Question: my data table here is an example to answer my question Save Homework: Chapter 11 Homework Score: 0.67 of 1 pt 4 of 8 (6

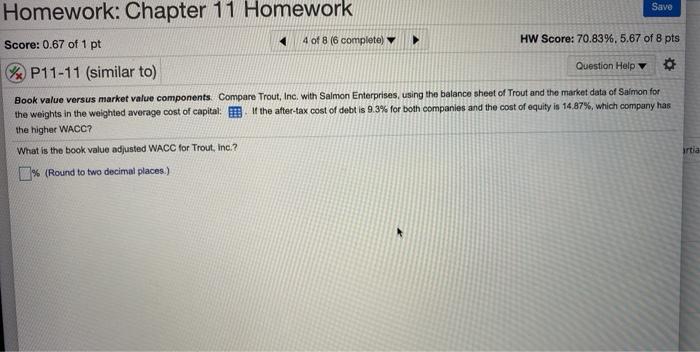

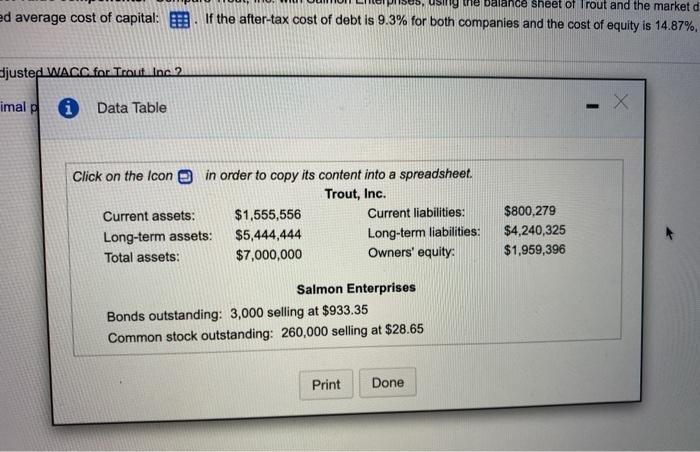

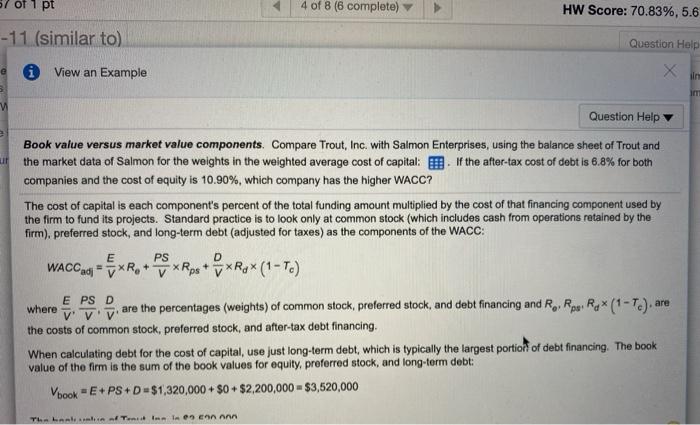

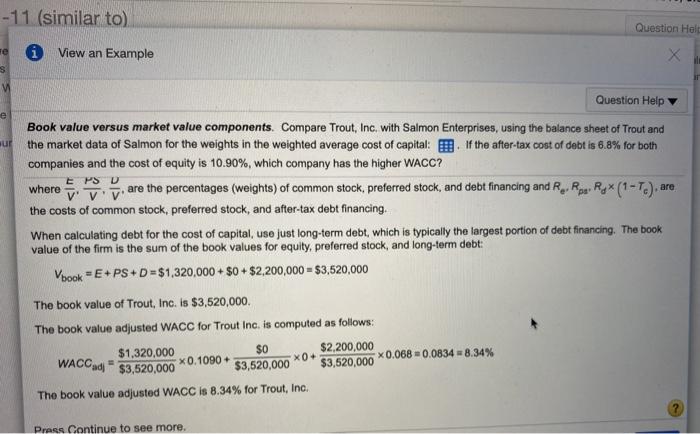

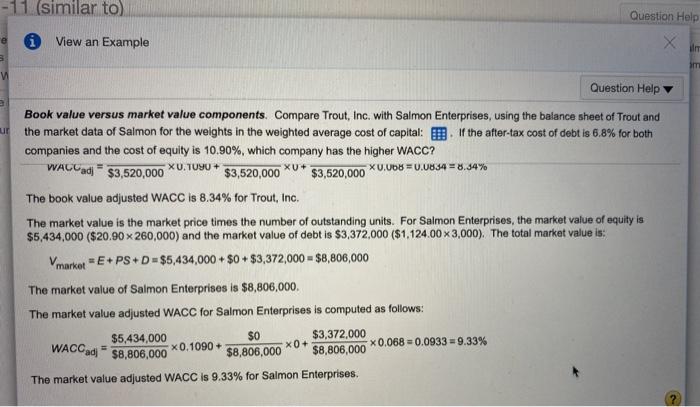

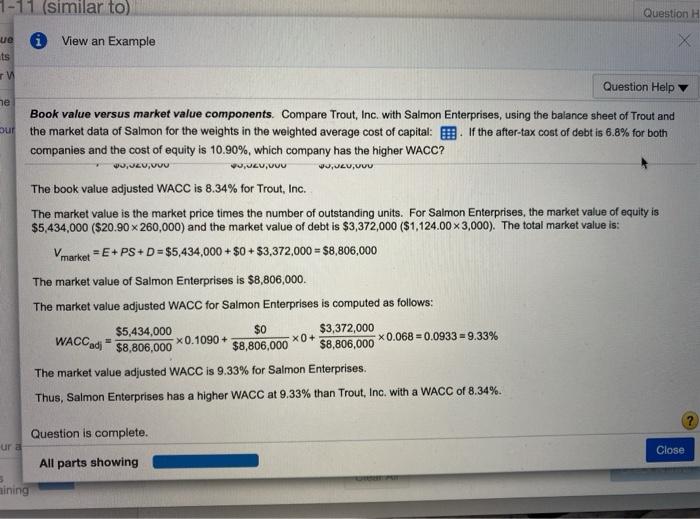

Save Homework: Chapter 11 Homework Score: 0.67 of 1 pt 4 of 8 (6 complete) HW Score: 70.83%, 5.67 of 8 pts Question Help % P11-11 (similar to) Book value versus market value components Compare Trout, Inc. with Salmon Enterprises, using the balance sheet of Trout and the market data of Salmon for the weights in the weighted average cost of capital: If the after-tax cost of debt is 9.3% for both companies and the cost of equity is 14.87%, which company has the higher WACC? What is the book value adjusted WACC for Trout, Inc.? % (Round to two decimal places.) artia balance sheet of trout and the market d ed average cost of capital: . If the after-tax cost of debt is 9.3% for both companies and the cost of equity is 14.87%. Sjusted WACC for Trout Inc. 2 imal 0 Data Table Click on the Icon in order to copy its content into a spreadsheet. Trout, Inc. Current assets: $1,555,556 Current liabilities: Long-term assets: $5,444,444 Long-term liabilities: Total assets: $7,000,000 Owners' equity: $800,279 $4,240,325 $1,959,396 Salmon Enterprises Bonds outstanding: 3,000 selling at $933.35 Common stock outstanding: 260,000 selling at $28.65 Print Done 57 of 1 pt A 4 of 8 (6 complete) HW Score: 70.83%, 5.6 -11 (similar to) Question Holp View an Example 7 3 uf Question Help Book value versus market value components. Compare Trout, Inc. with Salmon Enterprises, using the balance sheet of Trout and the market data of Salmon for the weights in the weighted average cost of capital: . If the after-tax cost of debt is 6.8% for both companies and the cost of equity is 10.90%, which company has the higher WACC? The cost of capital is each component's percent of the total funding amount multiplied by the cost of that financing component used by the firm to fund its projects. Standard practice is to look only at common stock (which includes cash from operations retained by the firm). preferred stock, and long-term debt (adjusted for taxes) as the components of the WACC: WACC ad **R Ex Rgx (1-To) E PS + XRps + where EPS D vvv are the percentages (weights) of common stock, preferred stock, and debt financing and R. Ross Ro* (1-7)are the costs of common stock, preferred stock, and after-tax debt financing. When calculating debt for the cost of capital, use just long-term debt, which is typically the largest portion of debt financing. The book value of the firm is the sum of the book values for equity, preferred stock, and long-term debt: VbookE+PS+D=$1,320,000 + $0 $2,200,000 - $3,520,000 The best in lesen Ann -11 (similar to) Question Hall View an Example X S e aur Question Help Book value versus market value components. Compare Trout, Inc. with Salmon Enterprises, using the balance sheet of Trout and the market data of Salmon for the weights in the weighted average cost of capital: . If the after-tax cost of debt is 6.8% for both companies and the cost of equity is 10.90%, which company has the higher WACC? E PSD where VVV are the percentages (weights) of common stock, preferred stock, and debt financing and R. RRX (1-T.) are the costs of common stock, preferred stock, and after-tax debt financing. When calculating debt for the cost of capital, use just long-term debt, which is typically the largest portion of debt financing. The book value of the firm is the sum of the book values for equity, preferred stock, and long-term debt: Vbook + E +PSD=$1,320,000 $0 + $2,200,000 = $3,520,000 The book value of Trout, Inc. is $3,520,000 The book value adjusted WACC for Trout Inc. is computed as follows: $1,320,000 $0 $2,200,000 x0.1090+ $3,520,000 $3,620,000 -0.068 = 0.0834 = 8.34% XO WACC ad $3,520,000 The book value adjusted WACC is 8.34% for Trout, Inc. Press Continue to see more. -11. (similar to) Question Help ilm * View an Example 5 im Question Help Book value versus market value components. Compare Trout, Inc. with Salmon Enterprises, using the balance sheet of Trout and the market data of Salmon for the weights in the weighted average cost of capital: . If the after-tax cost of debt is 6.8% for both companies and the cost of equity is 10.90%, which company has the higher WACC? WAC adj - $3,520,000 XU. TU90+ XU+ $3,520,000 $3,520,000 0.00=0.0054 = 8.34% The book value adjusted WACC is 8.34% for Trout, Inc. The market value is the market price times the number of outstanding units. For Salmon Enterprises, the market value of equity is $5,434,000 ($20.90 x 260,000) and the market value of debt is $3,372,000 ($1,124.00 x 3,000). The total market value is: market =E+PS+D=$5,434,000 + $0 + $3,372,000 - $8,806,000 The market value of Salmon Enterprises is $8,806,000. The market value adjusted WACC for Salmon Enterprises is computed as follows: $5,434,000 $0 $3,372.000 x0.1090 + X0+ $8,806,000 $8,806,000 *0.068 = 0.0933 = 9.33% WACCad - $8,806,000 The market value adjusted WACC is 9.33% for Salmon Enterprises. 1-11. (similar to) Question ue i View an Example ts he Our UULUVUU WJJLUUUU Question Help Book value versus market value components. Compare Trout, Inc. with Salmon Enterprises, using the balance sheet of Trout and the market data of Salmon for the weights in the weighted average cost of capital: . If the after-tax cost of debt is 6.8% for both companies and the cost of equity is 10.90%, which company has the higher WACC? WU,J20,000 The book value adjusted WACC is 8.34% for Trout, Inc. The market value is the market price times the number of outstanding units. For Salmon Enterprises, the market value of equity is $5,434,000 ($20.90 x 260,000) and the market value of debt is $3,372,000 ($1,124.00 x 3,000). The total market value is: = E + PS+D=$5,434,000 + $0 $3,372,000 = $8,806,000 The market value of Salmon Enterprises is $8,806,000. The market value adjusted WACC for Salmon Enterprises is computed as follows: $5,434,000 $0 $3,372,000 x0.1090+ xO+ $8,806,000 $8,806,000 *0.068 -0.0933 = 9.33% The market value adjusted WACC is 9.33% for Salmon Enterprises. Thus, Salmon Enterprises has a higher WACC at 9.33% than Trout, Inc. with a WACC of 8.34%. V market WACC ad $8,806,000 Question is complete. ura Close All parts showing mining

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts