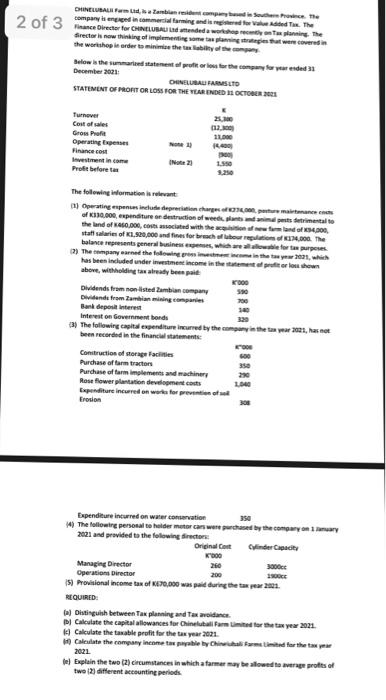

Question: my major questions are from the statement that is from a to e ) Distinguish between Tax planning and Tax avoidance. (b) Calculate the capital

tirecter in now thinking of implementiec aome tas plawning itrehpien that were cover es in the wertihos in erder to minimise the the liability di the mongany Belon is the summarihed atatentent elf proff or low har the ton pany for poar ended 31 December 26el. The following iformation is relrwant halave tepresenta general bunineis easecses, whish are all alfowale for tas purpeses. above, wirkholdiec tas alreaty been pail. been peciorati in the financial statements: (3) moeilonal income tax of kito,090 was paid duries the taw pear zaz.. MTOUIRED: (b) Oistiveruhh between Tax planning and Tax aroidince. (D) Calculate the capieal allowances for Chinelutalifarm Uimited tor Butar year 2021 . (2) Calculate the tanable peofit far the tax pear 2021 . 2021 (e) Explain the two (2) circumulances in which a farmer may be alowed ts average grofts of two {2 different actountine periods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts