Question: my numbers arent adding up? can you help me? Home Chegg.com Advanced Accounting Complete the worksheet for consolidated financial statements for the year ended December

my numbers arent adding up? can you help me?

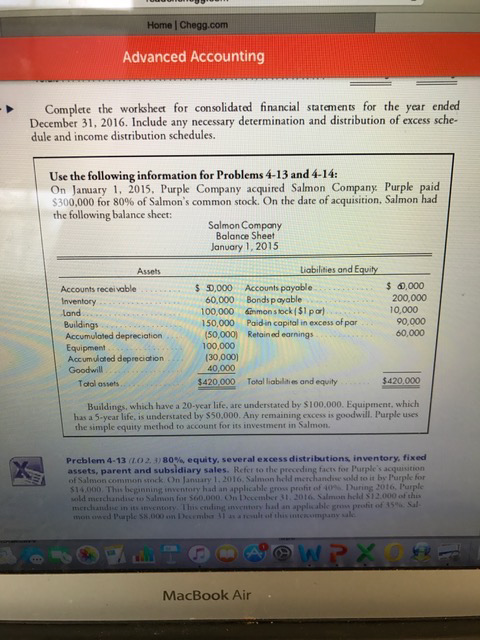

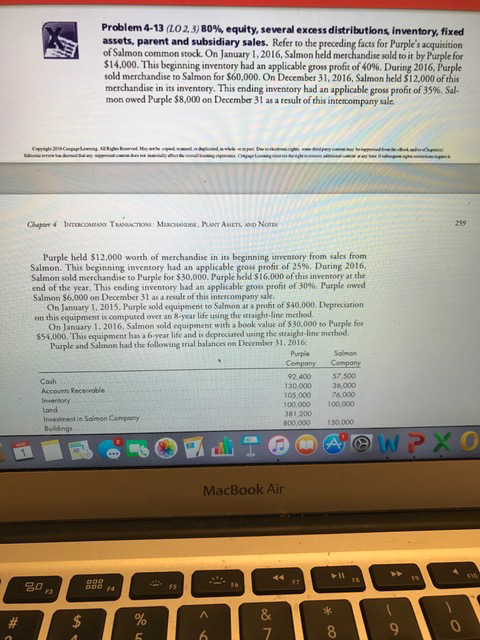

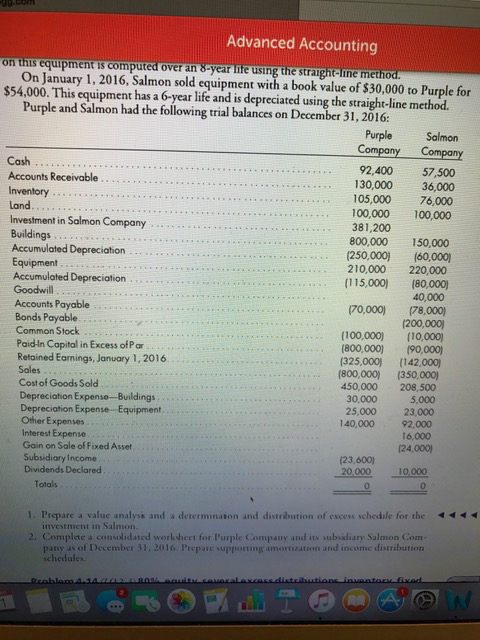

Home Chegg.com Advanced Accounting Complete the worksheet for consolidated financial statements for the year ended December 31, 2016. Include any necessary determination and distribution of excess sche- dule and income distribution schedules. Use the following information for Problems 4-13 and 4-14 On January 1, 2015, Purple Company acquired Salmon Company Purple paid $300,000 for 80% of Salmon's common stock. On the date of acquisition, Salmon had the following balance sheet: Salmon Company Balance Sheet January 1, 2015 Liabilities and E 0.000 5,000 Accounts payable Accounts receivable 200,000 60,000 Bonds payable Inventory 10,000 100,000 saimon stock($1por) 150,000 Paidin capital in excess of par 50,000 Retained earnings Accumulated depreciation 100,000 Equipment (30,000) Accumulated depreciation $420. Total liabilities and equity $420,000 Tool assets Buildings, which have a 20-year life. are understated by si00.000. Equipment, which has a 5-year life, is understated by S50,000. Any remaining excess is goodwill. Purple uses the simple equity method to account for its investment in Salmon. (Lo 2,3 8o%, equity, several excess distributions, inventory, fixed assets, parent and subsidiary sales. Refer to the preceding facts for Purple s acquisition to it by Purple for Salmon common stock On Jansary 1. 2016, Salmon 6, Salmon held S12.000 od sending inventory owed Purple SK 00 on Dec mba MacBook Air Home Chegg.com Advanced Accounting Complete the worksheet for consolidated financial statements for the year ended December 31, 2016. Include any necessary determination and distribution of excess sche- dule and income distribution schedules. Use the following information for Problems 4-13 and 4-14 On January 1, 2015, Purple Company acquired Salmon Company Purple paid $300,000 for 80% of Salmon's common stock. On the date of acquisition, Salmon had the following balance sheet: Salmon Company Balance Sheet January 1, 2015 Liabilities and E 0.000 5,000 Accounts payable Accounts receivable 200,000 60,000 Bonds payable Inventory 10,000 100,000 saimon stock($1por) 150,000 Paidin capital in excess of par 50,000 Retained earnings Accumulated depreciation 100,000 Equipment (30,000) Accumulated depreciation $420. Total liabilities and equity $420,000 Tool assets Buildings, which have a 20-year life. are understated by si00.000. Equipment, which has a 5-year life, is understated by S50,000. Any remaining excess is goodwill. Purple uses the simple equity method to account for its investment in Salmon. (Lo 2,3 8o%, equity, several excess distributions, inventory, fixed assets, parent and subsidiary sales. Refer to the preceding facts for Purple s acquisition to it by Purple for Salmon common stock On Jansary 1. 2016, Salmon 6, Salmon held S12.000 od sending inventory owed Purple SK 00 on Dec mba MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts