Question: my 2020.pal - Adobe Acrobat Reader 2017 View Window Help Tools Example of how to... Unit 2 Homework B. Interest expense on the debt borrowed

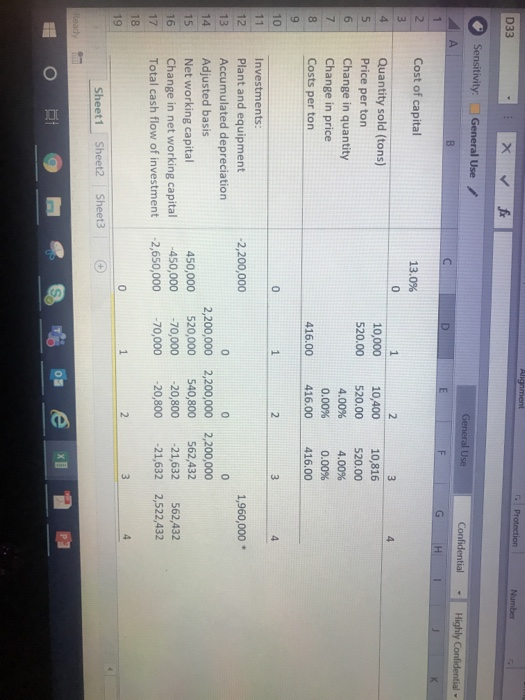

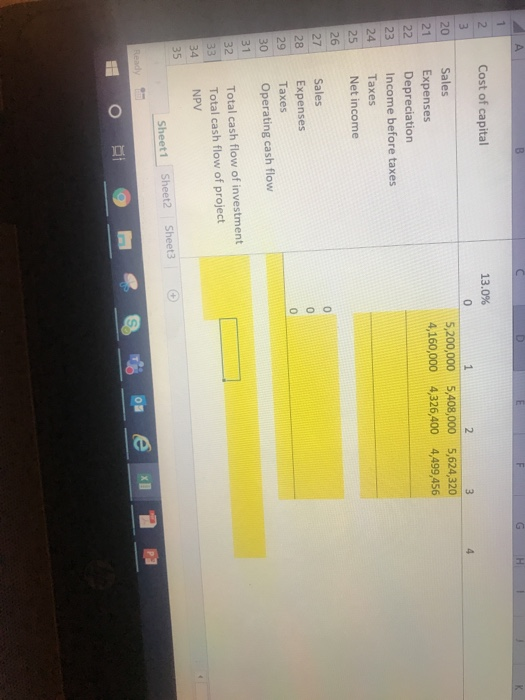

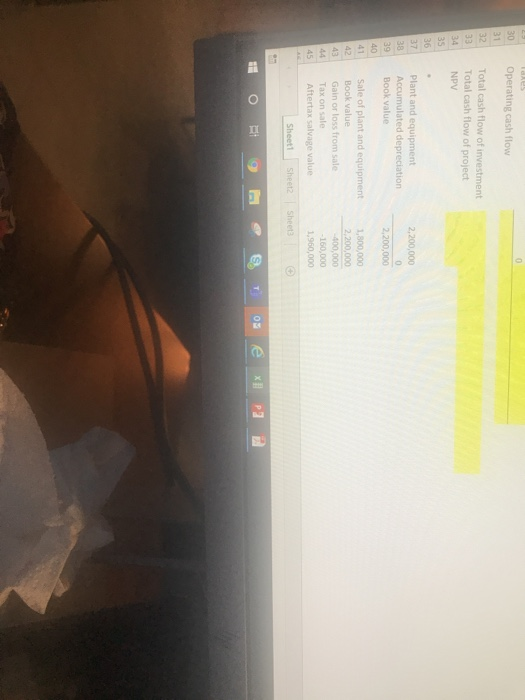

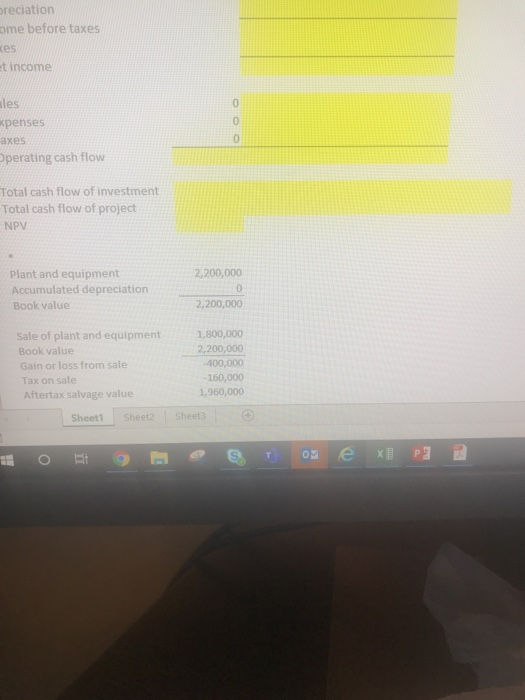

my 2020.pal - Adobe Acrobat Reader 2017 View Window Help Tools Example of how to... Unit 2 Homework B. Interest expense on the debt borrowed to pay the construction costs. 11. (10) Please refer to the spreadsheet file (Unit 2 Supplemental Analysis.xls) for the analysis related to a hog feed project. United Feed is considering a proposal to produce hog feed. The hog feed project requires an investment in new plant and equipment of $2.20 million. This could be depreciated for tax purposes straight-line over 10 years to zero salvage value. However, the plant and equipment will be sold when the project is terminated for $1.8 million. The project will generate sales for 3 years and will be terminated at the end of year 4. Year 1 sales of hog feed are expected to be 10,000 tons at $520 per ton, and thereafter quantity is forecasted to grow by 4% a year while the price remains constant. Costs are expected to be $416 per ton. Profits are subject to tax at 40% and the cost of capital is 13%. The project requires the following amounts in working capital, $450,000, $520,000, $540,800, $562,432 in year 0-year 3, respectively and the accumulated level of working capital in year 3 will be recovered in year 4. Determine the values of yellow background cells in the spreadsheet file and decide if United Feed should invest in this project? Also include a set of concerns or questions for further analysis. 03 e ki pa - Protection D33 - Number X for Sensitivity: General Use General Use Highly Confidential c o Confidential G H E F - I Cost of capital 13.0% Nmco 10,000 520.00 Quantity sold (tons) Price per ton Change in quantity Change in price Costs per ton 10,400 520.00 4.00% 0.00% 416.00 1 0,816 520.00 4.00% 0.00% 416.00 416.00 -2,200,000 1,960,000 NO Investments: Plant and equipment Accumulated depreciation Adjusted basis Net working capital Change in net working capital Total cash flow of investment 450,000 -450,000 -2,650,000 2,200,000 520,000 -70,000 -70,000 PHOTO 2,200,000 2,200,000 540,800 562,432 -20,800 21,632 -20,800 21,632 562,432 2,522,432 0 1 2 3 4 Sheet1 Sheet2 Sheet3 Ready D E F G H I J K Cost of capital 13.0% 5,200,000 5,408,000 5,624,320 4,160,000 4,326,400 4,499,456 -Nm NAM Sales Expenses Depreciation Income before taxes Taxes Net income Sales Expenses Taxes Operating cash flow Total cash flow of investment Total cash flow of project NPV 35 Sheet1 Sheet2 Sheet3 Ready Operating cash flow Total cash flow of investment Total cash flow of project NPV 2,200,000 plant and equipment Accumulated depreciation Book value 2,200,000 1,800,000 2.200,000 43 Sale of plant and equipment Book value Gain or loss from sale Tax on sale Aftertax salvage value -100.000 1,960,000 Sheet1 Sheet2Sheet3 110 Rige Boxe XP2 preciation ome before taxes kes et income ales expenses axes Pperating cash flow Total cash flow of investment Total cash flow of project NPV 2,200,000 Plant and equipment Accumulated depreciation Book value 2,200,000 Sale of plant and equipment Book value Gain or loss from sale Tax on sale Aftertax salvage value Sheet1 Sheet2 1,800,000 2,200,000 -400,000 -160,000 1,960,000 Sheet o t ome XP] 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts