Question: my apologies. this is the question i need help with. thank you! Should the investor buy this property? What would be his Net Present Value

my apologies. this is the question i need help with. thank you!

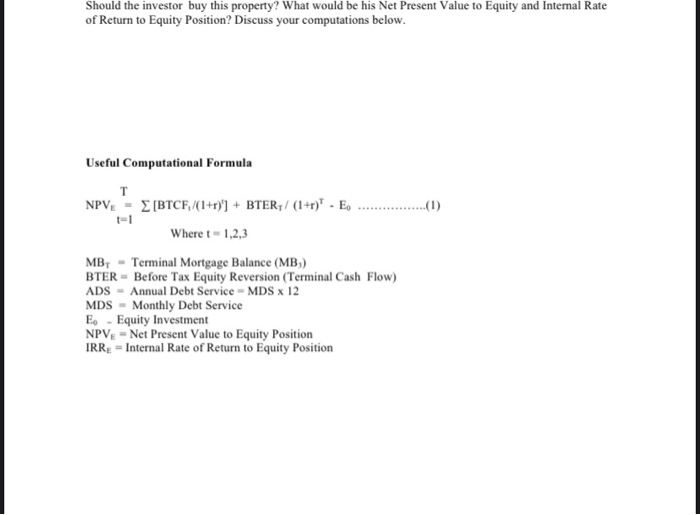

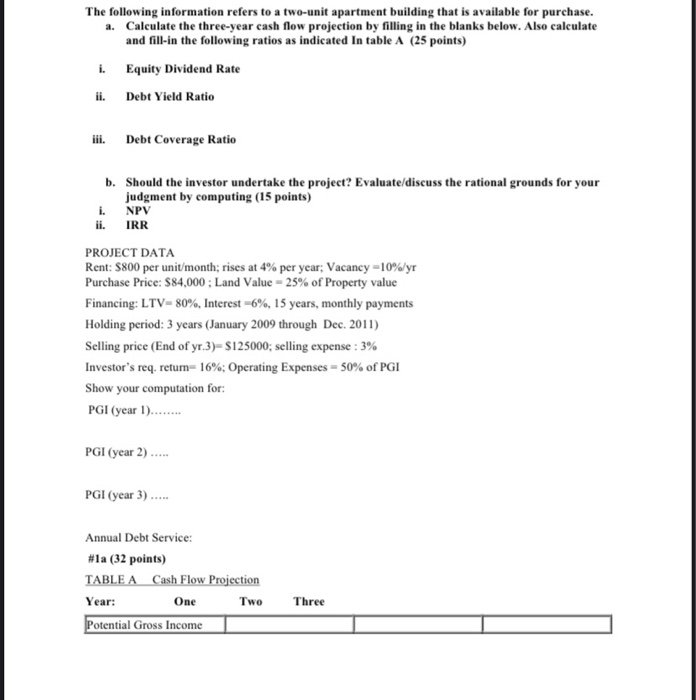

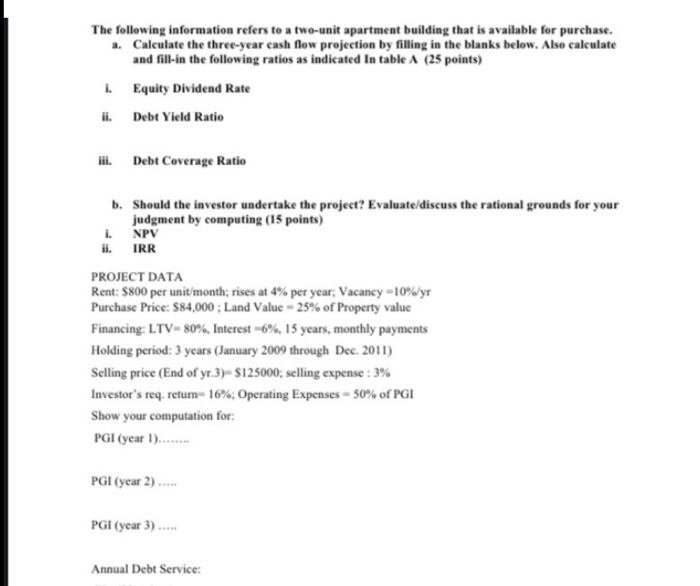

my apologies. this is the question i need help with. thank you!Should the investor buy this property? What would be his Net Present Value to Equity and Intemal Rate of Return to Equity Position? Discuss your computations below. Useful Computational Formula NPV = (BTCF/(1+r)") + BTER / (1+r)". E .................(1) Where t - 1,2,3 MBT - Terminal Mortgage Balance (MB) BTER - Before Tax Equity Reversion (Terminal Cash Flow) ADS - Annual Debt Service - MDS X 12 MDS - Monthly Debt Service E - Equity Investment NPVE-Net Present Value to Equity Position IRRE = Internal Rate of Return to Equity Position The following information refers to a two-unit apartment building that is available for purchase. a. Calculate the three-year cash flow projection by filling in the blanks below. Also calculate and fill in the following ratios as indicated In table A (25 points) Equity Dividend Rate ii. Debt Yield Ratio iii. Debt Coverage Ratio b. Should the investor undertake the project? Evaluate/discuss the rational grounds for your judgment by computing (15 points) i. NPV ii. IRR PROJECT DATA Rent: $800 per unit/month; rises at 4% per year; Vacancy=10%/yr Purchase Price: $84.000 : Land Value - 25% of Property value Financing: LTV-80%, Interest -6%, 15 years, monthly payments Holding period: 3 years (January 2009 through Dec. 2011) Selling price (End of yr.3)=$125000; selling expense : 3% Investor's req. retum=16%; Operating Expenses = 50% of PGI Show your computation for: PGI (year 1). PGI (year 2).... PGI (year 3) .... Annual Debt Service: #1a (32 points) TABLE A Cash Flow Projection Year: One Two Potential Gross Income Three The following information refers to a two-unit apartment building that is available for purchase. a. Calculate the three-year cash flow projection by filling in the blanks below. Also calculate and fill in the following ratios as indicated In table A (25 points) i. Equity Dividend Rate ii. Debt Yield Ratio iii. Debt Coverage Ratio b. Should the invester undertake the project? Evaluate/discuss the rational grounds for your judgment by computing (15 points) i. NPV ii. IRR PROJECT DATA Rent: $800 per unit/month; rises at 4% per year, Vacancy -10%/yr Purchase Price: 584,000 : Land Value - 25% of Property value Financing: LTV-80%, Interest -6%, 15 years, monthly payments Holding period: 3 years (January 2009 through Dec. 2011) Selling price (End of yr 3)-$125000; selling expense : 3% Investor's req. retum- 16%: Operating Expenses -50% of PGI Show your computation for: PGI (year 1)........ PGI (year 2) .... PGI (year 3)..... Annual Debt Service: Should the investor buy this property? What would be his Net Present Value to Equity and Intemal Rate of Return to Equity Position? Discuss your computations below. Useful Computational Formula NPV = (BTCF/(1+r)") + BTER / (1+r)". E .................(1) Where t - 1,2,3 MBT - Terminal Mortgage Balance (MB) BTER - Before Tax Equity Reversion (Terminal Cash Flow) ADS - Annual Debt Service - MDS X 12 MDS - Monthly Debt Service E - Equity Investment NPVE-Net Present Value to Equity Position IRRE = Internal Rate of Return to Equity Position The following information refers to a two-unit apartment building that is available for purchase. a. Calculate the three-year cash flow projection by filling in the blanks below. Also calculate and fill in the following ratios as indicated In table A (25 points) Equity Dividend Rate ii. Debt Yield Ratio iii. Debt Coverage Ratio b. Should the investor undertake the project? Evaluate/discuss the rational grounds for your judgment by computing (15 points) i. NPV ii. IRR PROJECT DATA Rent: $800 per unit/month; rises at 4% per year; Vacancy=10%/yr Purchase Price: $84.000 : Land Value - 25% of Property value Financing: LTV-80%, Interest -6%, 15 years, monthly payments Holding period: 3 years (January 2009 through Dec. 2011) Selling price (End of yr.3)=$125000; selling expense : 3% Investor's req. retum=16%; Operating Expenses = 50% of PGI Show your computation for: PGI (year 1). PGI (year 2).... PGI (year 3) .... Annual Debt Service: #1a (32 points) TABLE A Cash Flow Projection Year: One Two Potential Gross Income Three The following information refers to a two-unit apartment building that is available for purchase. a. Calculate the three-year cash flow projection by filling in the blanks below. Also calculate and fill in the following ratios as indicated In table A (25 points) i. Equity Dividend Rate ii. Debt Yield Ratio iii. Debt Coverage Ratio b. Should the invester undertake the project? Evaluate/discuss the rational grounds for your judgment by computing (15 points) i. NPV ii. IRR PROJECT DATA Rent: $800 per unit/month; rises at 4% per year, Vacancy -10%/yr Purchase Price: 584,000 : Land Value - 25% of Property value Financing: LTV-80%, Interest -6%, 15 years, monthly payments Holding period: 3 years (January 2009 through Dec. 2011) Selling price (End of yr 3)-$125000; selling expense : 3% Investor's req. retum- 16%: Operating Expenses -50% of PGI Show your computation for: PGI (year 1)........ PGI (year 2) .... PGI (year 3)..... Annual Debt Service

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts