Question: mutually exclusive projects X and Y with identical initial outlays and useful lives of 5 years. Project X is expected to produce an 16. Consider

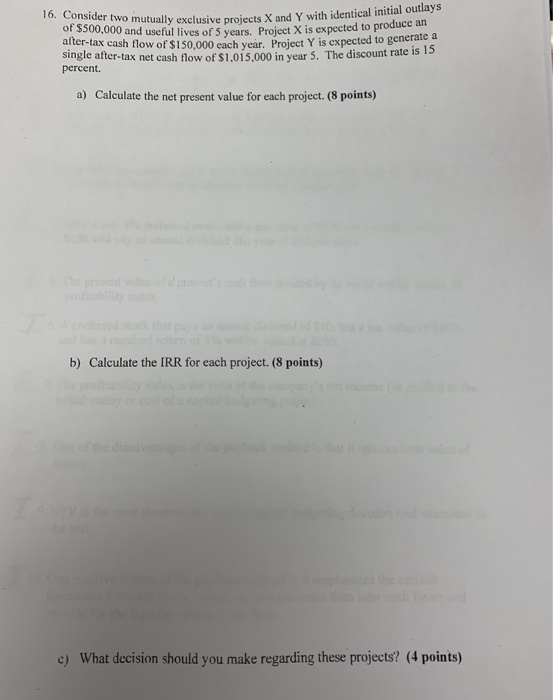

mutually exclusive projects X and Y with identical initial outlays and useful lives of 5 years. Project X is expected to produce an 16. Consider two alter-tax cash flow of $150,000 each year. Project Y is expected to generate single after-tax net cash flow of $1.015,000 in year 5. The discount rate is 15 percent. Calculate the net present value for each project. (8 points) a) b) Calculate the IRR for each project. (8 points) What decision should you make regarding these projects? (4 points) c)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock