Question: My calculations do not match the correct answer, which may be due to some minor errors in the process. Could you please write out the

My calculations do not match the correct answer, which may be due to some minor errors in the process. Could you please write out the detailed steps and formulae for this question to help me figure out what the problem is? Thank you for your help and have a good day!

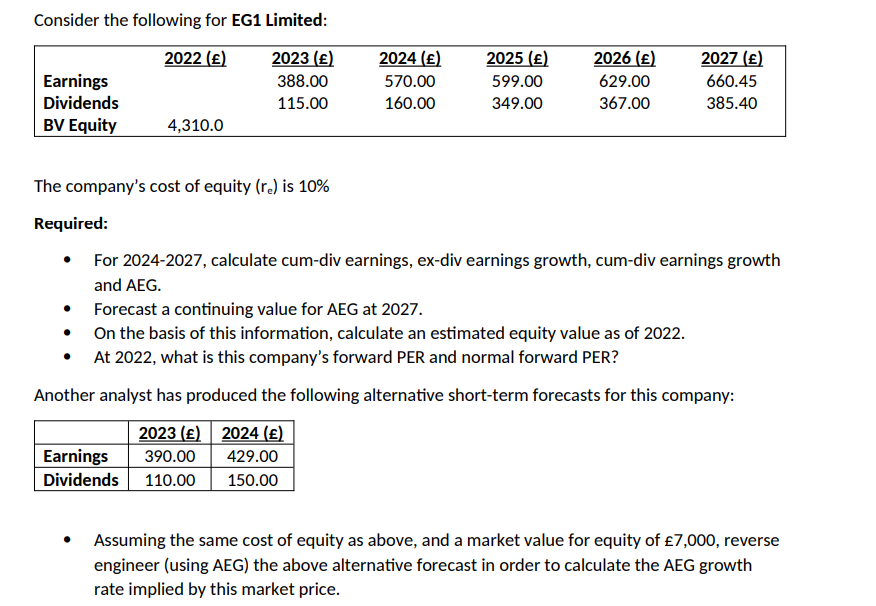

Consider the following for EG1 Limited: The company's cost of equity (re) is 10% Required: - For 2024-2027, calculate cum-div earnings, ex-div earnings growth, cum-div earnings growth and AEG. - Forecast a continuing value for AEG at 2027. - On the basis of this information, calculate an estimated equity value as of 2022 . - At 2022, what is this company's forward PER and normal forward PER? Another analyst has produced the following alternative short-term forecasts for this company: - Assuming the same cost of equity as above, and a market value for equity of 7,000, reverse engineer (using AEG) the above alternative forecast in order to calculate the AEG growth rate implied by this market price. Consider the following for EG1 Limited: The company's cost of equity (re) is 10% Required: - For 2024-2027, calculate cum-div earnings, ex-div earnings growth, cum-div earnings growth and AEG. - Forecast a continuing value for AEG at 2027. - On the basis of this information, calculate an estimated equity value as of 2022 . - At 2022, what is this company's forward PER and normal forward PER? Another analyst has produced the following alternative short-term forecasts for this company: - Assuming the same cost of equity as above, and a market value for equity of 7,000, reverse engineer (using AEG) the above alternative forecast in order to calculate the AEG growth rate implied by this market price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts