Question: my Home | myLU X Lu Read & Intera X Lu Homework: V X Question 1 - | X Class BUSI 53 x Course Hero

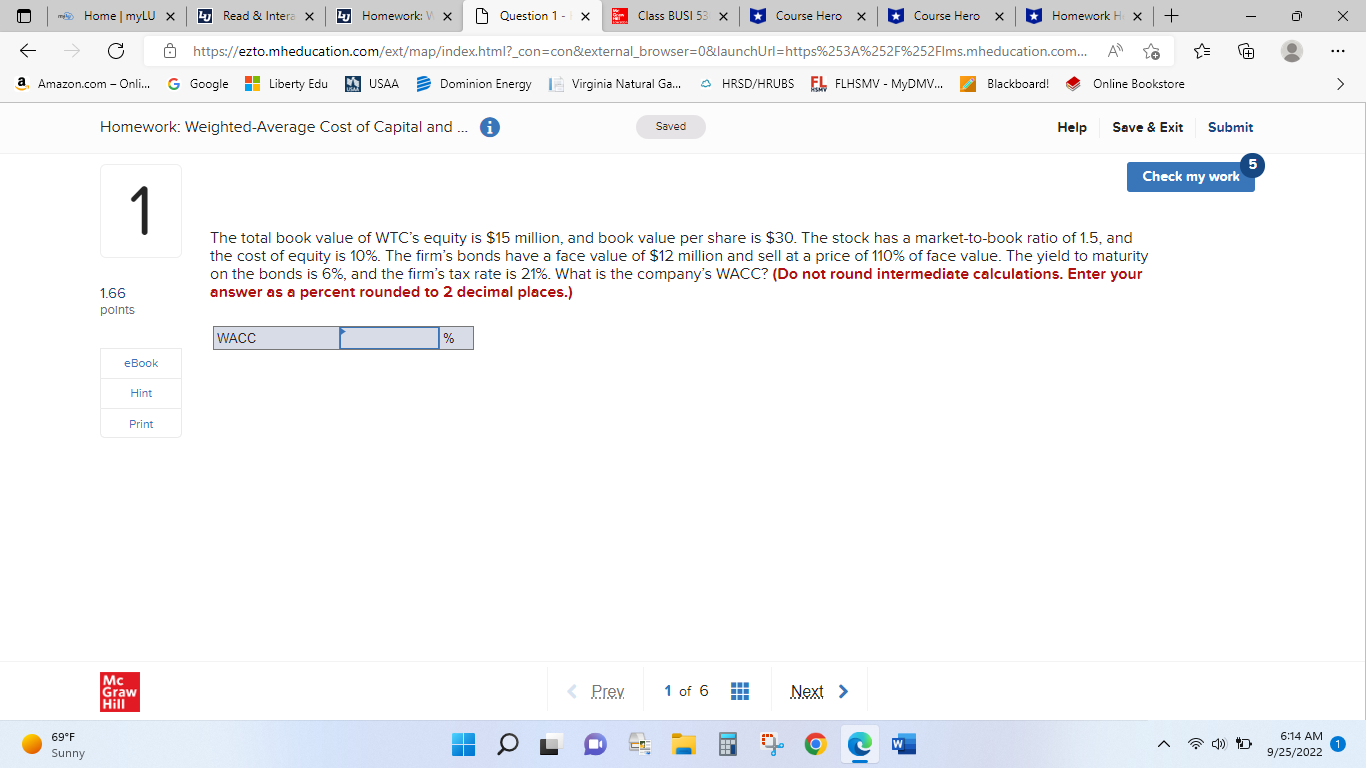

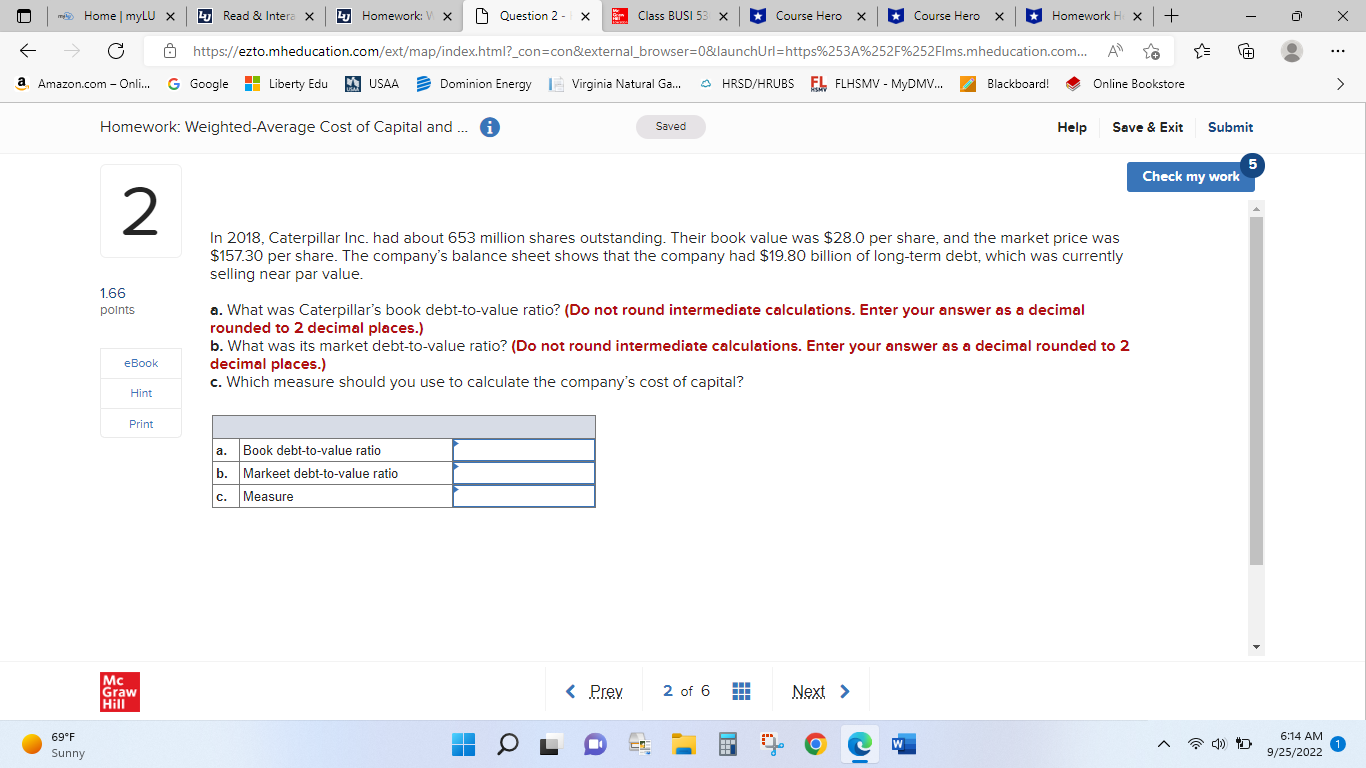

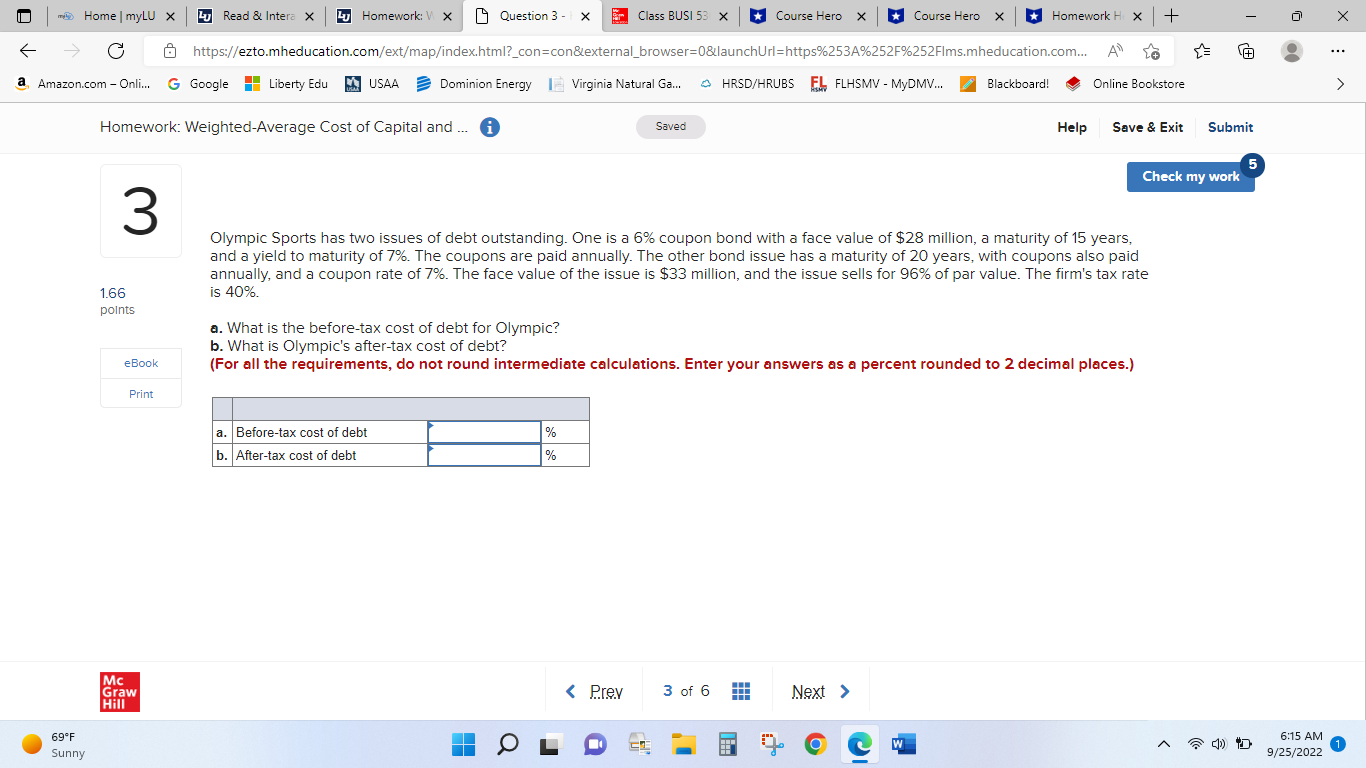

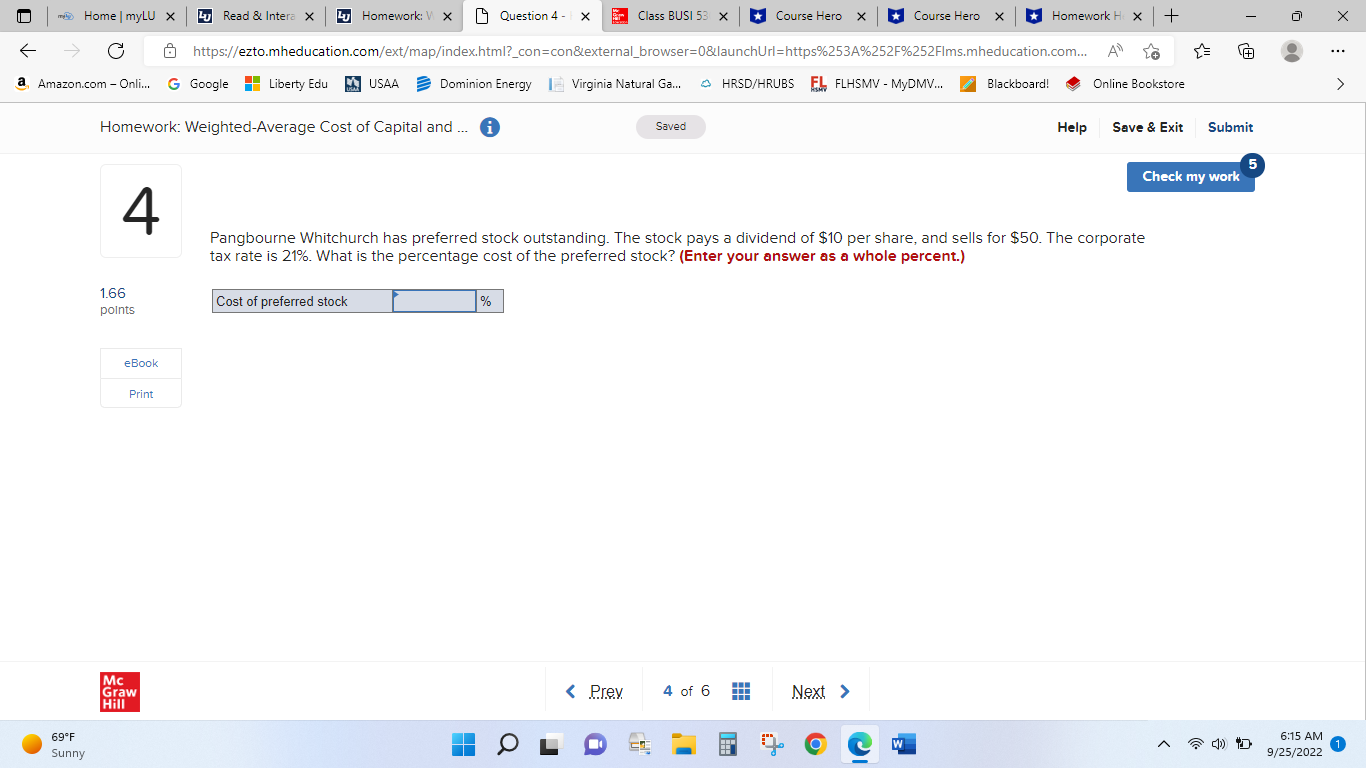

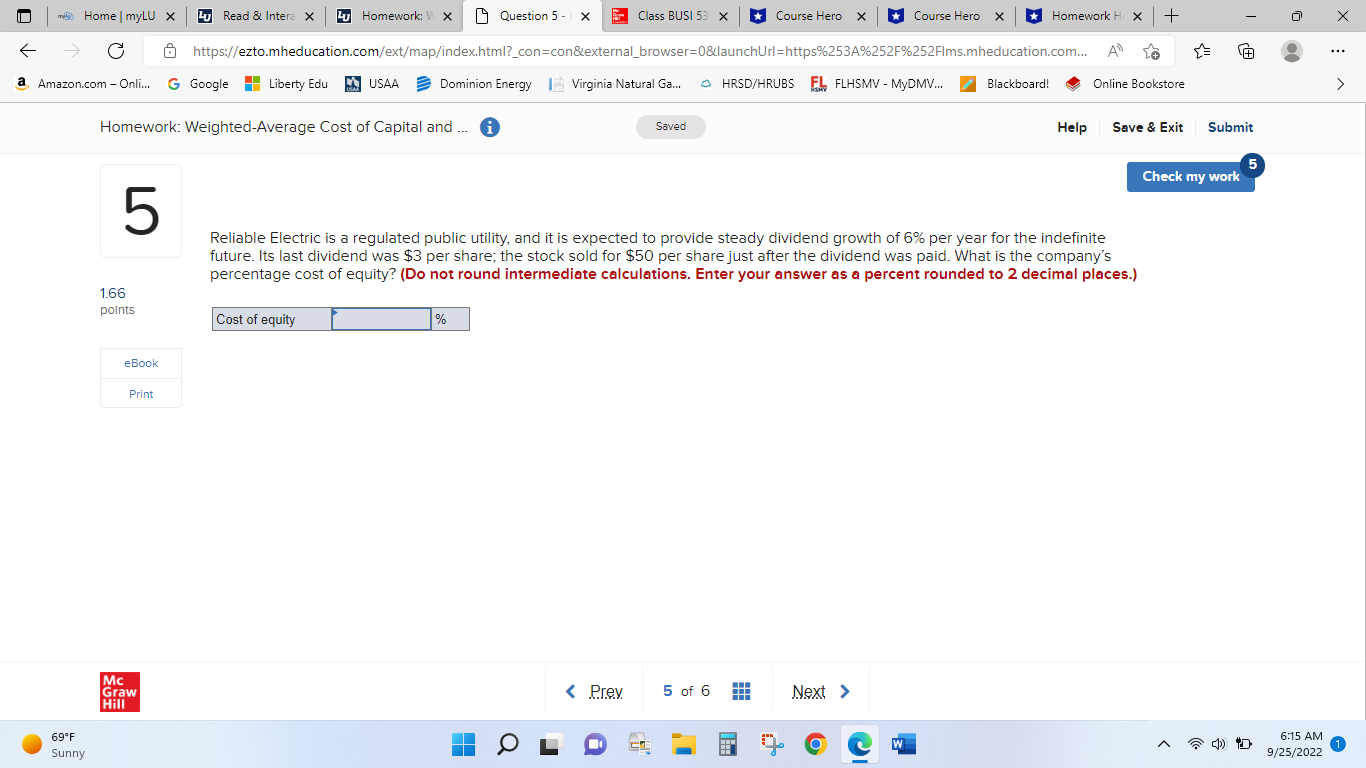

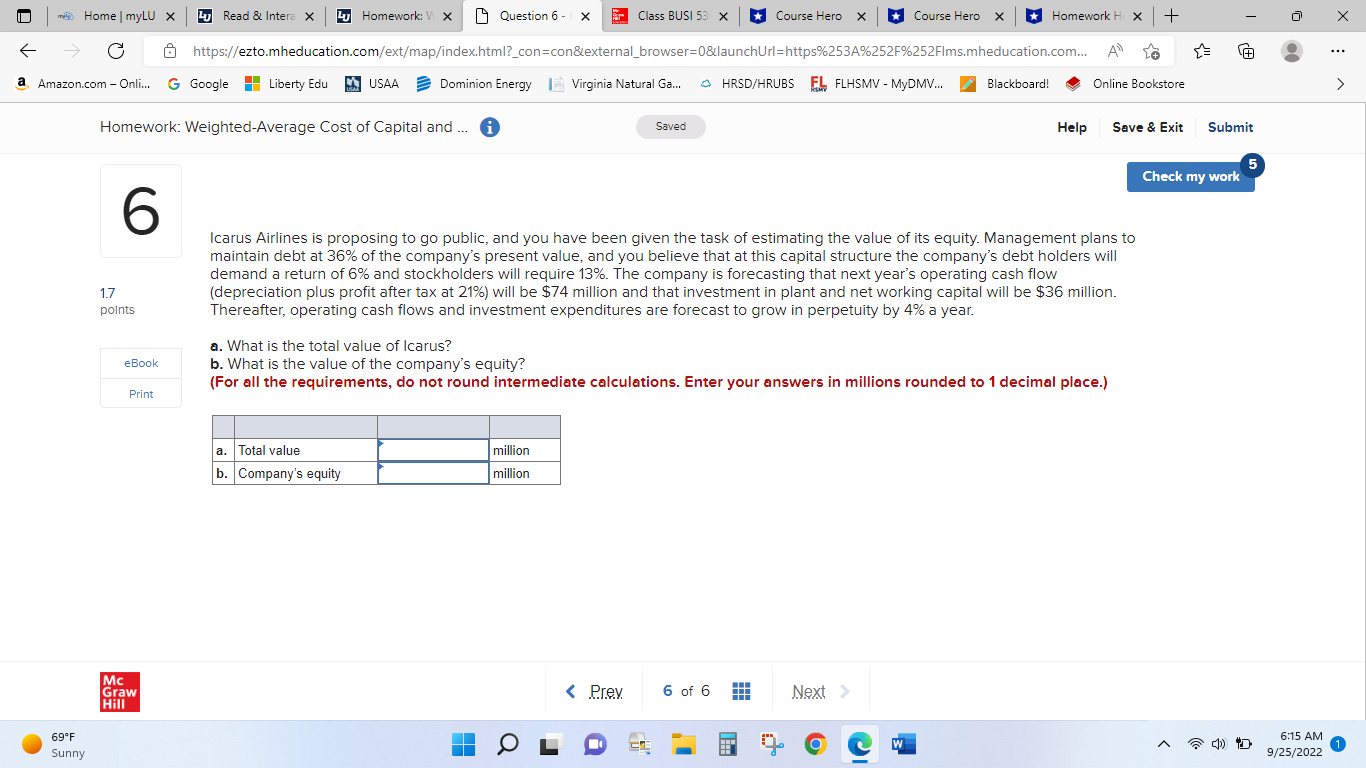

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts