Question: My Grade Do Homework-Kathi Wagner-Google Chrome C secure https://www.mathdcom tudent PlayerHomework aspx?homeworkld 4333478738 questo ldslen shed false cla ACC 215S Intermediate Accounting ll Fall 17

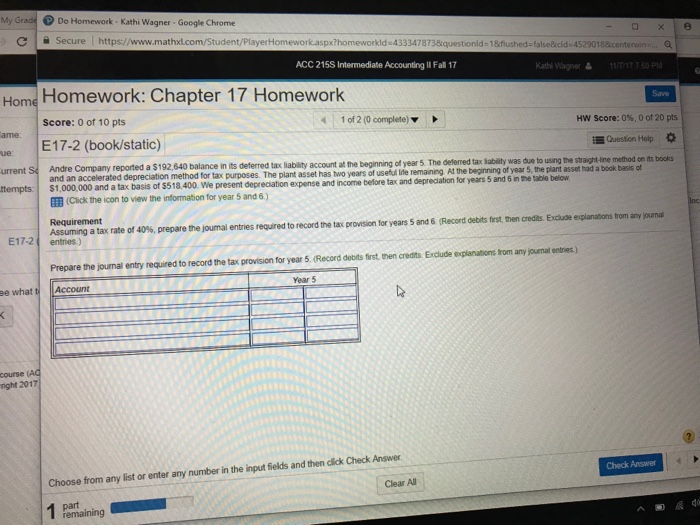

My Grade Do Homework-Kathi Wagner-Google Chrome C secure https://www.mathdcom tudent PlayerHomework aspx?homeworkld 4333478738 questo ldslen shed false cla ACC 215S Intermediate Accounting ll Fall 17 Kath Wagner 11/T17 7 50 PM Home Homework: Chapter 17 Homework Save Score: 0 of 10 pts ld?(0 complete) ue E17-2 (book/static) rent S Andre Company reported a $192640 balance in its deferred tax lablity account at the beginning of year 5 The defere tax iability was dus to using the straight-ine method o Hw Score: 0%,0 or 20 pts Question Help * its books and an accelerated depreciation method for tax purposes. T EEB (Click the icon to view the information for year 5 and 6) Requirement he plant asset has two years of useful ife remaining At the beginning of year present depreciation expense and income before tax and deprecation for years 5 and 6 in the table belovw 5, the plant asset had a book basis of ttempts: $1,000,000 and a tax basis of $518.400. We present depreciation e Assuming a tax rate of 40% prepare the male nes regred to record the tapro son fr years s and 6 Record de str te ei baeega entom a yang E17-2 entries Prepare the journal entry required to record the tax provision for year 5. (Record debits first then credits. Exclude explanations from any journal entnies) ee what t Account Year 5 course (Ad right 2017 Choose from any list or enter any number in the input fields and then click Check Answer Check Answer Clear All My Grade Do Homework-Kathi Wagner-Google Chrome C secure https://www.mathdcom tudent PlayerHomework aspx?homeworkld 4333478738 questo ldslen shed false cla ACC 215S Intermediate Accounting ll Fall 17 Kath Wagner 11/T17 7 50 PM Home Homework: Chapter 17 Homework Save Score: 0 of 10 pts ld?(0 complete) ue E17-2 (book/static) rent S Andre Company reported a $192640 balance in its deferred tax lablity account at the beginning of year 5 The defere tax iability was dus to using the straight-ine method o Hw Score: 0%,0 or 20 pts Question Help * its books and an accelerated depreciation method for tax purposes. T EEB (Click the icon to view the information for year 5 and 6) Requirement he plant asset has two years of useful ife remaining At the beginning of year present depreciation expense and income before tax and deprecation for years 5 and 6 in the table belovw 5, the plant asset had a book basis of ttempts: $1,000,000 and a tax basis of $518.400. We present depreciation e Assuming a tax rate of 40% prepare the male nes regred to record the tapro son fr years s and 6 Record de str te ei baeega entom a yang E17-2 entries Prepare the journal entry required to record the tax provision for year 5. (Record debits first then credits. Exclude explanations from any journal entnies) ee what t Account Year 5 course (Ad right 2017 Choose from any list or enter any number in the input fields and then click Check Answer Check Answer Clear All

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts