Question: my current selections are incorrect together. please help! Partner Jackson receives a distribution of partnership property that is in complete liquidation of his partnership interest.

my current selections are incorrect together. please help!

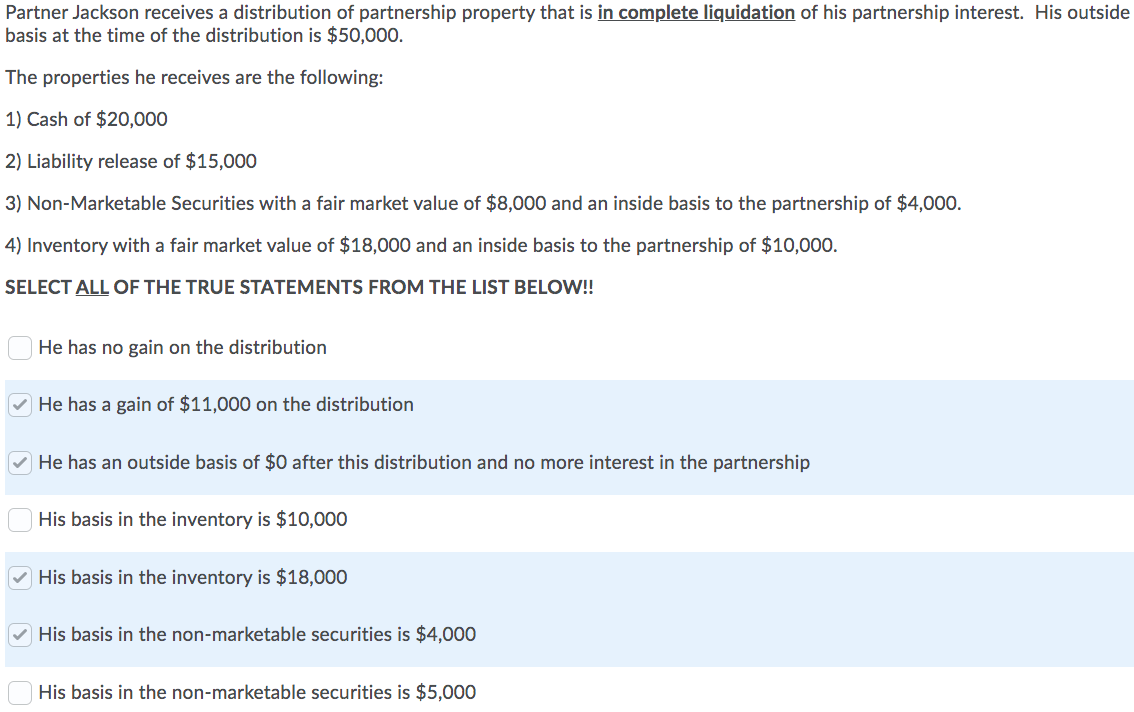

Partner Jackson receives a distribution of partnership property that is in complete liquidation of his partnership interest. His outside basis at the time of the distribution is $50,000. The properties he receives are the following: 1) Cash of $20,000 2) Liability release of $15,000 3) Non-Marketable Securities with a fair market value of $8,000 and an inside basis to the partnership of $4,000. 4) Inventory with a fair market value of $18,000 and inside basis to the partnership of $10,000. SELECT ALL OF THE TRUE STATEMENTS FROM THE LIST BELOW!! He has no gain on the distribution He has a gain of $11,000 on the distribution He has an outside basis of $0 after this distribution and no mo interest in the partnership His basis in the inventory is $10,000 His basis in the inventory is $18,000 His basis in the non-marketable securities is $4,000 His basis in the non-marketable securities is $5,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts