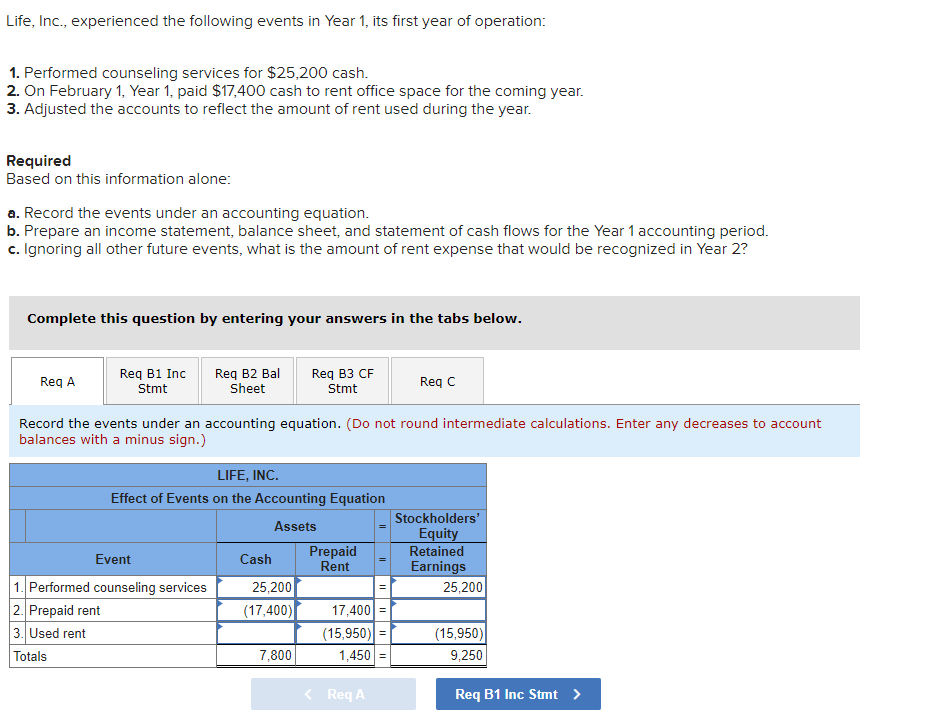

Question: My progress so far: Options for the left side: accounts payable, accounts receivable, cash, common stock, dividends, insurance expense, prepaid insurance, pre-paid rent, rent expense,

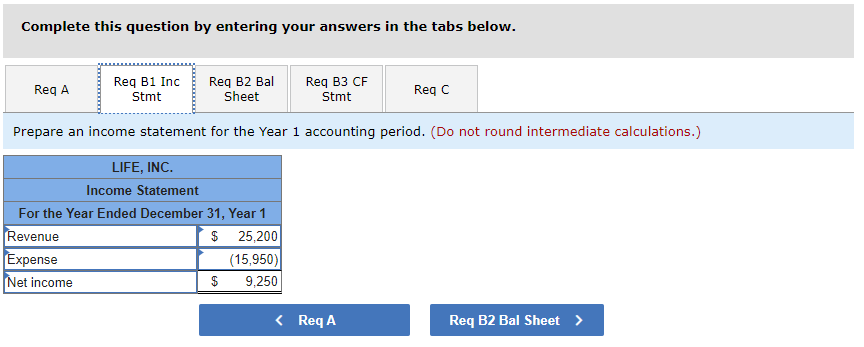

My progress so far:

Options for the left side: accounts payable, accounts receivable, cash, common stock, dividends, insurance expense, prepaid insurance, pre-paid rent, rent expense, retained earnings, salaries expense, salaries payable, utilities expense - for question below:

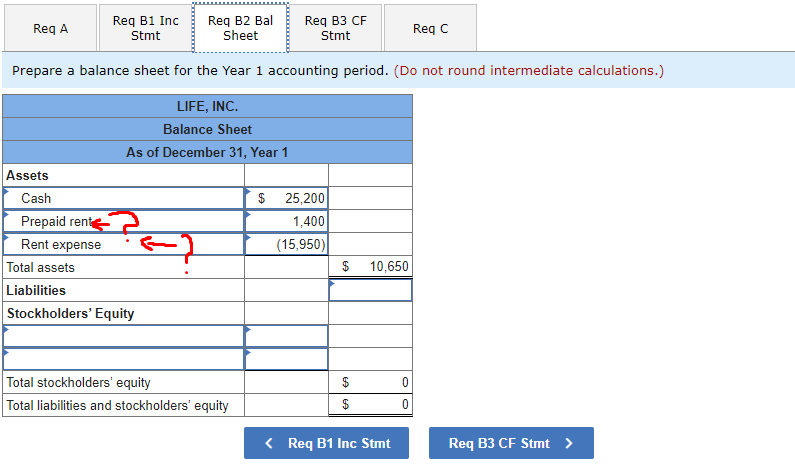

Don't know whether "Revenue/expense" is the correct choice out of my selection.

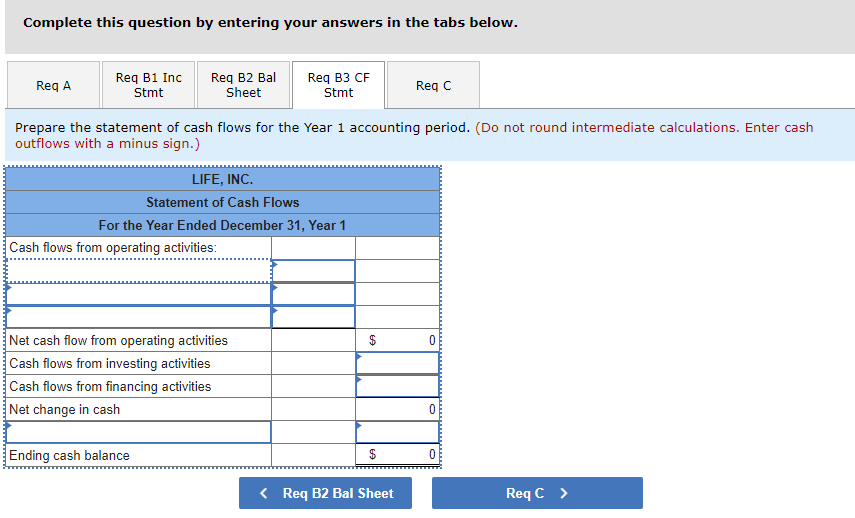

cont:

Question marks over the selections in the textboxes - don't know whether they are correct, or if the corresponding numbers are correctly inputed

Options for the left side: accounts payable, accounts receivable, cash, common stock, dividends, insurance expense, prepaid insurance, pre-paid rent, rent expense, retained earnings, salaries expense, salaries payable, utilities expense

Text boxes on the left options:

Last text box option above "ending cash balance" : "Plus/Less: Begining cash balance"

Format it the way it's displayed in the images - Please insure the formatting isn't confusing in the final post - some tables are incorrectly made and hard to understand where the numbers are supposed to be placed, please show me where the numbers are coming from and how you came to the solution. If possible, replicate these tables in excel and format them the same way as shown in the photos. Thanks for your help!

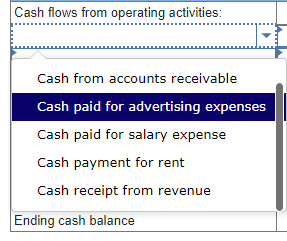

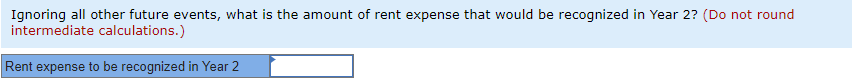

Life, Inc., experienced the following events in Year 1, its first year of operation: 1. Performed counseling services for $25,200 cash. 2. On February 1, Year 1, paid $17,400 cash to rent office space for the coming year. 3. Adjusted the accounts to reflect the amount of rent used during the year. Required Based on this information alone: a. Record the events under an accounting equation. b. Prepare an income statement, balance sheet, and statement of cash flows for the Year 1 accounting period. c. Ignoring all other future events, what is the amount of rent expense that would be recognized in Year 2 ? Complete this question by entering your answers in the tabs below. Record the events under an accounting equation. (Do not round intermediate calculations. Enter any decreases to account balances with a minus sign.) Complete this question by entering your answers in the tabs below. Srepare an income statement for the Year 1 accounting period. (Do not round intermediate calculations.) Prepare a balance sheet for the Year 1 accounting period. (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Prepare the statement of cash flows for the Year 1 accounting period. (Do not round intermediate calculations. Enter cash outflows with a minus sign.) Cash flows from operating activities: Cash from accounts receivable Cash paid for advertising expenses Cash paid for salary expense Cash payment for rent Cash receipt from revenue Ending cash balance Ignoring all other future events, what is the amount of rent expense that would be recognized in Year 2 ? (Do not round intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Great work so far Your confusion about the balance sheet and categories is natural for new accounting learners Lets walk through each requirement prop... View full answer

Get step-by-step solutions from verified subject matter experts