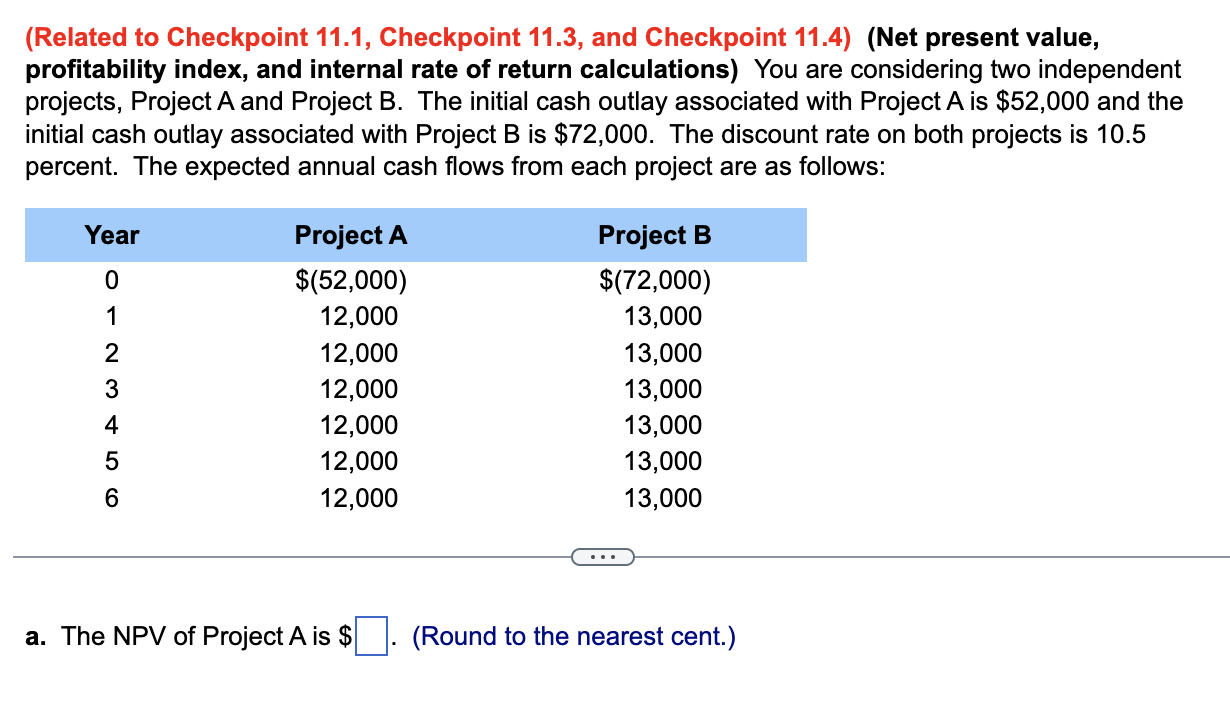

(Mutually exclusive projects and NPV) You have been assigned the task of evaluating two mutually exclusive projects with the following projected cash flows: Year Project A Project B Cash Flow Cash Flow 0 $(95,000) $(95,000) 1 31,000 0 2 31,000 0 3 31,000 0 4 31,000 0 5 31,000 240,000 (Click on the icon in order to copy its contents into a spreadsheet.) If the appropriate discount rate on these projects is 9 percent, which would be chosen and why? The NPV of Project A is $. (Round to the nearest cent.) (Related to Checkpoint 11.1, Checkpoint 11.3, and Checkpoint 11.4) (Net present value, profitability index, and internal rate of return calculations) You are considering two independent projects, Project A and Project B. The initial cash outlay associated with Project A is $52,000 and the initial cash outlay associated with Project B is $72,000. The discount rate on both projects is 10.5 percent. The expected annual cash flows from each project are as follows: Year 2 3 Project A $(52,000) 12,000 12,000 12,000 12,000 12,0 12,000 Project B $(72,000) 13,000 13,000 13,000 13,000 13,000 13,000 4 a. The NPV of Project A is $| (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts