Question: My answer is wrong. You are provided with the following amounts for Wendy Riley for the current year: Net employment income (ITA 5 to 8)

My answer is wrong.

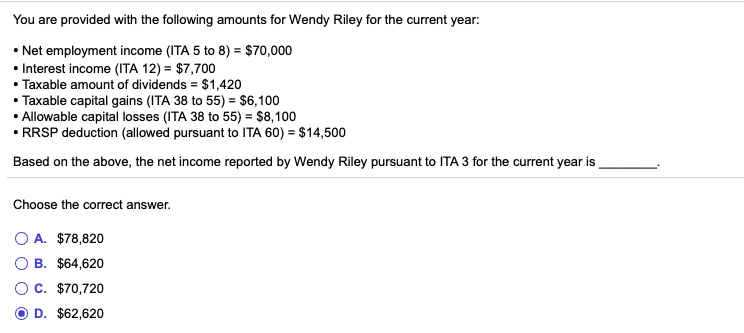

You are provided with the following amounts for Wendy Riley for the current year: Net employment income (ITA 5 to 8) = $70,000 Interest income (ITA 12) = $7,700 Taxable amount of dividends = $1,420 Taxable capital gains (ITA 38 to 55) = $6,100 Allowable capital losses (ITA 38 to 55) = $8,100 RRSP deduction (allowed pursuant to ITA 60) = $14,500 Based on the above, the net income reported by Wendy Riley pursuant to ITA 3 for the current year is Choose the correct answer. O A. $78,820 B. $64,620 C. $70,720 D. $62,620

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock