Question: my last post please answer all! thank u! a. (15%) (Bonds) A $1000 bond has a coupon rate of 4 percent and coupons are payable

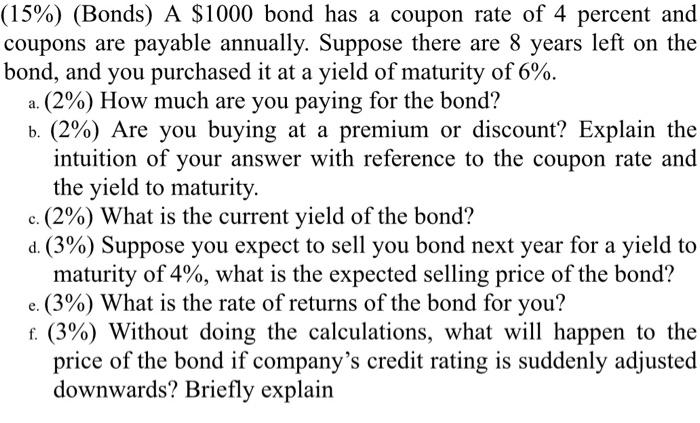

a. (15%) (Bonds) A $1000 bond has a coupon rate of 4 percent and coupons are payable annually. Suppose there are 8 years left on the bond, and you purchased it at a yield of maturity of 6%. (2%) How much are you paying for the bond? b. (2%) Are you buying at a premium or discount? Explain the intuition of your answer with reference to the coupon rate and the yield to maturity. c. (2%) What is the current yield of the bond? d. (3%) Suppose you expect to sell you bond next year for a yield to maturity of 4%, what is the expected selling price of the bond? (3%) What is the rate of returns of the bond for you? f. (3%) Without doing the calculations, what will happen to the price of the bond if company's credit rating is suddenly adjusted downwards? Briefly explain e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts