Question: MY NOTES ASK YOUR TEACHER Solve by using the sinking fund or amortization formula. Betty Price purchased a new home for $265,000 with a 20%

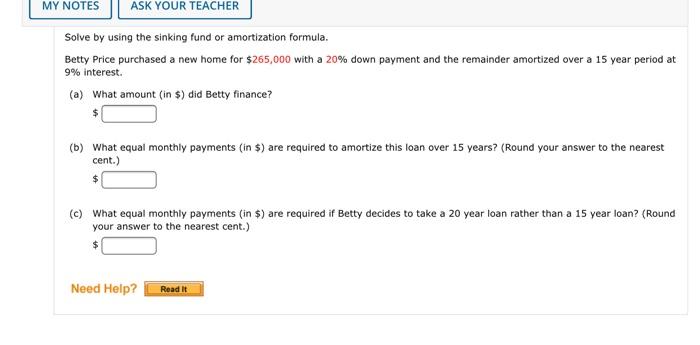

MY NOTES ASK YOUR TEACHER Solve by using the sinking fund or amortization formula. Betty Price purchased a new home for $265,000 with a 20% down payment and the remainder amortized over a 15 year period at 9% interest. (a) What amount (in $) did Betty finance? (b) What equal monthly payments (in $) are required to amortize this loan over 15 years? (Round your answer to the nearest cent.) $ (c) What equal monthly payments (in $) are required if Betty decides to take a 20 year loan rather than a 15 year loan? (Round your answer to the nearest cent.) Need Help? Read It

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts