Question: My professor gave this as a homework question and solution, but I'm not even sure what I'm looking at, can someone explain the concepts, and

My professor gave this as a homework question and solution, but I'm not even sure what I'm looking at, can someone explain the concepts, and how in the solution he got 1.5, -.50, 1.25, and .75. Thanks,

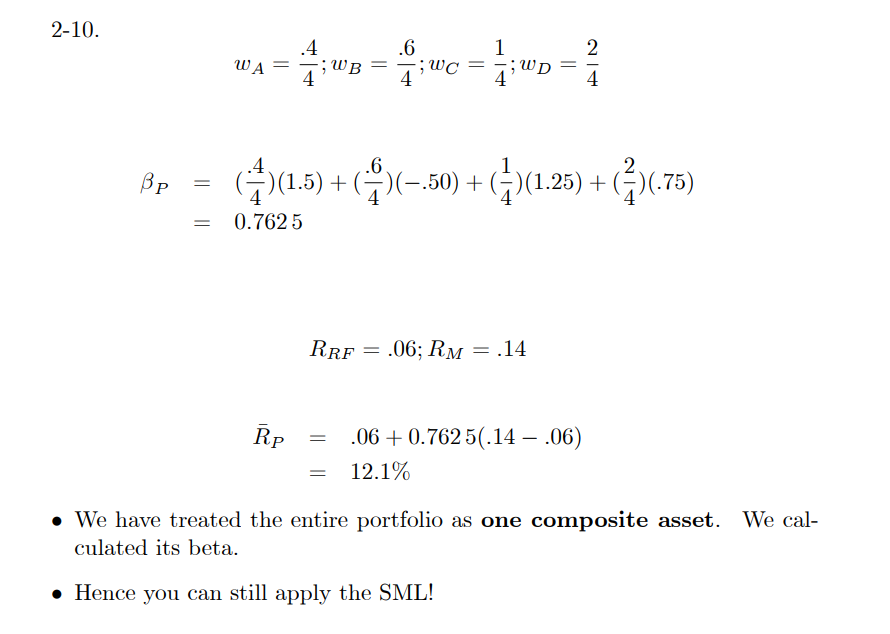

2-10. .4 WA= ;WB = 4 BP C) (1.5) + (-_50 ) +C)(1.25 ) +C)(-75 ) 0.7625 RRF = .06; RM = .14 Rp = .06 +0.762 50.14 .06) 12.1% We have treated the entire portfolio as one composite asset. We cal- culated its beta. Hence you can still apply the SML

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts