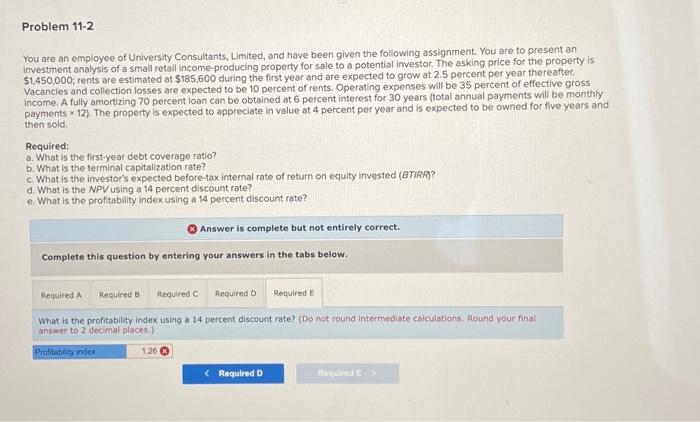

Question: MY ANSWERS ARE WRONG PLEASE FIX, Answer all parts!! A, B, C, D, E CHECK WORK PLEASE ANSWER CORRECTLY THIS IS VERY IMOPORTANT PLEASE MESSAGE

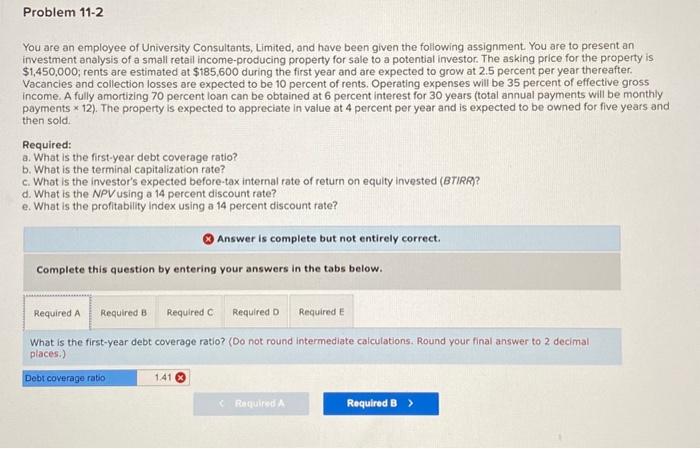

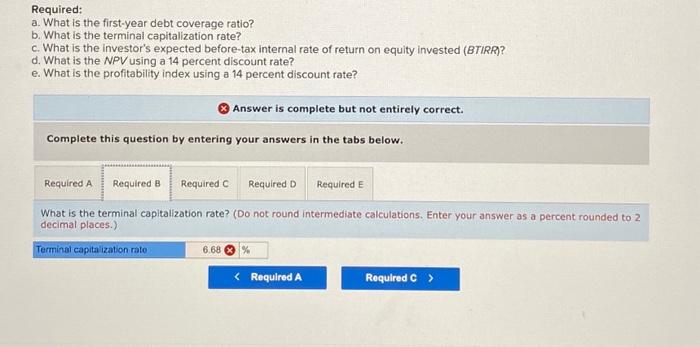

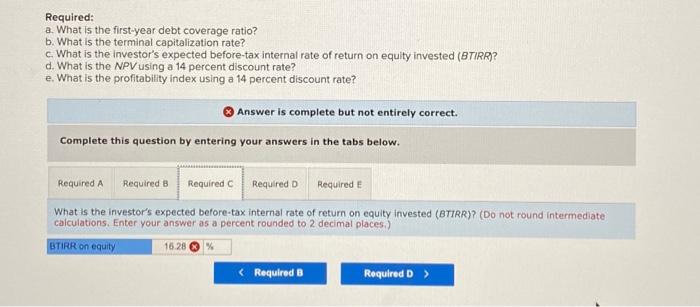

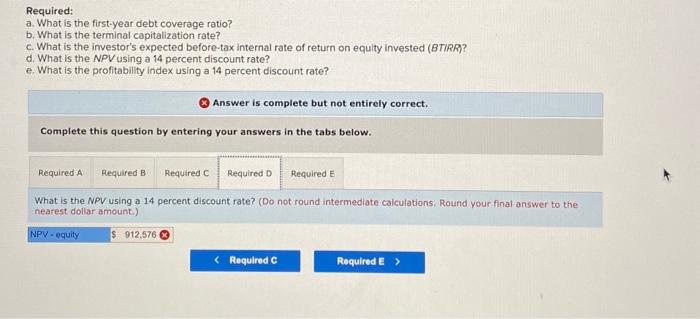

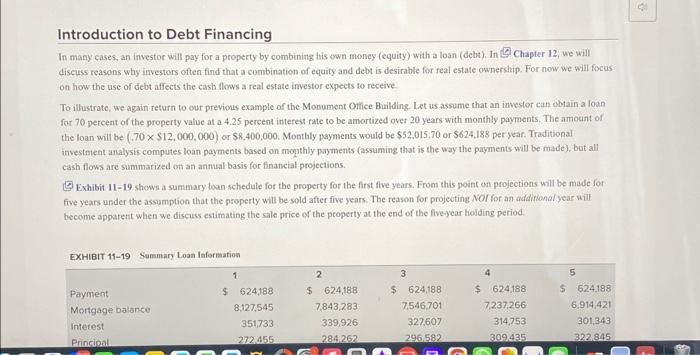

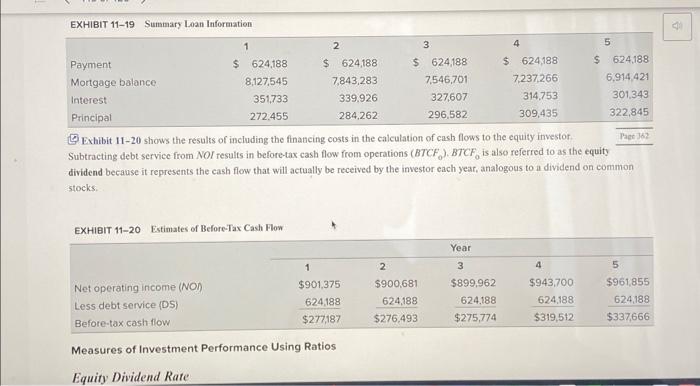

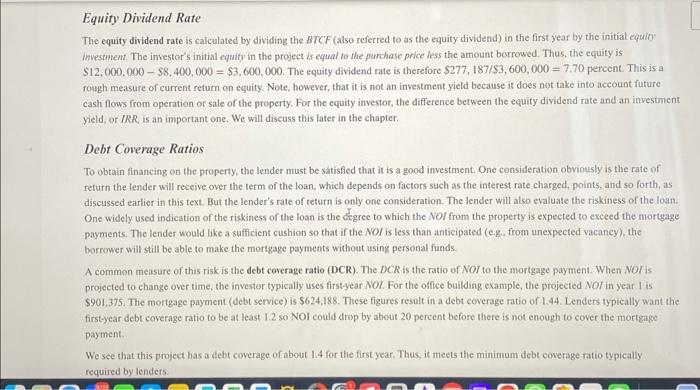

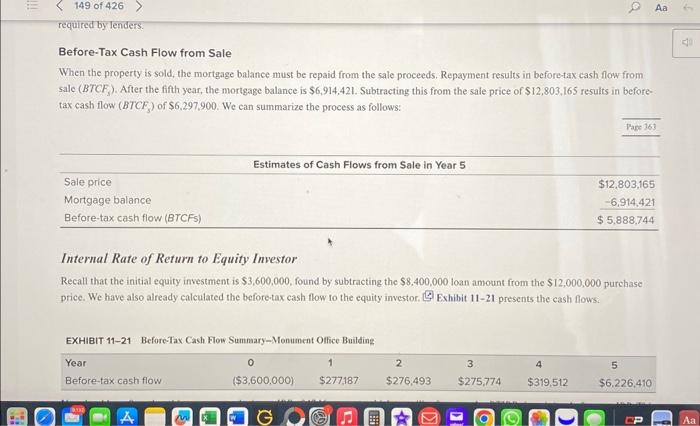

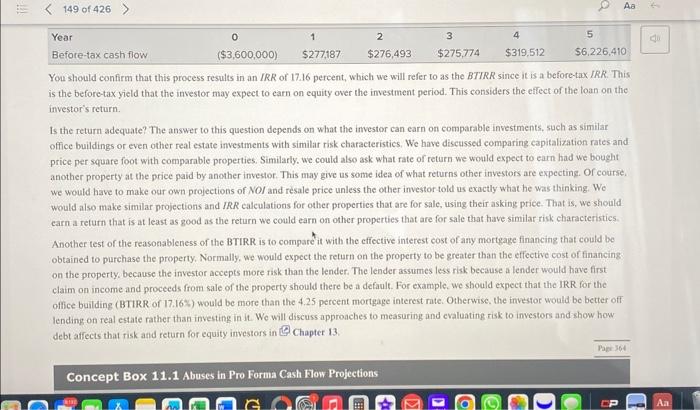

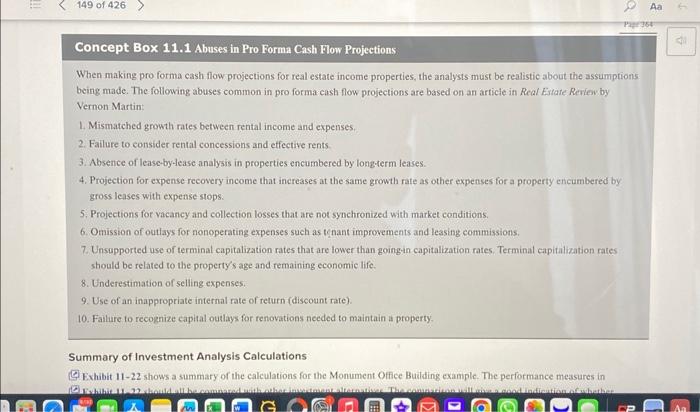

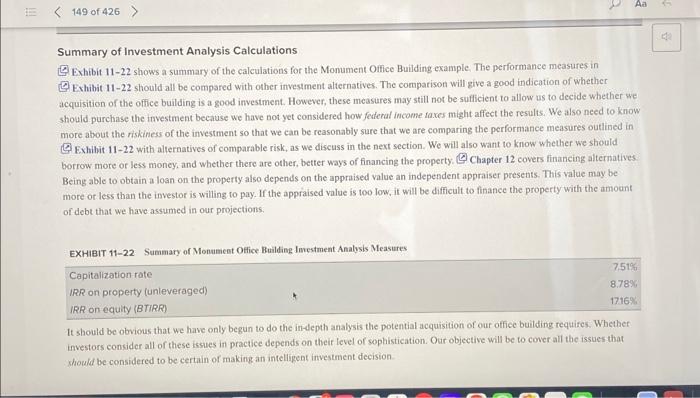

You are an employee of University Consultants, Limited, and have been given the following assignment. You are to present an investment analysis of a small retail income-producing property for sale to a potential investor. The asking price for the property is $1,450,000; rents are estimated at $185,600 during the first year and are expected to grow at 2.5 percent per year thereafter. Vacancies and collection losses are expected to be 10 percent of rents. Operating expenses will be 35 percent of effective gross income. A fully amortizing 70 percent loan can be obtained at 6 percent interest for 30 years (total annual payments will be monthly payments 12 ). The property is expected to appreciate in value at 4 percent per year and is expected to be owned for five years and then sold. Required: a. What is the first-year debt coverage ratio? b. What is the terminal capitalization rate? c. What is the investor's expected before-tax internal rate of return on equity invested (BTIRR)? d. What is the NPVusing a 14 percent discount rate? e. What is the profitability Index using a 14 percent discount rate? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What is the first-year debt coverage ratio? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Required: a. What is the first-year debt coverage ratio? b. What is the terminal capitalization rate? c. What is the investor's expected before-tax internal rate of return on equity invested (BTIRR)? d. What is the NPV using a 14 percent discount rate? e. What is the profitability index using a 14 percent discount rate? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What is the terminal capitalization rate? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 . decimal places.) Required: a. What is the first-year debt coverage ratio? b. What is the terminal capitalization rate? c. What is the investor's expected before-tax internal rate of return on equity invested (BTIRR)? d. What is the NPV using a 14 percent discount rate? e. What is the profitability index using a 14 percent discount rate? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What is the investor's expected before-tax internal rate of retum on equity invested (BTIRR)? (Do not round intermediate caiculations. Enter your answer as a percent rounded to 2 decimal places.) Required: a. What is the first-year debt coverage ratio? b. What is the terminal capitalization rate? c. What is the investor's expected before-tax internal rate of return on equity invested (BTIRR)? d. What is the NPV using a 14 percent discount rate? e. What is the profitability index using a 14 percent discount rate? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What is the NPV using a 14 percent discount rate? (Do not round intermediate calculations: Round your final answer to the nearest dollar amount.) Required: a. What is the first-year debt coverage rotio? b. What is the terminai capitalization rate? c. What is the investor's expected before-tax internal rate of return on equity invested (BTIRR)? d. What is the NPV using a 14 percent discount rate? e. What is the profitability index using a 14 percent discount rate? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What is the profitability index using a 14 percent discount rate? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Introduction to Debt Financing In many cases, an investor will pay for a property by combining bis own money (equity) with a loan (debt). In (S) Chapter 12, we will discuss reasons why investors often find that a combination of equity and debt is desirable for real estate ownership. For now we will focus on how the use of debt affects the cash flows a real estate investor expects to receive. To illustratc, we again return to our previous example of the Monument Olice Building. Let us assume that an investor can obtain a loan for 70 percent of the property value at a 4.25 percent interest rate to be amortized over 20 years with monthly payments. The amount of the loan will be (.70$12,000,000) or $8,400,000. Monthly payments would be $52,015,70 or $624,188 per year. Traditional investment analysis computes loan payments based on mopthly payments (assuming that is the way the payments will be made), but all cash flows are summarized ot an annual basis for financial projections. (39 Exhibit 11-19 shows a summary loan schedule for the property for the first five years. From this point on projections will be made for five years under the assumption that the property will be sold after five years. The reason for projecting NOI for an addirional year will become apparent when we discuss estimating the sale price of the property at the end of the fiveyear holding period. (3) Exhibit 11-20 shows the results of including the finatcing costs in the calculation of cash flows to the equity investor Subtracting debt service from NOI results in before-tax cash flow from operations (BTCF N 0) BTCF is also referred to as the equity dividend because it represents the cash flow that will actually be received by the investor each year, analogous to al dividend on common stocks. EXHIBIT 11-20 Estimates of Before-Tax Cash Flow Measures of Investment Performance Using Ratios Eauity Dividend Rate Equity Dividend Rate The equity dividend rate is calculated by dividing the BTCF (also referred to as the equity dividend) in the first year by the initial equity investment. The investor's initial equity in the project is equal to the purchase price less the amount borrowed. Thus, the equity is $12,000,000$8,400,000=$3,600,000. The equity dividend rate is therefore $277,187/$3,600,000=7.70 percent. This is a rough measure of current return on equity. Note, however, that it is not an investment yield because it does not take into account future cash flows from operation or sale of the property. For the equity investor, the difference between the equity dividend rate and an investment yield, or IRR is an important one. We will discuss this later in the chapter. Debt Coverage Ratios To obtain financing on the property, the lender must be satisfled that it is a good investment. One consideration obviously is the rate of return the lender will receive over the term of the loan, which depends on factors such as the interest rate charged, points, and so forth, as discussed earlier in this text. But the lender's rate of return is only one consideration. The lender will also evaluate the riskiness of the loan. One widely used indication of the riskiness of the loan is the degree to which the NOl from the property is expected to exceed the mortgage payments. The lender would like a sufficient cushion so that if the NOr is less than anticipated (e.g. from unexpected vacancy), the borrower will still be able to make the mortgage payments without using personal funds. A common measure of this risk is the debt corerage ratio (DCR). The DCR is the ratio of NOI to the mortgage payment. When NOI is projected to change over time, the investor typically uses first-year.NOI. For the office building example, the projected NOI in yeat 1 is $901,375. The mortgage payment (debt service) is $624,188. These figures result in a debt coverage ratio of 1.44 . Lenders typically want the firstyear debt coverage ratio to be at least 1.2 so NOI could drop by about 20 percent before there is not enough to cover the mortgage payment We see that this project has a debt coverage of about 1.4 for the first year. Thus, it meets the minimum debt coverage ratio typically required by lenders Before-Tax Cash Flow from Sale When the property is sold, the mortgage balance must be repaid from the sale proceeds. Repayment results in before-tax cash flow from sale (BTCFs). After the fifth year, the mortgage balance is $6,914,421. Subtracting this from the sale price of $12,803,165 results in beforetax cash flow (BTCFs) of $6,297,900. We can summarize the process as follows: Internal Rate of Return to Equity Investor Recall that the initial equity investment is $3,600,000, found by subtracting the $8,400,000 loan amount from the $12,000,000 purchase price. We have also already calculated the before-tax cash flow to the equity investor. (9) Exhibit 11-21 presents the cash flows. EXHIBIT 11-21 Before-Tax Cash Flow Summary-Monument Olfice Building You should confirm that this process results in an IRR of 17.16 percent, which we will refer to as the BTIRR since it is a before-tax IRR. This is the before-tax yield that the investor may expeet to carn on equity over the investment period. This considers the effect of the loan on the investor's return. Is the return adequate? The answer to this question depends on what the investor can earn on comparable investments, such as similar office buildings or even other real estate investments with similar risk eharacteristics. We have discussed comparing capitalization rates and price per square foot with comparable properties. Similarly, we could also ask what rate of return we would expect to earn had we bough another property at the price paid by another investor. This may give us some idea of what returns other investors are expecting. Of course. we would have to make our own projections of NOI and resale price unless the other investor told us exactly what he was thinking. Wo would also make similar projections and IRR calculations for other properties that are for sale, using their asking price. That is, we should carn a return that is at least as good as the return we could earn on other properties that are for sale that have similar risk characteristics Another test of the reasonableness of the BTIRR is to compare it with the effective interest cost of any mortgage financing that could be obtained to purchase the property, Normally, we would expect the return on the property to be greater than the effective cost of financing on the properly, because the investor aceepts more risk than the lender. The lender assumes less risk because a lender would have first claim on income and proceeds from sale of the property should there be a default. For example, we should expect that the IRR for the office building (BTIRR of 17.16% ) would be more than the 4.25 percent mortgage interest rate. OAherwise, the investor would be better off lending on real estate rather than inventing in it. Wo will discuss approaches to measuring and evaluating risk to investors and show how debt affects that risk and return for equity imvestors in 0 Chapter 13 When making pro forma cash flow projections for real estate income properties, the analysts must be realistic about the assumptions being made. The following abuses common in pro forma cash flow projections are based on an article in Real Eitate Reniev by Vernon Martin: 1. Mismatched growth rates between rental income and expenses. 2. Failure to consider rental concessions and etfective rents 3. Absence of lease-by-lease analysis in properties encumbered by longterm leases. 4. Projection for expense recovery income that increases at the same growth rate as other expenses for a property encumbered by gross leases with expense slops. 5. Projections for vacancy and collection losses that are not synchronized with market conditions. 6. Omission of outlays for nonoperating expenses such as tenant improvements and leasing commissions. 7. Unsupported use of terminal capitalization rates that are lower than going-in capitalization rates. Terminal capitalization rates should be related to the property's age and remaining economie lifc. 8. Underestimation of selling expenses. 9. Use of an inappropriate internal rate of return (discount rate). 10. Failure to recognize capital outlays for renovations needed to maintain a ptoperty. Summary of Investment Analysis Calculations Exhibit 11-22 shows a summary of the calculations for the Monument Ofice Buiding example. The performance measures in Summary of Investment Analysis Calculations Exhibit 11-22 shows a summary of the calculations for the Monument Ofice Building example. The performance measures in Exhibit 11-22 should all be compared with other investment alternatives. The comparison will give a good indication of whether acquisition of the office building is a good investment. However, these measures may still not be sufficient to allow us to decide whether we should purchase the investment because we have not yet considered how federat income taxes might affect the results. We also need to know more atout the riskiness of the investment so that we can be reasonably sure that we are comparing the performance measures outlined in (G Exhibit 11-22 with alternatives of comparable risk, as we discuss in the next section. We will also want to know whether we should borrow more or less money; and whether there are other, better ways of financing the property. Chapter 12 covers financing alternatives. Being able to obtain a loan on the property also depends on the appraised value an independent appraiser presents. This value may be more of less than the investor is willing to pay. If the appraised value is too low, it will be difficult to finance the property with the amount of debt that we have assumed in our projections. EXHIBIT 11-22 Summary of Monumient Otfice Building Imestment Analysis Measures: Capitalization rate IRR on property (unleveraged) IRR on equity (BTIRR) It should be obvious that we have only begun to do the in-depth analysis the potential acquisition of our office building requires. Whether investors consider all of these issues in practice depends on their level of sophistication. Our objective will be to cover all the issues that should be considered to be certain of making an intelligent investment deeision You are an employee of University Consultants, Limited, and have been given the following assignment. You are to present an investment analysis of a small retail income-producing property for sale to a potential investor. The asking price for the property is $1,450,000; rents are estimated at $185,600 during the first year and are expected to grow at 2.5 percent per year thereafter Vacancies and collection losses are expected to be to percent of rents. Operating expenses will be 35 percent of effective gross income. A fully amortizing 70 percent loan can be obtained at 6 percent interest for 30 years (total annual payments will be monthly payments x12 ). The property is expected to appreciate in value at 4 percent per year and is expected to be owned for five years and then sold. Required: a. What is the first-year debt coverage ratio? b. What is the terminal capitalization rate? c. What is the investor's expected before-tax internal rate of retum on equity invested (BTIRA)? d. What is the NPV using a 14 percent discount rate? e. What is the profitability index using a 14 percent discount rate? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What is the profitability index using a 14 percent discount rate? (Do nat round intermediate caiculations. Round your final answer to 2 decmal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts